Before deciding to buy, sell, or hold a stock, investors often look to the recommendations of Wall Street analysts. These brokerage-firm employed (or sell-side) analysts frequently sway media reports and, subsequently, stock prices. But, the crucial question is, do their opinions truly influence investment success?

Let’s start by delving into the perspectives of Wall Street heavyweights on Perion Network (PERI). Afterward, we’ll critically assess the reliability of brokerage recommendations and how investors can leverage them to their advantage.

Brokerage Recommendations for PERI

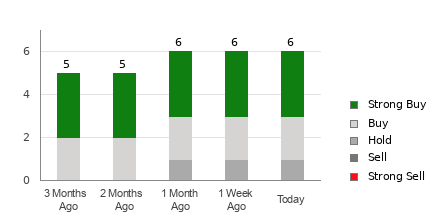

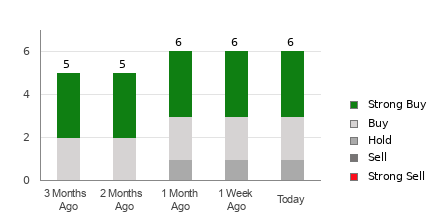

Currently, Perion Network holds an average brokerage recommendation (ABR) of 1.83 on the traditional 1 to 5 scale (ranging from Strong Buy to Strong Sell). This figure is derived from the actual endorsements (Buy, Hold, Sell, etc.) provided by six brokerage firms. Essentially, an ABR of 1.83 falls between Strong Buy and Buy.

Among the six endorsements contributing to the prevailing ABR, three advocate Strong Buy, while one suggests Buy. This implies that Strong Buy and Buy collectively account for 66.7% of all recommendations.

Explore price target & stock forecast for Perion Network here>>>

Although the ABR leans toward a recommendation to buy Perion Network, it’s unwise for investors to base their decisions solely on this statistic. Numerous studies have revealed the limited effectiveness, if not outright failure, of brokerage recommendations in deciphering stocks with the highest potential for price appreciation.

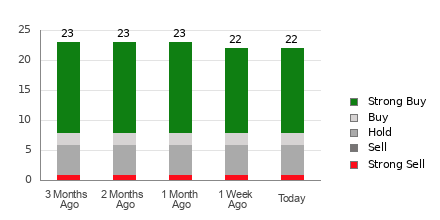

The reason? Brokerage firms often harbor a strong positive bias toward stocks they cover, owing to their vested interests, resulting in inflated ratings by their analysts. Research indicates that for every “Strong Sell” recommendation, brokerage firms issue five “Strong Buy” recommendations.

Consequently, the objectives of these institutions seldom align with those of individual investors. As such, brokerage recommendations offer little insight into a stock’s future price trajectory. It’s prudent to use this information for validating personal analysis or in tandem with a proven tool for forecasting stock price movements.

Combining ABR with Zacks Rank

With a meticulously audited track record, our proprietary stock rating tool, the Zacks Rank, categorizes stocks into five groups, spanning from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell). This system stands as a reliable barometer for a stock’s short-term price performance. Consequently, cross-referencing the ABR with the Zacks Rank can be instrumental in guiding lucrative investment decisions.

Distinction between Zacks Rank and ABR

Despite both metrics converging on a 1 to 5 scale, they represent disparate measures.

Broker recommendations singularly influence the ABR, conventionally displayed in decimals (e.g., 1.28). Conversely, the Zacks Rank operates as a quantitative model engineered to harness earnings estimate revisions, reflecting whole numbers from 1 to 5.

Historically, analysts employed by brokerage firms have consistently displayed an excessively optimistic stance in their recommendations. Given their employers’ vested interests, these ratings often exceed the objective foundation of their research, more frequently misleading than guiding investors.

Conversely, earnings estimate revisions constitute the cornerstone of the Zacks Rank. Empirical evidence substantiates a robust correlation between trends in earnings estimate revisions and short-term stock price movements.

Furthermore, diverse Zacks Rank grades are equitably applied across all stocks for which brokerage analysts furnish current-year earnings estimates. This system thereby maintains equilibrium among its five ranks.

Another pivotal contrast between the ABR and Zacks Rank lies in their currency. The ABR may not consistently reflect the latest information, unlike the Zacks Rank. Given that brokerage analysts continually adjust their earnings estimates to accommodate a company’s evolving business dynamics, these alterations are promptly integrated into the Zacks Rank, invariably offering a timely indication of future price movements.

Considering an Investment in PERI

In terms of earnings estimate revisions for Perion Network, the Zacks Consensus Estimate for the current year has remained static over the past month at $3.27.

This steadfast consensus estimate signifies analysts’ unwavering outlook on the company’s earnings prospects, potentially underpinning the stock’s alignment with the broader market in the immediate future.

The scale of the recent alteration in the consensus estimate, compounded by three other factors related to earnings estimates, has resulted in a Zacks Rank #3 (Hold) for Perion Network. For a comprehensive list of today’s Zacks Rank #1 (Strong Buy) stocks, check out this resource >>>>

Hence, exercising diligence might be wise regarding the Buy-equivalent ABR for Perion Network.

Zacks Names #1 Semiconductor Stock

It’s only 1/9,000th the size of NVIDIA, which surged over +800% since we recommended it. While NVIDIA remains robust, our latest top chip stock presents substantially more potential for exponential growth.

Backed by robust earnings expansion and a burgeoning customer base, it’s strategically positioned to cater to the burgeoning demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is anticipated to surge from $452 billion in 2021 to $803 billion by 2028.

View This Stock Now for Free >>

Perion Network Ltd (PERI) : Free Stock Analysis Report

Read more about this article on Zacks.com by clicking here.

The author’s opinions expressed here may not necessarily reflect those of Nasdaq, Inc.