When thinking over potential stock actions, investors often turn to the advice of analysts. The media frequently trumpets changes in ratings by these sell-side analysts, but how impactful are these ratings really? Before delving into the reliability of brokerage recommendations and how to leverage them, let’s first delve into Wall Street’s stance on Snowflake Inc. (SNOW).

Brokerage Recommendations for Snowflake Inc.

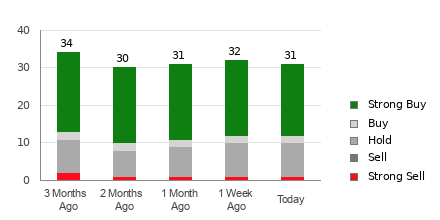

Snowflake Inc. currently boasts an average brokerage recommendation (ABR) of 1.79, falling between Strong Buy and Buy on a scale of 1 to 5, with 38 brokerage firms contributing recommendations. Of these, 24 render Strong Buy and 2 declare Buy, making up 63.2% and 5.3% of all recommendations respectively.

Deciphering Broker Recommendations

While the ABR suggests a buy for Snowflake Inc., heeding this information exclusively may not be wise. Research indicates that brokerage recommendations hold limited sway in steering investors towards stocks with significant potential for price appreciation.

So why should brokerage recommendations be taken with a pinch of salt? The vested interests of brokerage firms in the stocks they cover often lead to an optimistic bias in their analysts’ ratings. Our findings show that for every “Strong Sell” recommendation, brokerage firms assign five “Strong Buy” ratings. This misalignment of interests between institutions and retail investors provides scant insight into a stock’s potential price movement. Thus, it’s best to use this information for validation purposes or as a complement to a more successful tool for predicting stock prices.

The Zacks Rank: An Alternative View

In contrast to brokerage recommendations, our internally audited Zacks Rank assesses stocks on a scale from #1 (Strong Buy) to #5 (Strong Sell). This tool, which capitalizes on earnings estimate revisions, has proven to be an effective indicator of a stock’s near-future price performance. Consequently, validating the ABR with the Zacks Rank could serve as a profitable investment strategy.

Differentiating the ABR from Zacks Rank

Although both the ABR and Zacks Rank are graded on a scale from 1 to 5, they embody distinct measures. The ABR hinges solely on broker recommendations and is typically displayed as decimals, while the Zacks Rank is a quantitative model guided by earnings estimate revisions, reflected in whole numbers.

Unlike the optimistic skew of brokerage recommendations, the Zacks Rank is grounded in earnings estimate revisions. Research shows a strong correlation between short-term stock price fluctuations and trends in earnings estimate revisions.

Zacks Rank Freshness vs. ABR Timeliness

Notably, the ABR might not always be current. Meanwhile, the Zacks Rank remains timely in predicting future stock prices, as brokerage analysts continuously update their earnings estimates, promptly reflected in the Zacks Rank.

Is SNOW a Sound Investment?

Observing the earnings estimate revisions for Snowflake Inc., the Zacks Consensus Estimate for the current year has flatlined at $0.79 over the past month. Unwavering analyst views on the company’s earnings prospects, exemplified by a steadfast consensus estimate, may indicate that the stock will parallel the broader market performance in the short term.

Considering the recent consensus estimate stagnation, combined with three other factors tied to earnings estimates, Snowflake Inc. has received a Zacks Rank #3 (Hold). This suggests some prudence regarding the Buy-equivalent ABR for Snowflake Inc.