Investors in Chinese electric vehicle (EV) company Nio (NYSE: NIO) faced a mixed bag of news when the company unveiled its fourth-quarter and full-year 2023 results earlier this year. On one hand, Nio saw a 25% increase in vehicle deliveries year over year for the quarter, and a 13% revenue surge for the full year, reaching a new milestone.

However, the landscape of the Chinese EV market got murkier in the preceding year, as soaring competition led to aggressive price cuts by EV manufacturers vying for market share. Consequently, Nio watched its vehicle margins dwindle from just under 14% in 2022 to below 10% in 2023, resulting in a significant surge in net losses. Clearly, this trajectory is unsustainable for Nio’s survival. Yet, a glimmer of hope is on the horizon.

A Path to the Masses

Nio set its sights on broadening its market reach by launching more affordable EV models. The latest buzz is that the company plans to unveil a new mass-market brand named “Le Dao” in May, targeting family-oriented consumers. Positioned as a beacon of lifestyle, the upcoming EV brand could potentially be priced as low as $20,000, aligning with the strategies of other Chinese EV peers venturing into the mass market segment.

While Nio contends with sales growth hurdles, the introduction of this budget-friendly brand could serve as a lifeline by igniting growth once large-scale deliveries kick off in late 2024. For investors, the burning question becomes whether a stake in Nio prior to this anticipated launch makes financial sense.

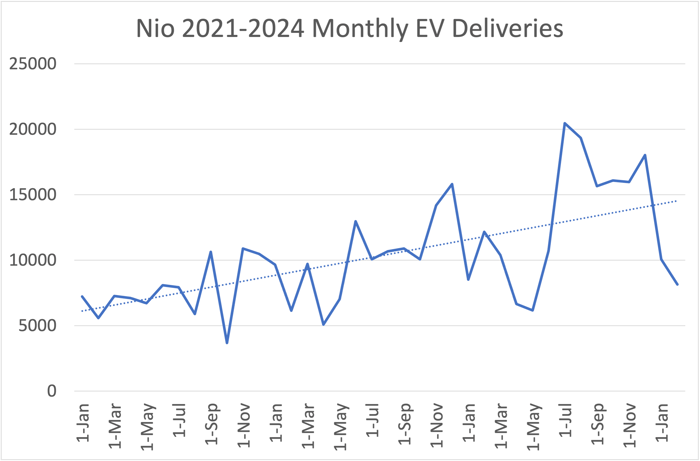

Data source: Nio. Chart by author.

Navigating the Risky Terrain

Before diving headfirst into a potential investment buoyed by a future catalyst, it’s imperative for investors to reckon with the looming risks. The tumultuous year that unfolded cast a shadow on Nio’s stock, plummeting over 40% year to date due to various challenges.

Amidst stiff competition, with global giants like Tesla and China’s very own BYD dominating the field, Nio struggles to maintain its growth trajectory. The price wars triggered amid the cutthroat market dynamics in China, exacerbated by a sluggish economy, continue to gnaw away at Nio’s profitability by compressing margins.

Diversifying geographically appears as a viable strategy for Nio to reduce its over-reliance on the Chinese market. While the company already exports to Europe, creating a foothold, this region too is witnessing a surge in competition, fueled by traditional automakers embracing EVs in their product lineup.

Despite the challenges, the broader horizons of the Chinese and European auto markets present long-term growth opportunities. A successful foray into the mass EV market could pave Nio’s way to profitability, painting a brighter future. Investors intrigued by this prospect might find value in the recent share price decline, potentially opting for a phased investment approach instead of risking a lump sum.

Is plunging $1,000 into Nio a wise move right now?

Prior to making a play on Nio, weigh this in:

The Motley Fool Stock Advisor analyst team has pinpointed their top picks for investors to reap the fruits in the years ahead, with Nio not making the cut. The selected 10 stocks hold the promise of substantial returns down the line.

Stock Advisor offers a roadmap to successful investing, featuring portfolio-building guidance, analyst insights, and bimonthly stock picks. Since 2002*, the Stock Advisor service has outperformed the S&P 500 by over triple!

Explore the 10 stock picks

*As of March 21, 2024

Howard Smith holds interests in BYD, Nio, Tesla, and XPeng. The Motley Fool has stakes in and endorses BYD, Nio, and Tesla. The Motley Fool abides by a disclosure policy.

The opinions and perspectives detailed herein belong to the author and do not necessarily mirror those of Nasdaq, Inc.