As investors harbor dreams of striking gold in the stock market, the captivating allure of Wall Street’s brokerage recommendations beckons like a siren’s call. A multitude of retail investors find themselves entranced, hoping to ride the wave of these analysts’ insights to financial success. But do these recommendations truly hold the golden ticket to investment prosperity?

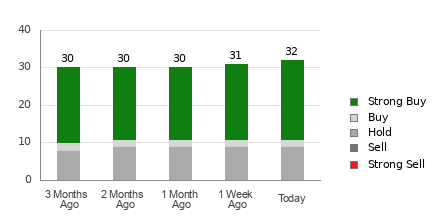

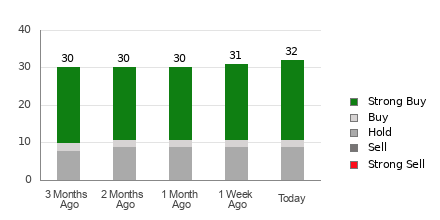

Within the realm of Wall Street’s elite, Pinterest (PINS) stands as a formidable contender. Touted by the brokerage behemoths, Pinterest boasts an Average Brokerage Recommendation (ABR) of 1.61, a number that flirts between the realms of Strong Buy and Buy. This endorsement is derived from the cumulative voices of 33 brokerage firms, with a substantial 66.7% ringing in as Strong Buy advocates.

Unveiling the Mysteries of Brokerage Recommendations for PINS

Discover Pinterest’s price target & stock forecast here >>>

While the ABR shines a beacon of positivity on Pinterest, heed the warning: building your investment empire solely on these recommendations may not be a wise strategy. Over the years, studies have indicated that brokerage recommendations often fall short in guiding investors towards stocks with the most promising price appreciation.

Why the discrepancy? Analysts, tethered to the vested interests of their firms, tend to cast a rosy glow on the stocks they cover. Picture this: for every “Strong Sell” recommendation, brokerage firms shower a stock with five “Strong Buy” ratings. This incongruity sheds light on the misalignment of interests between brokerage analysts and retail investors, leaving the price trajectory of a stock shrouded in uncertainty.

Enter the Zacks Rank – an audited oracle unveiling a stock’s potential for near-term price performance. Comprising five distinct groupings, the Zacks Rank dances in harmony with the ABR, creating a synergy that could steer you towards financial triumph.

Educating on the Distinctions between the ABR and Zacks Rank

Despite their shared numerical scale of 1 to 5, the ABR and Zacks Rank follow diverging paths. While the ABR hinges solely on broker recommendations, often skewed by biases, the Zacks Rank stands as a beacon of objectivity, fueled by the winds of earnings estimate revisions.

Analysts, shackled by their firms’ interests, peddle optimistic ratings that may lead investors astray. In contrast, the Zacks Rank adheres to the concrete foundations of earnings estimate revisions, a compass pointing to the true north of stock price movements.

Unlike the ABR, which may languish in staleness, the Zacks Rank boasts a freshness that resonates with the winds of change. As analysts diligently revise their estimates to mirror a company’s dynamic business landscape, the Zacks Rank pivots swiftly, offering a timely projection of future price shifts.

Unlocking Pinterest’s Financial Horizons

Surveying the realm of Pinterest’s earnings estimates unveils a sobering tale. The Zacks Consensus Estimate for the current year, after a month-long slumber, has dipped by a marginal 0.1% to $1.43. Analysts, marching in unison towards pessimism, have stamped Pinterest with a Zacks Rank #4 (Sell), forewarning of potential turbulence ahead.

So, as you contemplate Pinterest’s seemingly enticing Buy-equivalent ABR, perhaps a pinch of skepticism is warranted.

Infrastructure Stock Boom to Sweep America

A symphony of jackhammers and bustling construction sites heralds America’s imminent infrastructure renaissance. A bipartisan quest laden with promise and fortune, preparing to bestow trillions upon the worthy. The question looms: are you poised to tap into this wellspring of potential riches?

Behold Zacks’ Special Report, a treasure map guiding you towards five companies poised to revel in the infrastructure bonanza. Dive into this invaluable resource now. The wealth of the future awaits.

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>

Brace yourself for wealth insights with the Pinterest, Inc. (PINS) : Free Stock Analysis Report

For more riveting analysis, click here to read this article on Zacks.com.

May the blessings of prosperity guide your investment journey.

Remember, the views expressed here are those of the author and not necessarily endorsed by Nasdaq, Inc.