Spotify’s Q1 Earnings Miss but Stock Sees Notable Rally

Despite falling short of first-quarter expectations, Spotify SPOT has seen its stock price rise by 3% since the report, now exceeding $600 per share.

With a year-to-date increase of over 35%, SPOT has outperformed broader market declines, surpassing Netflix’s NFLX gain of 27%.

Image Source: Zacks Investment Research

Spotify’s Q1 Performance

Spotify reported a Q1 earnings per share (EPS) of $1.13, which fell short of expectations of $2.29 per share. However, this reflects a 7% increase from the $1.05 EPS in Q1 2024. Revenue increased by 11% year-over-year to $4.4 billion, missing estimates of $4.59 billion.

Amid growing buzz, Spotify added 5 million net subscribers in Q1, bringing total subscribers to 268 million. Monthly active users (MAU) reached 678 million after an increase of 3 million.

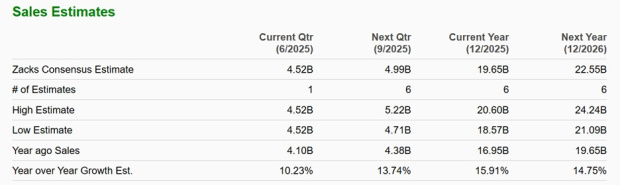

Guidance and Future Projections

Looking ahead, Spotify anticipates adding 11 million MAU and 5 million subscribers in Q2. The company expects Q2 revenue to reach $4.52 billion, representing a 10% growth, consistent with Zacks estimates. Projections show total sales could grow by 16% in fiscal 2025 and another 15% in FY26, reaching $22.55 billion. Also, the firm expects a Q2 operating income of 539 million euros with a 31.5% gross margin.

For the full year, Spotify expects margins to improve in 2025 albeit at a more controlled pace compared to last year’s remarkable gains as it continues to invest strategically for long-term growth.

Image Source: Zacks Investment Research

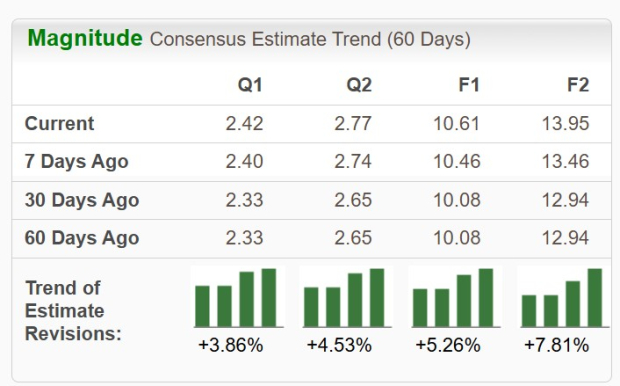

EPS Estimates Indicate Growth

Recent revisions to earnings estimates for Spotify suggest potential for further upside. In the last week, EPS estimates for FY25 and FY26 have risen by 5% and 8%, respectively.

Annual earnings are estimated to jump by 78% this year to $10.61 per share, up from $5.95 in 2024. Additionally, FY26 EPS is projected to climb by 31% to $13.95.

Image Source: Zacks Investment Research

Conclusion

Despite the Q1 earnings miss, Spotify’s ongoing expansion remains noteworthy. The stock currently holds a Zacks Rank #1 (Strong Buy), largely driven by the trend of positive earnings estimate revisions. This could indicate that the strong performance of SPOT may continue in the future.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.