Shopify’s Valuation Concerns Amidst Competitive Pressures

Shopify (SHOP) currently appears overvalued, as evidenced by a Value Score of F. The company’s 12-month Price/Sales ratio stands at 11.10X, significantly higher than the broader Computer & Technology sector, which averages 5.58X.

Price/Sales Ratio (Forward 12 Months)

Image Source: Zacks Investment Research

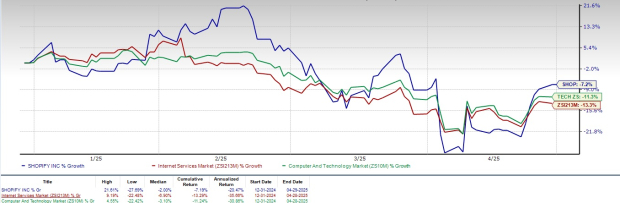

Year-to-date, SHOP shares have decreased by 7.2%, while the Zacks Computer & Technology sector has seen a decline of 11.3%. Notably, the Zacks Internet – Services industry has increased by 13.3% during the same period.

YTD SHOP Stock Price Performance

Image Source: Zacks Investment Research

The drop in SHOP’s share price can be attributed to increasing macroeconomic challenges, particularly U.S. tariffs on major trading partners like China, Mexico, and Canada, heightening trade war risks. However, Shopify’s growth in its merchant base, supported by merchant-friendly tools like Shop Pay, Shopify Pay Installments, and the Shop App, continues to attract users despite these challenges.

SHOP’s Expanding Portfolio Boosts Prospects

Shopify’s expanding portfolio is a crucial growth driver. The company’s Shop Pay application processed $27 billion in gross merchandise value in Q4 2024, up 50% year over year. This tool now accounts for 41% of gross payment volume, significantly enhancing Shopify’s overall transaction volume.

Investments in AI-driven tools, such as Shopify Sidekick and Shop Inbox, are enhancing customer engagement and streamlining merchant operations. By integrating AI, Shopify is making its platform more effective and user-friendly.

In the B2B arena, Shopify has seen remarkable progress, registering 132% growth in B2B Gross Merchandise Value in Q4 2024. Recently, the company launched new tailored solutions for B2B businesses that aim to improve digital commerce for manufacturers and distributors.

A Strong Partner Base Strengthens SHOP’s Growth

The company’s extensive partner ecosystem has been vital in driving growth. Shopify has established partnerships with major companies, including TikTok, Instagram, Target, PayPal (PYPL), Roblox (RBLX), Alphabet, and Oracle.

Through an expanded collaboration with PayPal, Shopify diversifies its payment product options, enhancing flexibility for merchants. This collaboration strengthens Shopify’s ability to offer comprehensive financial tools to its global merchant base.

With its partnership with Roblox, Shopify opens new channels for merchants to engage with a younger demographic, reinforcing its position in the digital commerce landscape.

SHOP’s 2025 Earnings Estimates Remain Steady

The Zacks Consensus Estimate for SHOP’s 2025 earnings remains at $1.45 per share, signaling a year-over-year growth rate of 11.54%. Meanwhile, the revenue estimate stands at $10.77 billion, reflecting a year-over-year growth of 21.26%.

Shopify Inc. Stock Price and Consensus

Shopify Inc. price-consensus-chart | Shopify Inc. Quote

Shopify has consistently met or exceeded the Zacks Consensus Estimate for earnings in the past four quarters, with an average surprise of 22.08%.

Facing Competitive Challenges

Shopify is encountering significant competition in e-commerce from giants like Alibaba and Amazon (AMZN). Following its acquisition of Deliverr, Shopify has directly positioned itself as a competitor to Amazon. Additionally, Amazon’s “Buy with Prime” feature further intensifies the competitive landscape.

Conclusion

Shopify is experiencing strong growth in its merchant base and expanding operations. Focusing on enhancing its client offering is a vital growth factor. Investors currently holding the stock may see long-term growth prospects as valuable.

Nonetheless, challenging macroeconomic conditions and heightened competition remain considerable obstacles. Shopify’s shift to a three-month paid trial in specific markets—compared to its previous one-month trial—aims to boost merchant retention but has negatively impacted fourth-quarter Monthly Recurring Revenue (MRR) growth and is expected to affect MRR in the first and second quarters of 2025.

Currently, Shopify holds a Zacks Rank of #3 (Hold), indicating that investors may want to wait for a more opportune moment to acquire the stock.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.