Alphabet’s Q1 Earnings Report: Insights and Market Sentiment

Aside from Tesla TSLA, analysts are turning their attention to Alphabet’s GOOGL quarterly performance this week. The tech giant is set to unveil its Q1 report on Thursday, April 24th.

In recent months, Alphabet has faced increasing antitrust scrutiny, leading to declining investor sentiment amid broader economic concerns. The call to consider breaking up Google’s search business has resulted in GOOGL shares dropping 20% year to date, further exacerbated by concerns over its monopoly in the online advertising sector.

Nevertheless, Alphabet Stock has still managed to realize over 40% gains over the past two years, inviting discussions on whether this presents a favorable opportunity to buy the dip.

Image Source: Zacks Investment Research

Alphabet’s Q1 Projections

Analysts project that Alphabet will report Q1 sales of $75.53 billion, marking a 12% rise from $67.59 billion in the same quarter last year. Additionally, the expected Q1 EPS of $2.01 indicates a 6% increase from $1.89 per share reported a year prior. Remarkably, Alphabet has consistently exceeded the Zacks EPS Consensus for eight consecutive quarters, enjoying an average earnings surprise of 11.57% in its last four quarterly disclosures.

Image Source: Zacks Investment Research

Low P/E Valuation Compared to Competitors

A compelling aspect of Alphabet Stock right now is its P/E ratio, which is currently the lowest among the “Magnificent 7” tech giants. GOOGL, trading near $150, boasts a forward earnings multiple of 16.9, a distinct discount compared to the S&P 500’s 19.8.

In contrast, Meta Platforms META comes in as the next lowest at 19.9, while Tesla’s 87X valuation is the highest within the group.

Image Source: Zacks Investment Research

Price Target and Analyst Recommendations

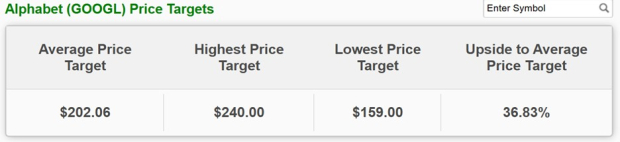

According to 48 analysts, the Average Zacks Price Target for Alphabet Stock stands at $202.06, suggesting a potential 37% upside from the current price.

Image Source: Zacks Investment Research

Notably, GOOGL has an average brokerage recommendation (ABR) of 1.40 on a scale from 1 (Strong Buy) to 5 (Strong Sell), based on insights from 53 brokerage firms.

Image Source: Zacks Investment Research

Summary and Final Insights

While risks seem to be factored into Alphabet Stock, it currently holds a Zacks Rank of #3 (Hold). Although the EPS outlook remains attractive, earnings estimates for fiscal 2025 and FY26 have continued to decline.

Consequently, the upcoming Q1 report will be crucial; if EPS revisions decline further, a sell rating could follow. Conversely, an upturn could lead to a buy rating, particularly as GOOGL trades at its most affordable forward P/E valuation in a decade.

5 Stocks Set to Double

Five stocks have been specifically selected by Zacks experts as their top picks with potential returns of +100% or more in 2024. Although not every selection will be a winner, prior recommendations have seen impressive gains of +143.0%, +175.9%, +498.3%, and +673.0%.

Many of the stocks mentioned in this report are off Wall Street’s radar, creating an opportunity for investors to engage at the initial stages.

Today, discover these 5 potential winners >>

For the latest recommendations from Zacks Investment Research, download the 7 Best Stocks for the Next 30 Days. Click for this free report.

Alphabet Inc. (GOOGL): Free Stock Analysis report.

Tesla, Inc. (TSLA): Free Stock Analysis report.

Meta Platforms, Inc. (META): Free Stock Analysis report.

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.