The tectonic plates in the energy industry have been shifting imperceptibly for decades. Lately, renewable energy has been catching up, accounting for 20% of electricity in the United States, a feat that eclipsed coal’s contribution for the first time in history.

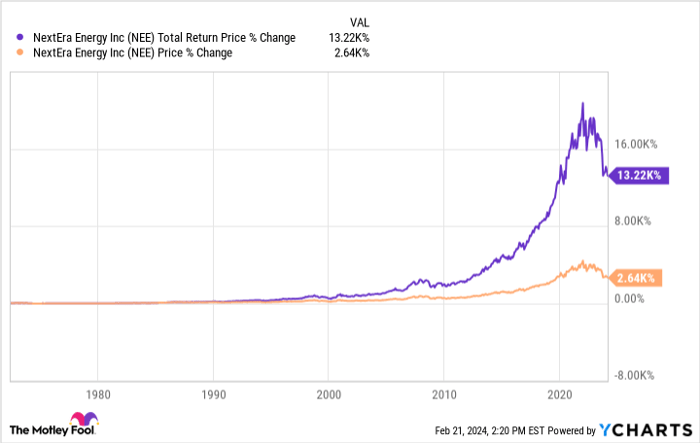

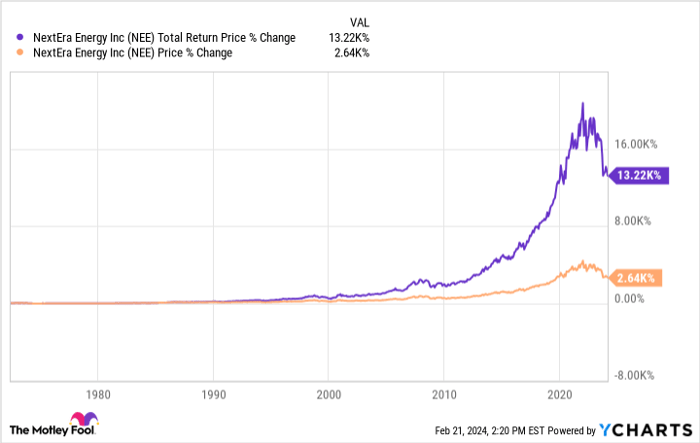

NextEra Energy (NYSE: NEE) stands out as a beneficiary amidst this revolution, blending its roles as an electric utility and a renewable energy producer. The stock has delivered an astronomical 13,000% return over its lifetime, miraculously transforming a humble $1,000 investment into a staggering $133,000 with reinvested dividends.

The Dual Path to Prosperity

NextEra Energy wears two hats with flair – an energy powerhouse and a utility juggernaut. Its subsidiary, NextEra Energy Resources, proudly reigns as the world’s top solar and wind energy producer, operating a colossal 28,000 megawatts of renewable energy capacity with an additional 18,000 in the pipeline. On the flip side, Florida Power & Light, NextEra’s utility arm, is the largest electric utility in the U.S., electrifying over 12 million souls across 6 million accounts.

The International Energy Agency (IEA) forecasts a doubling of global solar and wind additions from 2022 to 2028, nudging the world further away from the embrace of coal and fossil fuels. Simultaneously, Florida Power & Light is pouring substantial resources into its power grid, with utility companies leveraging rate hikes to fund these infrastructure upgrades, thus creating a cycle that fuels financial expansion.

Florida’s population is booming, with its economy riding the wave of growth. The surge in electricity demand is imminent, prompting Florida Power & Light to turbocharge its investments and expand vigorously.

The Power of Dividends in Wealth Creation

Dividends are like the hidden gems of passive income, quietly shaping the landscape of total returns. NextEra Energy boasts an enviable dividend track record, wielding a robust dividend yield of 3.6% presently, and flaunting a streak of 29 consecutive years of dividend hikes.

Behold the transformative prowess of dividends on investment returns:

NEE Total Return Price data by YCharts

The dividend stream appears sturdy, a promising sign for long-term investors. With a 52% dividend payout ratio and consistent high-single-digit earnings growth, the future looks bright for dividend enthusiasts.

A Golden Opportunity Amidst Market Fluctuations

Market darlings rarely come with bargains. NextEra Energy has savored a premium valuation courtesy of Wall Street, riding high on its stellar reputation and dividend legacy. The stock historically commanded a price-to-earnings ratio exceeding 28 over the last decade.

Investors flocked to NextEra Energy, particularly in recent years, enticed by the allure of decent yields amidst low-interest rate environments.

Alas, the interest rate tide has turned, offering investors a plethora of alternative yield options. Rising rates also crank up borrowing costs for companies like NextEra, often reliant on debt for project financing.

At present, shares are trading at a modest forward P/E of just over 16, a bargain for a firm pelting towards high-single-digit earnings growth. Long-term investors are no longer obligated to break the bank to bask in the glow of this sensational dividend stock.

Could NextEra be the Catalyst to Millionaire Status?

Warren Buffett’s wisdom echoes – it’s preferable to pay a fair price for an exceptional company than a pittance for a mediocre one. NextEra Energy’s relentless march on the winds of green energy sets it apart as an alluring long-term investment at its current valuation. Years of consistent dividend and earnings growth can diligently stack your wealth. NextEra Energy has executed this wealth alchemy before and seems poised to concoct millionaires yet again.

The only jarring note in NextEra’s symphony over the years has been its price tag, a snag thankfully now ironed out. Rest assured, investors can confidently embrace and hold NextEra Energy close to their portfolios.

Thinking of committing $1,000 to NextEra Energy?

Before taking the plunge into NextEra Energy stock, consider this:

The Motley Fool Stock Advisor analyst squad recently pinpointed what they deem as the 10 most promising stocks for savvy investors to scoop up, and NextEra Energy was conspicuously absent from the list. These chosen few could potentially yield monstrous returns in the foreseeable future.

Stock Advisor equips investors with a foolproof roadmap to success, including tips on sculpting a robust portfolio, regular insights from analysts, and bi-monthly stock recommendations. Since 2002*, the Stock Advisor service has left the S&P 500 trailing in its wake with triple the returns.

Discover the 10 stocks

*Stock Advisor returns as of February 20, 2024

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends NextEra Energy. The Motley Fool has a disclosure policy.

The perspectives articulated here represent the author’s views and opinions and not necessarily those of Nasdaq, Inc.