“`html

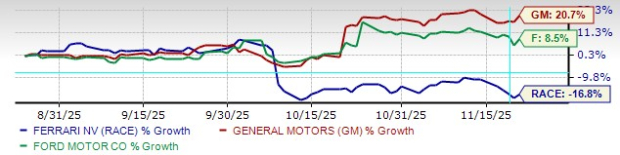

Ferrari N.V. (RACE) has seen a 17% decline in its stock price over the last three months, dropping to its lowest level in a year. This comes as major automakers like General Motors (GM) and Ford (F) have experienced stock increases. The company reported 3,401 units delivered in Q3 2023, with strong demand for its new model, the Purosangue, contributing significantly to sales.

Despite the recent downturn in stock price, Ferrari’s fundamentals remain robust, highlighted by a 37.9% EBITDA margin in Q3, thanks to high levels of customization and pricing power. The company’s multi-year backlog extends into 2027, with over 80% of annual sales coming from existing owners. Ferrari plans to launch four new models annually from 2026 to 2030, further ensuring product exclusivity and market position.

As of now, Ferrari has repurchased approximately 5.84 million shares for about €1.95 billion as part of its €2 billion buyback program initiated in July 2022. This move reflects the company’s strong financial structure, characterized by little debt and positive cash flow, while maintaining a conservative growth outlook that targets earnings increases of 15.3% for 2025 and 8.7% for 2026.

“`