Netflix Set to Surpass YouTube in Video Revenues by 2025

In a remarkable shift within the streaming industry, Netflix (NFLX) is poised to achieve a major milestone that many thought unrealistic only a few years back. Exclusive research from Omdia, a part of TechTarget (TTGT), shared at MIP TV London 2025, indicates that Netflix will eclipse Alphabet (GOOGL)-owned YouTube in total video revenues for the first time in 2025. This milestone represents a significant turning point in the digital entertainment landscape.

A Changing Revenue Landscape

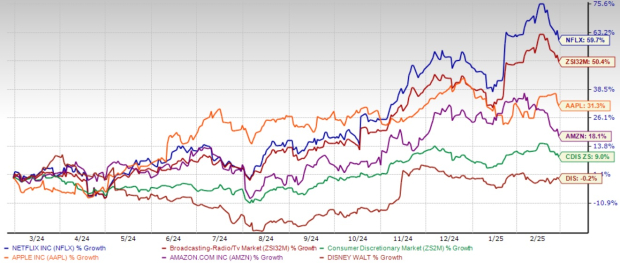

YouTube led the market in 2024, generating $42.5 billion in revenues compared to Netflix’s $39.2 billion. However, this dynamic is shifting. Investors are responding positively to Netflix’s performance; its shares have surged an impressive 59.7% in the past year. This increase outpaces tech giants like Apple (AAPL), Amazon, Disney, and the broader Zacks Consumer Discretionary sector.

1-Year Performance

Image Source: Zacks Investment Research

Looking ahead, Netflix is projected to generate $46.2 billion in 2025, surpassing YouTube’s anticipated $45.6 billion. This growth aligns with Netflix’s effective dual revenue strategy, which includes $43.2 billion from subscriptions and a burgeoning advertising segment worth $3.2 billion.

The Zacks Consensus Estimate predicts a revenue of $44.43 billion for NFLX in 2025, reflecting a 13.92% year-over-year growth. Expected earnings stand at $24.58 per share, marking a 23.95% increase from the previous year.

Image Source: Zacks Investment Research

Find the latest EPS estimates and surprises on Zacks earnings Calendar.

Even with over 2 billion users worldwide, YouTube is expected to derive most of its revenue from advertising ($36 billion), with its premium subscription tier contributing $9.6 billion. This strategy contrasts with Netflix’s ability to monetize content directly through its subscriber base, a number projected to exceed 340 million paying members in 2025, reaching over 600 million users worldwide.

Growth Strategies Driving Expansion

Netflix’s upward trajectory is the result of a carefully crafted growth strategy. The company has not only expanded its global subscriber base but has also developed its advertising business since launching it in late 2022. This shift has transformed Netflix from a pure subscription service into a diversified entertainment titan. Their tiered pricing strategy has attracted market segments previously put off by subscription costs.

The fourth quarter of 2024 showcased impressive results, revealing that Netflix’s ad-supported plan accounted for over 55% of new sign-ups in markets where it is available. Additionally, membership growth for ad plans surged approximately 30% quarter-over-quarter. Executives project a doubling of ad revenues in 2025, building on similar success in 2024.

In addition to advertising, NFLX’s strategic ventures into gaming, live events, and international content production have created diverse avenues for growth, significantly enhancing their share of global screen time and solidifying its status as the preferred entertainment source for millions.

However, Netflix’s forward 12-month sales multiple currently stands at 9.1, which surpasses its five-year median of 6.79 and the Zacks Broadcast Radio and Television industry’s forward earnings multiple of 3.89. This indicates that Netflix may be trading at a premium compared to its historical valuation and peers.

Price-to-Sales (Forward 12 Months)

Image Source: Zacks Investment Research

Engaging Content Fuels Continued Growth

Netflix’s content lineup for 2025 is impressive, featuring returning seasons of popular series like Squid Game, Wednesday, Stranger Things, and Night Agent. New films from renowned directors such as Guillermo del Toro, Kathryn Bigelow, and Noah Baumbach are also part of their strategy.

The growing live programming segment, encompassing WWE Raw, NFL games, and the recent acquisition of rights to the FIFA Women’s World Cup in 2027 and 2031, will further drive viewer engagement. The success of Netflix’s original film Carry-On has proven their capability to create cultural impact without needing theatrical releases, reinforcing their industry leadership.

Collaborations between YouTube, Netflix, and other industry participants are indicative of a maturing digital entertainment ecosystem that allows platforms to benefit from each other’s strengths. For instance, Netflix has utilized YouTube influencers to promote popular series like Squid Game, fostering subscriber growth through creator partnerships. This mutually beneficial relationship is evident, especially since 57% of U.S. YouTube users are also Netflix subscribers, a figure that climbs to 67% in the United Kingdom.

Investment Insight: Promising Buying Opportunity

With anticipated revenue leadership, increasing margins, and diverse income streams, Netflix emerges as a solid investment prospect. The studio expects to generate around $8 billion in free cash flow in 2025, providing significant shareholder benefits. Their operating margin is expected to rise to 29% in 2025, up from 27% in 2024, reflecting substantial profitability alongside revenue growth.

Despite trading at a premium, Netflix’s unique position at the intersection of technology and entertainment justifies its higher valuation. The company’s ability to outperform both traditional media entities and tech giants like YouTube illustrates its robust business model and execution capabilities.

For investors eager to seize opportunities within the ongoing digital transformation of entertainment, Netflix stands out as a compelling choice. Boasting content leadership, expanding revenue channels, and enhancing profitability, 2025 could herald Netflix’s next phase of market dominance, making this an opportune time to acquire shares of the Stock. NFLX is currently rated as a Zacks Rank #2 (Buy). You can view the full listing of today’s Zacks #1 Rank (Strong Buy) stocks here.

7 Best Stocks for the Next 30 Days

Just released: Experts have identified 7 outstanding stocks among 220 Zacks Rank #1 Strong Buys, highlighting them as “Most Likely for Early Price Pops.”

Since 1988, this curated list has outperformed the market by more than double, averaging a gain of +24.3% per year. Don’t miss the opportunity to examine these 7 stocks closely.

Want the latest recommendations from Zacks Investment Research? Download the report on the 7 Best Stocks for the Next 30 Days for free. Click to access this report.

Apple Inc. (AAPL): Free Stock Analysis report

Netflix, Inc. (NFLX): Free Stock Analysis report

Alphabet Inc. (GOOGL): Free Stock Analysis report

TechTarget, Inc. (TTGT): Free Stock Analysis report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.