Tesla Faces Major Production Delay, Shares Drop Sharply

Tesla (NASDAQ: TSLA) Stock experienced a notable decline on Monday due to significant news surrounding its production plans. At 2 p.m. ET, Tesla’s share price decreased by 7.3%, contrasting with the S&P 500, which fell by 3.4% as broader market concerns escalated.

Production Delays Impact Investor Sentiment

Investors reacted sharply to reports that Tesla would delay the U.S. launch of the more affordable version of its Model Y. This new electric vehicle (EV) was originally set to debut this quarter, but it has now been postponed to at least the third quarter, potentially running into 2026. Reuters did not disclose the reasons for this delay. As a result, Tesla Stock has seen a 45% decline across 2025’s trading.

Upcoming Earnings Call and Sales Prospects

The electric vehicle manufacturer is expected to announce its first-quarter earnings after market close on Tuesday. Early delivery figures from this month indicate that the company may report significant declines in both sales and earnings.

Given the postponement of the lower-cost Model Y, Tesla’s anticipated sales rebound is likely stalled, which could negatively influence its overall performance for the year. Despite these challenges, Tesla Stock remains priced at high growth-dependent valuations.

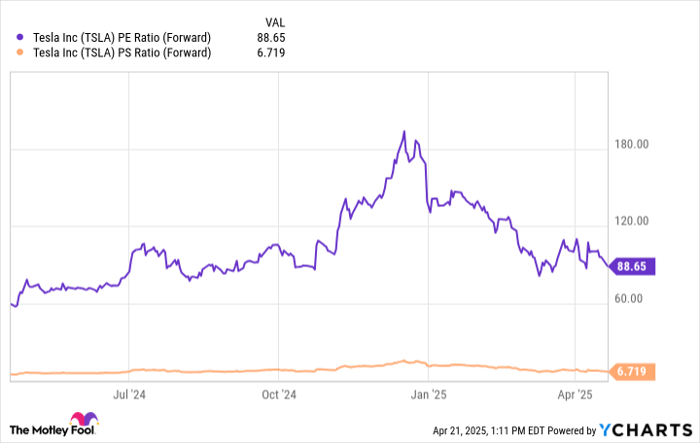

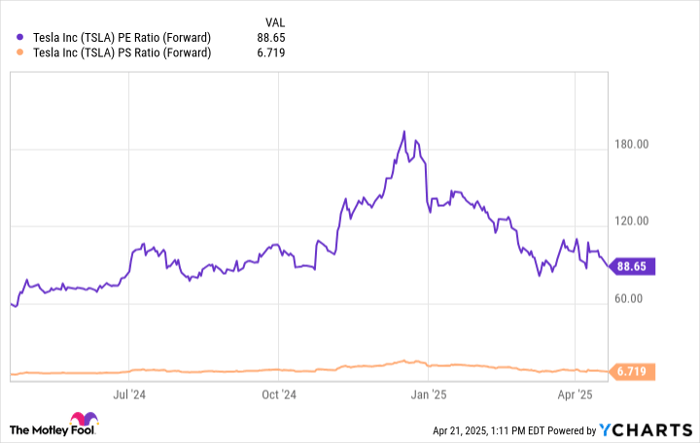

TSLA PE Ratio (Forward) data by YCharts.

Currently, Tesla shares trade at more than 88 times this year’s expected earnings and around 6.7 times anticipated revenue, even as negative trends in sales emerge. Given the current conditions for its core EV sector, investors may find shares overpriced. Unless you are particularly optimistic about Tesla’s robotaxi service generating substantial revenue soon, it may be prudent to hold off on purchasing Tesla Stock for now.

Exploring New Investment Opportunities

Investors wondering if they missed out on lucrative stock opportunities should consider the following insights.

Occasionally, our team of analysts issues a strong “Double Down” Stock recommendation for companies poised for growth. Don’t let a chance slip away. Here are some past successes:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $263,189!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $37,346!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $524,747!*

At present, we are issuing “Double Down” alerts for three significant companies, which are accessible upon joining Stock Advisor.

see the 3 stocks »

*Stock Advisor returns as of April 21, 2025

Keith Noonan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.