“`html

MP Materials Gains Amidst Rare Earth Metal Tensions

MP Materials, based in California, has secured a Pentagon-backed price floor of $110/kg for neodymium-praseodymium (NdPr) and a $500 million deal with Apple, signaling a significant boost in value for the company as it operates the only large-scale rare earth metal mine in the U.S. In July, the Pentagon committed $400 million to MP while planning long-term purchases, and the Apple deal will enable the company to supply recycled magnets by 2027.

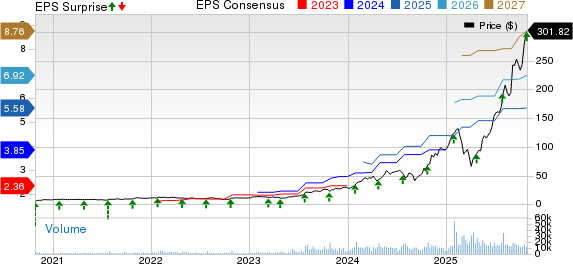

Despite a 300% stock surge this year, MP faces profitability challenges. Its current production capacity is limited to about 1,000 tons annually at its Fort Worth plant, with the larger 10X facility not expected to be operational until 2028, which will potentially increase output to over 10,000 tons. In Q2, MP’s revenue grew by 84% year-over-year, although it still reported a loss of $12.5 million.

With rising tensions from China affecting rare earth metal exports, the U.S. is increasing efforts to bolster domestic supplies, evidenced by new partnerships with countries like Australia. However, MP’s growth may be impacted by manufacturing limitations and evolving trade dynamics.

“`