Market Volatility and High-Yield Fund Opportunities for Investors

Income investors should pay attention to two key developments right now. First is my outlook on the volatile market conditions that have recently emerged. Second, I want to discuss a fund yielding 15.6% that has undergone a recent name and ticker change that has caught the eye of many contrarian investors.

Let’s delve into the current market landscape. The NASDAQ has dipped more than 10% from its high, contributing to an overall decline in stocks for the year. However, I anticipate this trend will not persist for long. My prediction is that 2025 will experience volatility, rather than a continual downward trend.

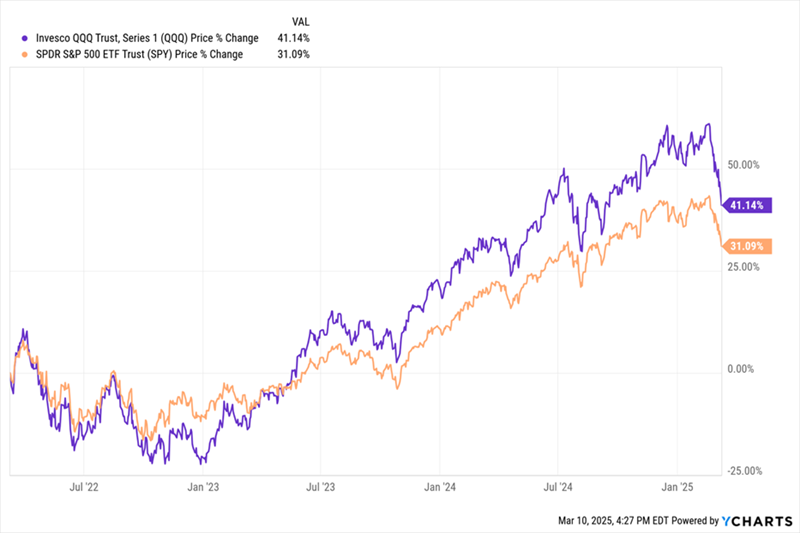

It’s noteworthy that the current market volatility is relatively recent. Stock reversals began in earnest only last month, but despite the recent downturn, the NASDAQ 100 shows a still-positive annualized gain of 12.6% over the past three years, while the S&P 500 reflects a 9.6% annualized increase.

Short-Term Dips Against a Long-Term Bullish Backdrop

This chart illustrates that buying dips during this volatile period has proven successful. Evidence suggests that both indices are poised for another buying opportunity, especially as stocks may decrease to levels that will make them attractive again.

COVID-19’s Impact on Market Stability

Market psychology plays a significant role during these volatile times, as drastic declines can erase trillions in wealth in a matter of days. Historically, this has posed serious problems for investors. However, I believe the effects of COVID-19 have changed the dynamics.

This may sound unusual, so let me clarify. During the pandemic’s onset, significant wealth was lost almost instantaneously as people were restricted from engaging in economic activities. At one point, oil prices even plummeted to negative territory.

However, stock prices rebounded, thanks in part to robust monetary policies. The Federal Reserve implemented emergency interest rate cuts and launched a significant bond-buying initiative, known as “quantitative easing.” Additionally, advancements in technology—including new supply chains and medical innovations—contributed to recovery.

Investors have already endured the market’s worst-case scenario, which is still fresh in their memory. Consequently, even if a recession occurs in the next couple of years, a collapse similar to those of 2008 or 2020 seems unlikely. Fear levels are lower now, giving way to a more resilient investor behavior despite economic challenges.

Strategic Dip Buying

Given the current market climate, it makes sense to adopt a measured approach when buying dips in stocks. Since fear can be unpredictable, it’s wise not to wait for the absolute bottom to make purchases. Instead, start acquiring stocks when they initially decline, increase your investment as the decrease worsens, and continue as required during a bear market.

An effective strategy to enhance your investment discount is to buy stocks within a closed-end fund (CEF) that trades at an attractive discount to its net asset value (NAV), or the value of its underlying portfolio.

Among these options is the BlackRock Technology and Private Equity Term Trust (BTX), which offers a striking 15.6% dividend. The fund changed its ticker from BIGZ last month and rebranded from the BlackRock Innovation and Growth Term Trust.

As indicated by its new name, the fund allocates part of its portfolio to private equity, which can yield higher returns compared to public stocks over time. The term “term” signifies that the fund is set to mature in 12 years, although important details reveal it can convert to a perpetual fund—something I expect will happen and therefore don’t focus heavily on the term.

BTX’s Changing Dynamics

The most significant aspect (beyond its attractive dividend) is the narrowing discount on BTX:

BTX’s Fading Discount

Following the significant selloff due to fear in 2022, the discount on BTX has decreased as investors recognized that purchasing the fund’s tech stock holdings at a 20% discount was an advantageous move. Furthermore, BlackRock, the firm managing the fund, initiated a stock-buyback program in early 2024.

There was a previous concern about BTX (when it was still named BIGZ) lagging behind other BlackRock tech CEFs. However, it has recently gained attention, although it may be too speculative to add to our CEF Insider portfolio.

From BIGZ to “Bigger X”

The changes to this fund are more profound than mere branding. BlackRock also significantly revised its investment mandate, allowing for even greater exposure to technology stocks.

Now, at least 80% of its assets are allocated to public and private tech companies, as opposed to the previous focus on small- and mid-cap growth stocks. This earlier strategy was less effective since small-cap stocks have generally underperformed their larger counterparts in recent years, as illustrated in the comparisons of stock indices below.

Small Caps = Smaller Profits

This dynamic has evolved over time, and while the reasons for small-cap underperformance could fill another article, it has contributed to my prior hesitance toward BTX when it was known as BIGZ. Ironically, BIGZ was not as “big-focused” as many believed.

BTX Welcomes New Management as Investors Eye Promising Prospects

Recently, BTX has undergone significant changes, including a shift in its management team. The fund is now led by Tony Kim and Reid Menge, known for their successful track record with the BlackRock Technology Opportunities Fund (BGSAX). This fund has consistently outperformed the market, including the challenging NASDAQ index, as indicated by its benchmark performance.

Expert Fund Managers Take the Helm of BTX

This notable outperformance might lead to a premium for BTX in the future. For now, the fund presents an appealing opportunity as it trades at a discount, attracting investor interest.

5 Monthly Dividend Opportunities Amid Market Fluctuations

In uncertain times marked by high volatility, investors may find wealth-building opportunities, particularly income investors. As stock and closed-end fund (CEF) prices decrease, dividend yields increase.

This period opens up chances to secure substantial dividend payouts. While BTX offers intriguing potential, it remains a more speculative investment suitable for short-term positions. However, there are several other opportunities with reliable income streams that are well positioned to deliver significant returns over the long term. These include 10%-yielding monthly dividend CEFs that I recommend exploring.

The five CEFs highlighted are currently attractively priced, providing instant diversification across various sectors, including U.S. and international equities, real estate investment trusts (REITs), and corporate bonds.

Investors recognize that substantial dividends can serve as crucial financial support in turbulent markets, ensuring that essential expenses are covered while awaiting a market recovery.

Take advantage of the opportunity to invest in these five dependable income sources before their prices rebound. Click here for more information about these monthly payers and to receive a free Special report detailing their names and tickers.

Also see:

- Warren Buffett Dividend Stocks

- Dividend Growth Stocks: 25 Aristocrats

- Future Dividend Aristocrats: Close Contenders

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.