Investors often lean on analyst recommendations to inform their decisions about stocks. Reports about rating changes by these brokerage-firm-employed (or sell-side) analysts can significantly impact a stock’s price, but are they truly reliable?

Before examining the dependability of brokerage recommendations and how investors can leverage them, let’s consider what the Wall Street heavyweights are saying about Rivian Automotive (RIVN).

Rivian Automotive’s Brokerage Recommendations

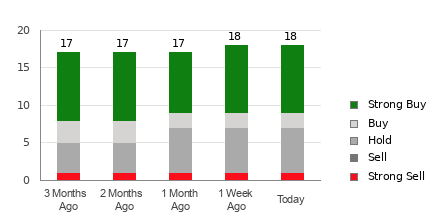

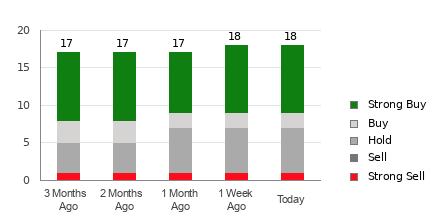

Rivian Automotive currently holds an average brokerage recommendation (ABR) of 1.72 on a scale of 1 to 5 (Strong Buy to Strong Sell). This number is derived from the actual recommendations (Buy, Hold, Sell, etc.) made by 23 brokerage firms. An ABR of 1.72 oscillates between Strong Buy and Buy.

Out of the 23 recommendations, 13 are Strong Buy and three are Buy. Cumulatively, Strong Buy and Buy represent 56.5% and 13% of all recommendations, respectively.

Brokerage Recommendation Trends for RIVN

Check price target & stock forecast for Rivian Automotive here>>>

While the ABR suggests buying Rivian Automotive, it’s crucial not to base investment decisions solely on this information. Multiple studies have shown that brokerage recommendations have minimal success in guiding investors to select stocks with the best price increase potential.

So why is that? The analysts at brokerage firms often exhibit a strong positive bias in rating stocks due to their vested interest in the stocks they cover. Research indicates that for every “Strong Sell” recommendation, brokerage firms assign five “Strong Buy” recommendations.

This misalignment of interests between brokerage analysts and retail investors provides little insight into the future price movement of a stock. It’s advisable to use this information to validate one’s own analysis or a reliable tool that effectively predicts stock price movements.

Using Zacks Rank for Informed Investment Decisions

With an externally audited track record, our proprietary stock rating tool, the Zacks Rank, is a dependable indicator of a stock’s near-term price performance. Validating the Zacks Rank with ABR could significantly aid in making profitable investment decisions.

Zacks Rank Should Not Be Confused With ABR

Although both Zacks Rank and ABR are displayed in a range of 1-5, they are different measures. Broker recommendations solely determine the ABR, often displayed in decimals (e.g., 1.28). In contrast, the Zacks Rank is a quantitative model based on harnessing the power of earnings estimate revisions and is displayed in whole numbers, ranging from 1 to 5.

Analysts employed by brokerage firms tend to issue more favorable ratings than their research would support due to their employers’ vested interests, which often misguides investors. In contrast, earnings estimate revisions, the foundation of the Zacks Rank, exhibit a strong correlation with near-term stock price movements.

Freshness and Reliability of ABR vs. Zacks Rank

One key difference between the ABR and Zacks Rank lies in their timeliness. ABR may not be up-to-date, while brokerage analysts constantly revise their earnings estimates, and these revisions quickly reflect in the Zacks Rank, making it a timely predictor of future stock prices.

Is RIVN Worth Investing In?

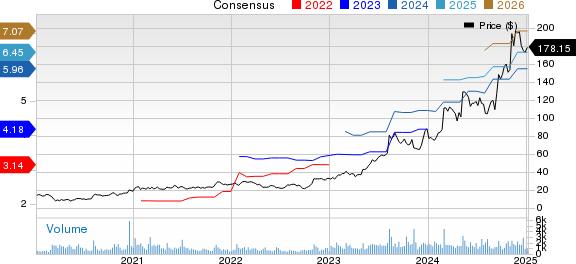

Regarding earnings estimate revisions for Rivian Automotive, the Zacks Consensus Estimate for the current year has declined by 0% over the past month to -$5.

Analysts’ growing pessimism about the company’s earnings prospects, evidenced by strong consensus in revising EPS estimates lower, could potentially cause the stock to plummet in the near term.

The recent change in the consensus estimate and three other factors related to earnings estimates led to a Zacks Rank #4 (Sell) for Rivian Automotive. You can view the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here >>>>

Therefore, it might be prudent to take the Buy-equivalent ABR for Rivian Automotive with a grain of salt.

The New Gold Rush: How Lithium Batteries Will Make Millionaires

Investors have an opportunity to capitalize on the expanding electric vehicle revolution. With millions of lithium batteries in production and an 889% increase in expected demand, significant gains are within reach.

Download the brand-new FREE report revealing 5 EV battery stocks set to soar.

Rivian Automotive, Inc. (RIVN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.