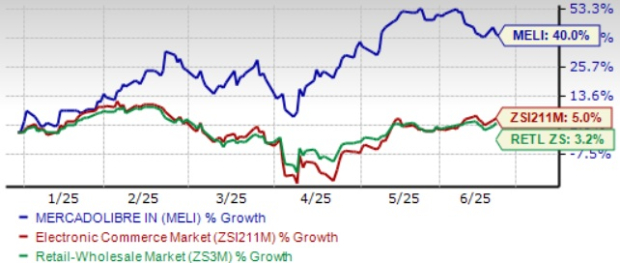

MercadoLibre (MELI) shares have returned 40% year-to-date (YTD) as of 2025, significantly surpassing the growth of the Zacks Retail-Wholesale sector (3.2%) and the Zacks Internet-Commerce industry (5%). The company boasts a robust 64 million monthly active users for its fintech arm, Mercado Pago, marking a 31% year-over-year increase, while fintech revenues reached $1.49 billion for the quarter, a 43% annual growth.

MercadoLibre has been enhancing its logistics network, achieving a fulfillment penetration rate of over 60% in Brazil as of March 2025. The supermarket category showed a compelling growth of 65% year-over-year in items sold, bolstering overall user engagement. However, concerns arise as the Zacks Consensus Estimate for 2025 earnings is forecasted at $47.75 per share, a 0.35% downward revision, with revenues expected to be $27.35 billion.

Despite strong performance, MELI faces competitive pressures from major players like Amazon and Walmart, which could impact pricing and profitability. Furthermore, margin declines of about 5 percentage points in Brazil and Mexico pose a challenge amidst rising operational costs. Due to these factors, MercadoLibre holds a Zacks Rank of 3 (Hold) at present.