Investors often rely on Wall Street analysts’ recommendations to inform their investment decisions. While these recommendations can impact a stock’s price, their reliability is often a subject of debate.

Before diving into the credibility of brokerage recommendations and how investors can leverage them, it’s important to understand the current sentiment of Wall Street heavyweights towards The Trade Desk (TTD).

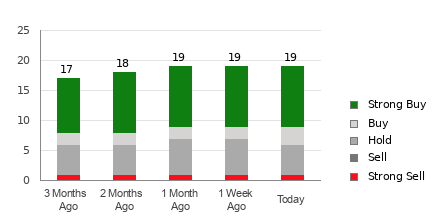

The Trade Desk presently holds an average brokerage recommendation (ABR) of 1.50, falling between a Strong Buy and Buy on a scale of 1 to 5. This average is based on recommendations from 28 brokerage firms, with 21 signaling a Strong Buy and two suggesting a Buy, accounting for approximately 82% of all recommendations.

Interpreting Brokerage Recommendation Trends for TTD

Explore price target and stock forecast for The Trade Desk here>>>

While the ABR suggests buying The Trade Desk, it’s essential to not make investment decisions based solely on this metric. Studies have consistently shown the limited success of brokerage recommendations in predicting stocks with significant price increase potential.

Why the skepticism? Brokerage firms’ vested interest in the stocks they cover often results in an inherent positive bias from their analysts. Research indicates that for every “Strong Sell” recommendation, brokerage firms assign five “Strong Buy” recommendations, indicating a clear positive skew in their ratings.

Consequently, these recommendations may not always align with the actual trajectory of a stock’s price. Their utility may lie in validating individual research or utilizing an indicator known for accurately predicting stock price movement.

The Zacks Rank, a proprietary stock rating tool with an externally audited track record, classifies stocks into five groups, providing a reliable indicator of a stock’s near-term price performance. Combining the ABR with the Zacks Rank may be instrumental in making informed investment decisions.

Distinguishing the Zacks Rank from ABR

Despite sharing a scale from 1 to 5, the Zacks Rank and ABR are distinct measures.

The ABR relies solely on broker recommendations, indicated in decimals, while the Zacks Rank is a quantitative model leveraging earnings estimate revisions, displayed in whole numbers from 1 to 5.

Brokerage analysts’ tendency to be overly optimistic in their recommendations due to their employers’ vested interests can lead to misguided investor decisions. In contrast, the Zacks Rank hinges on earnings estimate revisions, strongly correlated with stock price movements, providing a more balanced and timely assessment.

The Zacks Rank also ensures currency, swiftly reflecting analysts’ earnings estimate revisions to offer updated insights into future price movements.

Is TTD a Good Investment?

The Zacks Consensus Estimate for The Trade Desk’s current-year earnings has decreased by 1% over the past month to $1.26. Analysts’ unanimous downward revisions in EPS estimates imply potential short-term challenges for the stock.

This bearish sentiment has resulted in a Zacks Rank #4 (Sell) for The Trade Desk, indicating caution for potential investors. Hence, it may be prudent to approach The Trade Desk’s Buy-equivalent ABR with some skepticism.

Just Released: Zacks Top 10 Stocks for 2024

Hurry – you can still get in early on our 10 top tickers for 2024. Hand-picked by Zacks Director of Research, Sheraz Mian, this portfolio has been stunningly and consistently successful. From inception in 2012 through November, 2023, the Zacks Top 10 Stocks gained +974.1%, nearly TRIPLING the S&P 500’s +340.1%. You can still be among the first to see these just-released stocks with enormous potential. See New Top 10 Stocks >>

The Trade Desk (TTD): Free Stock Analysis Report

Read this article on Zacks.com

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.