ARM Holdings Faces Decline, But Future Prospects Remain Strong

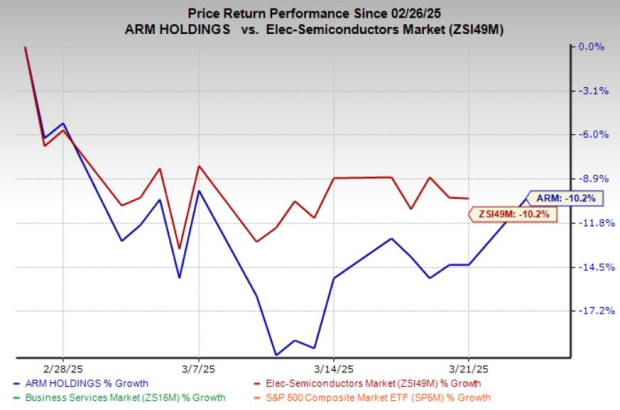

Arm Holdings plc ARM Stock has experienced a significant decline over the past month, with shares dropping 10%, consistent with industry trends.

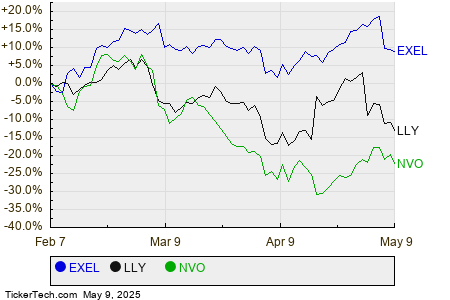

Image Source: Zacks Investment Research

Given this downturn, investors might consider if this is the right moment to invest in ARM Stock. Let’s explore further.

Dominance in Mobile and AI Markets

Arm Holdings maintains a strong foothold in the semiconductor sector, particularly in the mobile device market. Its low-power architecture has been essential for decades, especially for smartphones and tablets. The company’s technology is supplied to major manufacturers such as Apple AAPL, Samsung, and Qualcomm QCOM. This sustained demand forms a crucial strength for ARM.

As AI and the Internet of Things (IoT) continue to expand, Arm Holdings stands to gain from these technological advancements. ARM-powered chips are increasingly embedded in smart devices, autonomous systems, and data centers, addressing the rising computational requirements of AI. The growth of AI workloads and IoT devices, which demand efficient and low-power processing, highlights the relevance of ARM’s architecture. Furthermore, the company is focusing on modifying its designs for AI-centric operations, presenting substantial growth potential.

Business Model and Financial Robustness

One of the key elements of Arm Holdings’ business model is its licensing and royalty framework. ARM licenses its chip designs to major tech companies, collecting royalties on each chip sold. This model generates a consistent revenue stream with minimal capital expenditure. Collaborations with industry leaders ensure ARM remains a go-to choice in various segments, including automotive, data centers, and smart devices.

The company’s recent IPO significantly bolstered its capital, leading to a strong balance sheet. As of December 31, it reported $2.7 billion in cash with no debt. This cash reserve positions ARM effectively to support its research and development efforts, pursue strategic acquisitions, and broaden its market footprint. Such financial flexibility also enhances ARM’s competitive stance, enabling it to navigate market volatility and invest in growth opportunities.

Positive Fourth-Quarter Guidance

Arm has set optimistic guidance for the fourth quarter of fiscal 2025, forecasting revenues between $1.175 billion and $1.275 billion. The midpoint of this range indicates a robust 32% year-over-year increase. Additionally, the expected adjusted EPS is between 48 cents and 56 cents, reflecting 44% growth at the midpoint compared to the previous year’s 36 cents. While the third-quarter results were solid, this guidance suggests that AI-driven growth is beginning to manifest in the company’s financials.

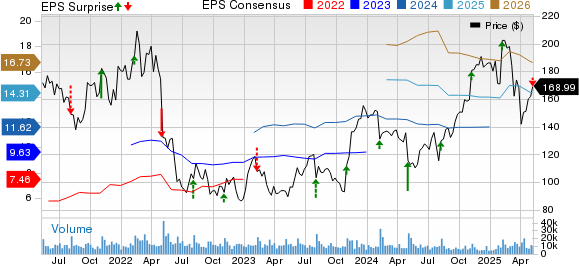

The Zacks Consensus Estimate for ARM’s fiscal 2025 earnings stands at $1.62, suggesting a 27.6% increase from the previous year. Furthermore, earnings for fiscal 2026 are anticipated to rise by 23.5% compared to prior-year figures.

Image Source: Zacks Investment Research

Projected sales growth for ARM is estimated at 23.5% and 23.3% year-over-year for fiscal 2025 and 2026, respectively.

Image Source: Zacks Investment Research

Overvaluation Concerns

Currently, ARM Stock appears overvalued, trading at approximately 62.7 times forward 12-month earnings per share. This figure is significantly above the industry average of 25.5 times. When evaluating the trailing 12-month EV-to-EBITDA ratio, ARM trades at around 252.8 times, vastly exceeding the industry average of 17.4 times.

Investment Timing is Key

Despite its current challenges, Arm Holdings is still a key player in the semiconductor arena, bolstered by its leading architecture and growth in AI and IoT sectors. The company’s solid licensing model and strong post-IPO financials lay a robust foundation for future expansion.

Nonetheless, it is essential for investors to consider the timing of their entry to maximize returns. With ARM’s existing valuation, there is potential for a price correction. It may be wise for investors to await a more favorable entry point before acquiring shares of the Stock.

ARM currently holds a Zacks Rank #3 (Hold). For a detailed list of today’s Zacks #1 Ranked (Strong Buy) stocks, you can see them here.

5 Stocks with Doubling Potential

These five stocks were meticulously selected by Zacks experts as the top picks expected to gain +100% or more in 2024. While not every selection will be successful, past recommendations have delivered impressive returns, including +143.0%, +175.9%, +498.3%, and +673.0%.

Many stocks in this report are flying under Wall Street’s radar, offering a promising opportunity to get in early.

Today, discover these five potential high performers >>

Ready for the latest recommendations from Zacks Investment Research? Download your copy of the 7 Best Stocks for the Next 30 Days today. Click here for this free report.

QUALCOMM Incorporated (QCOM): Free Stock Analysis report

Apple Inc. (AAPL): Free Stock Analysis report

ARM Holdings PLC Sponsored ADR (ARM): Free Stock Analysis report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.