Microsoft Set to Report Q3 Fiscal 2025 Earnings on April 30

Microsoft (MSFT) will announce its third-quarter fiscal 2025 results on April 30. Analysts predict revenues to reach $68.38 billion, reflecting a 10.55% increase over the previous year’s figures.

The consensus estimate for earnings stands at $3.20 per share, which suggests an 8.84% growth year over year. This estimate has remained unchanged over the past 30 days.

Image Source: Zacks Investment Research

Examining MSFT’s Earnings Surprise History

In the last reported quarter, Microsoft produced an earnings surprise of 3.86%. The company has exceeded the Zacks Consensus Estimate for earnings in the last four quarters, with an average surprise of 4.34%.

Microsoft Corporation Price and EPS Surprise

Microsoft Corporation price-eps-surprise | Microsoft Corporation Quote

Earnings Predictions for MSFT

Current forecasts do not confidently suggest an earnings beat for Microsoft this quarter. The ideal combination of a positive earnings ESP and a Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 (Hold) enhances the chances for an earnings surprise. However, this is not the scenario here. MSFT currently holds an earnings ESP of -0.51% and is rated #3 on the Zacks Rank scale.

Analyzing Factors Influencing MSFT’s Upcoming Results

Expected growth in Microsoft’s upcoming third-quarter fiscal 2025 results appears steady, although some indicators suggest a more cautious approach for investors. The company’s growth is largely powered by its cloud-centric segments, but performance varies among its different business units.

In the Productivity and Business Processes segment, revenues are projected between $29.4 billion and $29.7 billion, with estimates indicating 8.9% year-over-year growth to $29.51 billion.

Office 365 Commercial revenues are expected to grow by 14-15% in constant currency (cc), reflecting an ongoing transition from conventional on-premise solutions to cloud-based services. While revenues from Office Commercial products may remain steady, Office Consumer products and cloud services are expected to show resilience with mid-to-high single-digit growth.

LinkedIn is projected to deliver moderate revenue increases in the low-to-mid single-digit range. In contrast, Dynamics 365 is expected to demonstrate stronger growth in the mid-teens.

The Intelligent Cloud segment remains the cornerstone of Microsoft’s growth, with revenue forecasts between $25.9 billion and $26.2 billion. The estimated revenue for this segment stands at $26.06 billion, signifying a growth rate of 17.7% compared to the same quarter last year.

Azure is the key driver here, with anticipated revenue growth of 31-32% in cc, emphasizing Microsoft’s commitment to AI strategies. Enterprise Services are projected for modest low-to-mid single-digit growth, while Server product revenues are anticipated to decline in mid-single-digit percentages.

For the More Personal Computing segment, revenue expectations are set within a range of $12.4 billion to $12.8 billion, with our estimate at $12.77 billion, reflecting a slight growth of 1.3% year on year.

The performance of Windows revenues appears tied to an improving, yet slow trend in PC demand. The latest preliminary report from the International Data Corporation indicates that first-quarter 2025 worldwide PC shipments total 63.2 million units, marking a growth of 4.9% from the previous year. Nonetheless, Microsoft foresees Windows OEM revenues declining in low-to-mid single-digit percentages.

The competitive landscape showcases stable performances, with Lenovo (LNVGY) reporting 10.8% shipment growth while both Hewlett Packard (HPE) and Dell Technologies (DELL) saw increases of 6.1% and 3%, respectively.

In the gaming sector, revenues are predicted to grow at a low single-digit rate, with Xbox content and services expected to rise by low-to-mid single-digit percentages. This moderate consumer segment performance contrasts sharply with the stronger revenues expected from enterprise and cloud divisions.

Despite Microsoft’s strong fundamentals and consistent growth in vital areas, particularly in cloud services and AI, the varied results in some segments may suggest possible headwinds. Investors should assess the company’s capacity to uphold premium valuation multiples amidst slow growth projections in personal computing and certain business areas, warranting a more cautious stance ahead of the earnings announcement.

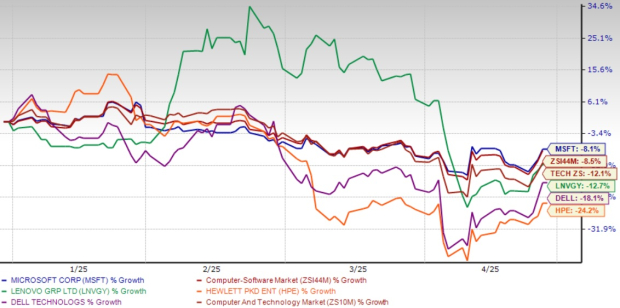

MSFT Price Performance and Stock Valuation

Year-to-date, MSFT shares have dipped by 8.1%, contrasting with the broader Zacks Computer & Technology sector, which fell by 12.1%. Shares of LNVGY, DELL, and HPE have seen declines of 12.7%, 18.1%, and 24.2%, respectively during the same period.

Review of Year-to-Date Performance

Image Source: Zacks Investment Research

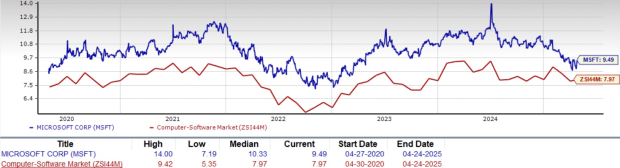

Currently, Microsoft’s valuation appears premium, with a forward 12-month P/S ratio of 9.49X compared to the Zacks Computer – Software industry’s average of 7.94X, indicating a stretched valuation.

MSFT’s P/S F12M Ratio Suggests Elevated Valuation

Image Source: Zacks Investment Research

Microsoft’s Q3 Fiscal 2025 Outlook: Cautious Optimism Required

Investment Thesis

Microsoft is an intriguing investment option as it approaches its third-quarter fiscal 2025 results. The company showcases solid fundamentals, driven by its robust performance in the cloud sector (Azure) and productivity offerings (Office 365). Additionally, strategic advancements in artificial intelligence support the prospect for long-term expansion. However, investors should adopt a cautious outlook.

While Microsoft benefits from diversified revenue streams that provide stability, it faces various near-term challenges. Increased competition in the cloud market from rivals like Amazon and Google, potential constraints on enterprise IT spending, and rising regulatory scrutiny could hinder profitability. Current market valuations may overlook these obstacles, even though Microsoft boasts a strong balance sheet and a history of consistent returns to shareholders. As such, it might be wise for investors to hold their current positions or await more favorable buying opportunities following the upcoming earnings report. This will allow for a reassessment of market expectations and growth forecasts against actual performance outcomes.

Final Thoughts

The anticipated robust performance from Microsoft’s productivity and collaboration sectors should contribute to steady growth in the third quarter of fiscal 2025. Despite a demanding valuation and intense competition in the cloud market, maintaining a position in Microsoft seems a sound strategy at this time. For those considering buying more shares, caution is advised, and waiting for a more favorable entry point may be beneficial.

Disclaimer: The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.