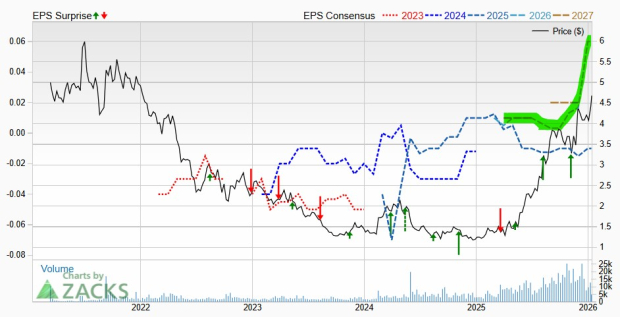

Labcorp Holdings Inc. has a market capitalization of $20.75 billion and has seen its stock rise 26.5% over the past year, significantly outperforming the medical products industry, which fell by 2.6%. The company’s earnings yield stands at 6.5%, compared to the industry’s 5.9%. For 2025, the Zacks Consensus Estimate projects revenue of $13.90 billion, a 6.9% increase from 2024.

In terms of strategic growth, Labcorp is enhancing its capabilities in oncology and neurology with new tests, including biomarkers for Alzheimer’s disease and a plasma-based test for multiple tumor types. The company has invested $211 million in acquisitions in early 2025 to bolster its oncology testing portfolio.

Despite these growth avenues, Labcorp faces challenges from macroeconomic volatility and competitive pressures in the diagnostic testing sector, which could impact profitability. The company’s financial health includes $369 million in cash and no short-term debt, with a long-term debt of $5.64 billion.