BigBear.ai Struggles Amid AI Market Demand and Investor Concerns

The strong performance of Palantir Technologies illustrates a genuine demand for artificial intelligence (AI) software that assists organizations in data utilization and informed decision-making. In late 2021, BigBear.ai Holdings (NYSE: BBAI) went public through a merger with a special purpose acquisition company (SPAC).

However, the timing was unfortunate. Following its debut, a Stock market bubble sparked by zero-percent interest rates burst. This period has been challenging for shareholders, and while the Stock showed some promise, recent market volatility has driven BigBear.ai’s value down nearly 80% from its previous peak.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Is this a dip worth buying before the Stock rebounds, or is the market advising investors to avoid it?

Comparing BigBear.ai to Palantir

On the surface, BigBear.ai appears to be an attractive Stock choice. The company’s software operates through three main functions: observe, orient, and dominate. In essence, BigBear.ai aggregates data, analyzes trends, and delivers insights that help decision-makers.

The company focuses on sectors such as government, supply chains, healthcare, and life sciences. A significant portion of its revenue comes from U.S. government contracts. This model resembles Palantir’s, which has achieved remarkable success with the release of its AIP platform in 2023. Currently, BigBear.ai has a $757 million market cap, leaving potential for future growth if the business improves.

Yet, investors remain cautious. BigBear.ai reported revenues of approximately $155 million in 2022 and 2023, followed by $158 million last year. For 2025, management anticipates sales between $160 million and $180 million, suggesting limited growth for this year.

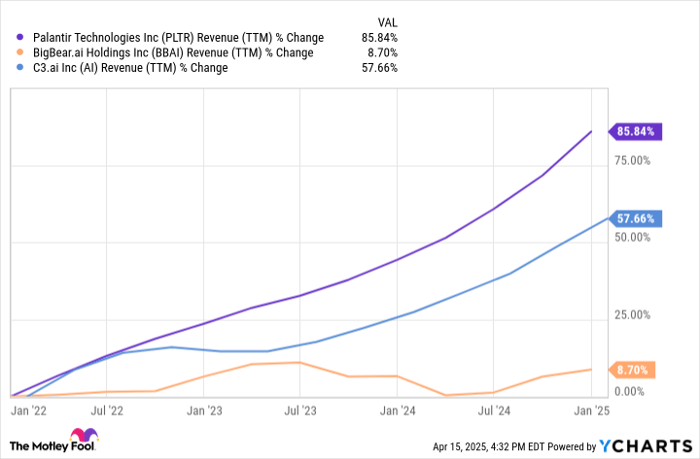

PLTR Revenue (TTM) data by YCharts

Amid rising interest in AI software since 2022, companies like Palantir and C3.ai have experienced significant revenue growth. Conversely, BigBear.ai’s struggles raise concerns about its business strategy and the value of its offerings compared to competitors.

Risks of Shareholder Dilution

BigBear.ai’s financial situation poses additional challenges. As of the end of 2024, the company had only $50.1 million in cash. With cash losses amounting to $49.2 million last year, raising funds in the near future seems inevitable. The company also carries about $200 million in long-term debt, primarily in convertible bonds due in 2029. While this isn’t an immediate crisis, it increases the likelihood of management issuing Stock to raise capital.

The ongoing cash burn and limited financial reserves highlight the potential for shareholder dilution. Management has already converted some debt into Stock to alleviate short-term financial pressure. Additionally, the share count has more than doubled since 2022 due to Stock-based compensation policies.

BBAI Average Diluted Shares Outstanding (Quarterly) data by YCharts

Issuing more shares can be detrimental for existing shareholders. Increased share dilution reduces the potential return on each share, akin to slicing a pizza into more pieces—everyone shares, but each piece is smaller.

Market Signals and Investment Outlook

BigBear.ai currently trades with a price-to-sales ratio below 4.0, positioning it among the cheaper technology stocks available. While low prices can signal a buying opportunity, this does not always hold true. The company’s stagnation in the face of rising AI demand, precarious financial standing, and significant dilution risks present legitimate concerns. Thus, although BigBear.ai may seem like a bargain, its shortcomings are hard to overlook.

For now, the recent downturn in BigBear.ai’s share price appears to reflect the market’s natural response to weaker fundamentals. Investors are advised to consider safer alternatives for their portfolios.

Is Now the Right Time to Invest $1,000 in BigBear.ai?

Before purchasing Stock in BigBear.ai, take into account the following:

The Motley Fool Stock Advisor team has just identified their top 10 best stocks for investors right now… and BigBear.ai isn’t among them. The selected stocks could generate substantial returns in the coming years.

Consider this: if you had invested $1,000 in Netflix when it made our list on December 17, 2004, you’d have gained $524,747!

Or if you had invested $1,000 in Nvidia when it was highlighted on April 15, 2005, that investment would now be worth $622,041!

The Stock Advisor has an average return of 792%, significantly outperforming the S&P 500’s 153%. Stay updated with their latest top 10 list when you join Stock Advisor.

*Returns as of April 14, 2025

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Palantir Technologies, and also recommends C3.ai. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.