Jacobs Solutions Faces Challenges Amid Market Slump

Jacobs Solutions Inc. (J), boasting a market cap of $15.1 billion, operates in the infrastructure, advanced facilities, and consulting sectors both in the United States and worldwide. Established in 1947 and headquartered in Dallas, Texas, the firm provides a suite of services, including consulting, planning, architecture, design, engineering, and infrastructure delivery.

Falling into the category of “large-cap stocks,” Jacobs Solutions exemplifies substantial size and market influence, given its market capital exceeds $10 billion. This size places it among leaders in the construction industry.

Active Investor: FREE newsletter exploring the latest stock trends for new trading opportunities.

Despite its stature, J’s stock has dipped 17.9% since reaching its 52-week peak of $150.54 on November 13. Over the past three months, J has declined 9.1%, which contrasts with the broader Dow Jones Industrial Average’s ($DOWI) smaller 1.6% decline during this period.

Looking at the longer term, J has fallen 3.7% over the last six months and 1.2% over the past year, lagging behind the $DOWI, which has risen 1.6% in the same six-month span and delivered an 8.3% return over the past year.

Evidence of J’s ongoing downtrend appears in its stock trading mainly below its 200-day moving average since the end of February. The stock has also stayed under its 50-day moving average since early February, reflecting a persistent bearish market sentiment.

After the release of its Q1 earnings on February 4, J’s stock fell 3.5%. The report indicated a 4.4% increase in gross revenue, totaling $2.9 billion, primarily due to a 4.8% rise in infrastructure & Advanced Facilities revenue. The company’s earnings per share (EPS) was reported at $1.33, exceeding Wall Street estimates by 3.1%.

In comparison, rival EMCOR Group, Inc. (EME) has also struggled in the short term, with its shares dropping 5.3% over the past six months and 18.8% over the past year.

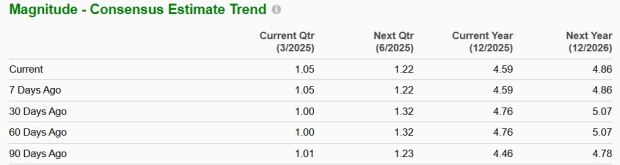

Among the 15 analysts monitoring J, the consensus rating remains a “Moderate Buy.” With a mean price target of $154.25, analysts suggest a potential upside of 24.8% from current pricing.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information, please view the Barchart Disclosure Policy here.

More news from Barchart

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.