Netflix’s 2025 Content Strategy Sets Stage for Growth

In a significant effort to reinforce its leading position in the streaming sector, Netflix (NFLX) has announced an exciting lineup of new content for 2025. This robust strategy places emphasis on a diverse range of programming—including anime, original series, and reality shows—indicating substantial growth potential and ongoing subscriber interest.

Expanding Anime Portfolio Boosts Global Engagement

Netflix’s investment in anime is proving beneficial, with more than half of its global subscribers having watched at least one anime title in 2024. During AnimeJapan, the platform highlighted its growing anime catalog, sharing trailers and details for expected titles such as Moonrise, BEASTARS Final Season, and Devil May Cry.

This expansion showcases Netflix’s insight into global viewing preferences and its appeal across cultures. The addition of over 11,000 hours of HDR content, coupled with a 300% increase in anime streaming over five years, unveils significant opportunities for growth. Anticipated titles like SAKAMOTO DAYS, Blue Box, and Fire Force Season 3 are set to further boost international subscriber expansion.

Technological Investments Improve Viewer Experience

Beyond content, Netflix is also investing in technology to enhance viewer experiences. Recently, the company announced support for HDR10+ content on AV1-enabled devices, improving picture quality with dynamic metadata for greater fidelity to the original material.

This advancement ensures that creative intent is preserved across devices while providing an immersive viewing experience, which may increase watch hours and improve subscriber satisfaction.

Star-Studded Original Programming

Netflix continues to capitalize on star power in its original programming. Upcoming titles feature well-known personalities, such as Kevin Hart in the comedy 72 Hours and Jin of BTS in the reality show Kian’s Bizarre B&B. Additionally, the thriller series The Residence, produced by Shondaland and starring Uzo Aduba, adds to the company’s esteemed original content.

These targeted investments in content help Netflix retain its competitive advantage in a saturated streaming market. The results for the fourth quarter of 2024 reflect this strategy; Netflix recorded a revenue increase of 16% year-over-year, with operating income rising by 52%.

Strong Financial Performance Points to Bright Future

The financial results of Netflix underscore the effectiveness of its content strategy. By the end of 2024, Netflix reported 302 million memberships, with 19 million of those paid subscribers added in the fourth quarter alone, marking its highest net additions in a quarter to date. Revenue reached $10.25 billion in the fourth quarter of 2024, accompanied by an operating income of $2.27 billion.

For 2025, Netflix anticipates revenues between $43.5 billion and $44.5 billion, along with an operating margin forecast of 29%, an increase from previous estimates. Additionally, free cash flow is predicted to reach around $8 billion, providing the company with substantial resources for ongoing content investments.

The Zacks Consensus Estimate for NFLX’s 2025 revenue stands at $44.47 billion, representing a 14.03% year-over-year growth. The anticipated earnings per share of $24.58 reflects a 23.95% increase over the prior year.

Image Source: Zacks Investment Research

Find the latest EPS estimates and surprises on Zacks earnings Calendar.

Though Netflix shares trade at a premium with a forward 12-month price-to-sales ratio of 9.11 compared to a broader industry multiple of 3.96, investors may find this valuation warranted given Netflix’s unique position at the intersection of entertainment and technology. Its ability to outperform traditional media and tech competitors like YouTube highlights its strong business model.

Premium Valuation of NFLX’s P/S F12M Ratio

Image Source: Zacks Investment Research

Investment Consideration for 2025

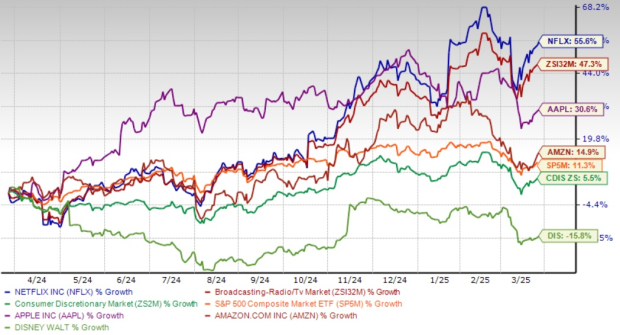

For investors, Netflix stands out as a promising investment option in 2025. The company has consistently surpassed market averages, yielding a 55.6% return over the past year, significantly outperforming competitors like Apple (AAPL), Amazon (AMZN), and Disney (DIS) as well as the broader Zacks Consumer Discretionary sector and the S&P 500.

1-Year Performance Overview

Image Source: Zacks Investment Research

With a strong pipeline of content, technological enhancements, and positive financial results, Netflix is well-positioned for sustainable growth. Although some fan-favorite K-dramas like When Life Gives You Tangerine will not return for more seasons, the introduction of fresh content should keep subscribers engaged and stimulate growth.

Final Thoughts

With returning seasons of hit shows like Squid Game, Wednesday, and Stranger Things slated for 2025, as well as an expanded anime catalog and innovative reality content, Netflix is set to enhance its leadership in engagement, revenue, and profit—making it a remarkable investment option for the upcoming year. NFLX currently holds a Zacks Rank #2 (Buy). You can check the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Five Stocks Poised for Growth

These selections were curated by Zacks experts as the top choice to gain 100% or more in 2024. While not every pick will succeed, prior recommendations have surged by 143.0%, 175.9%, 498.3%, and 673.0%.

Most stocks in this report are currently under the radar of Wall Street, creating a promising opportunity to invest early.

Today, discover these five potential high-return stocks >>

Want the latest recommendations from Zacks Investment Research? Download 7 Best Stocks for the Next 30 Days today. Click here for your free report.

Amazon.com, Inc. (AMZN): Free Stock Analysis report

Apple Inc. (AAPL): Free Stock Analysis report

Netflix, Inc. (NFLX): Free Stock Analysis report

The Walt Disney Company (DIS): Free Stock Analysis report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily represent those of Nasdaq, Inc.