Investors Eye Nucor (NUE) Stock, Trading Near 52-Week Lows

As the new year begins, investors are keen to spot stocks that might be undervalued.

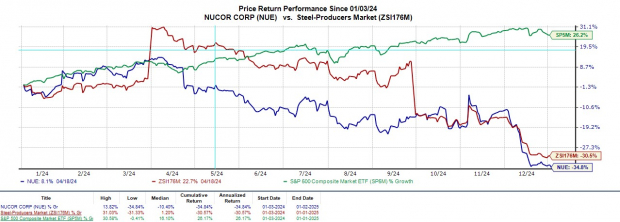

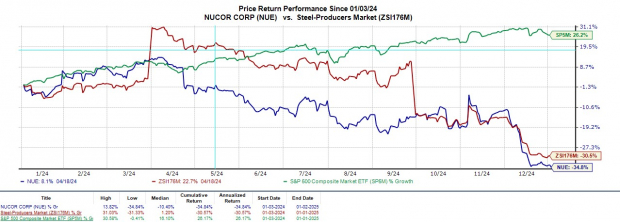

Nucor NUE, currently priced around $115 per share and close to its 52-week low, is attracting attention as a prominent steel producer in the U.S.

With a more than 30% drop over the last year, many are asking if now is the right time to invest in Nucor for a potential rebound.

Image Source: Zacks Investment Research

Current Industry Struggles

Nucor’s challenges reflect broader issues in the industry; the Zacks Steel-Producers Market has also dropped 30% over the past year. Weighing heavily on performance, pricing pressures have brought the cost of Hot-Rolled Coil (HRC) steel to a yearly low of $706 per metric ton.

Furthermore, increased raw material costs and supply chain disruptions have further pressured Nucor’s profitability.

Image Source: Trading Economics

Outlook for Nucor

According to Zacks estimates, Nucor’s annual earnings are expected to fall by 53% in fiscal 2024, with projections showing earnings per share (EPS) dropping to $8.35 from $18.00 in 2023. However, FY25 EPS is expected to recover slightly, increasing by 6% to $8.83.

Total sales for Nucor are also projected to decline by 13% in FY24, with an additional 2% dip forecasted for FY25, bringing the total to $29.46 billion.

Image Source: Zacks Investment Research

Evaluating Nucor’s Valuation

Despite declines in revenue and earnings, Nucor’s valuation stands out at 13.9 times forward earnings. This is higher than the Zacks Steel-Producers Industry average of 9.8 times, yet lower than United States Steel’s X multiple of 15.5 times, and still provides a notable discount compared to the S&P 500. Additionally, Nucor trades at less than 1 times sales.

Image Source: Zacks Investment Research

Final Thoughts

Currently, Nucor’s stock carries a Zacks Rank of #3 (Hold). While it may not be the ideal moment for a quick rebound, the company’s appealing valuation could shift investor perceptions. For long-term investors, opportunities from these levels might prove rewarding, although waiting for potentially better buying conditions could be wise.

Fresh Insights: Zacks’ Top 10 Stocks for 2024

Don’t miss the chance to explore Zacks Director of Research Sheraz Mian’s handpicked list of the top 10 stocks for 2025. This portfolio has achieved remarkable success, with gains of +2,112.6% since its launch in 2012, far surpassing the S&P 500’s +475.6%. By sifting through 4,400 stocks covered by the Zacks Rank, Sheraz has identified ten exceptional investment choices for the coming year. Seize this opportunity to discover these newly released stocks with significant potential.

Get a Free Stock Analysis Report on Nucor Corporation (NUE)

Get a Free Stock Analysis Report on United States Steel Corporation (X)

Click here to read the original article on Zacks.com.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.