Nvidia’s Soaring Stock: Should You Jump In Before 2024?

As the year draws to a close, Nvidia (NASDAQ: NVDA) is experiencing significant stock gains. Investors now face the question: Is it wise to invest in Nvidia ahead of 2024?

Nvidia’s Strong First Quarter History

Investors typically have time to decide when to buy stocks. However, Nvidia’s case is different. This company made its public debut on January 22, 1999, and has delivered positive returns in the first quarter 20 times out of nearly 25 years. Its average gain for Q1 stands at an impressive 19%.

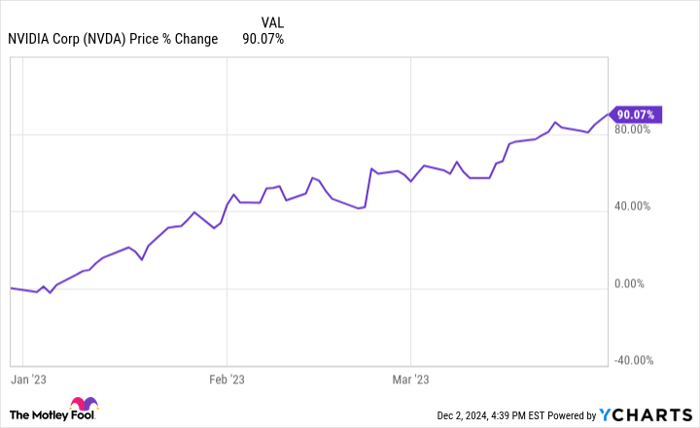

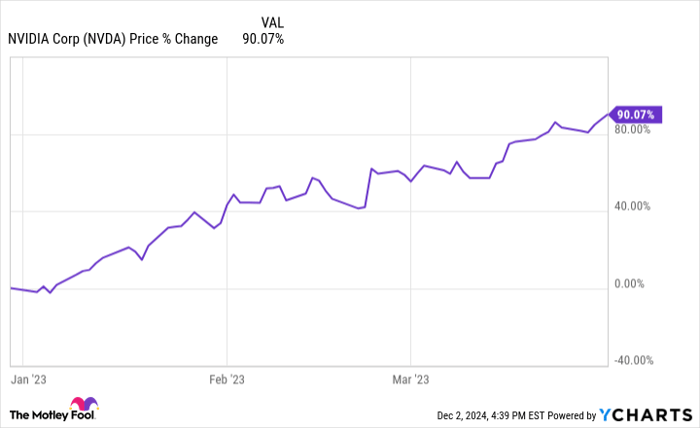

If you had delayed your purchase to after the year began, you would have missed out on significant gains more often than not. Over Nvidia’s 25 complete first quarters, 14 saw double-digit percentage increases. The most notable rise came last year, where the stock shot up by 90%. This year’s Q1 was also remarkable, with a substantial gain of 82.5%.

NVDA data by YCharts

It’s worth noting that Nvidia has experienced poor performances in some years, such as a 42% drop in Q1 of 2008. Yet, in the last decade, the stock only declined once in Q1—by about 7% in 2022.

Long-Term Performance Insights

Most investors typically hold onto stocks for more extended periods rather than selling just a few months after purchase. Looking at Nvidia’s performance over three-year spans, the company has posted positive results in 17 of the 23 periods since its IPO, averaging an impressive return of around 195%.

For those who choose to hold onto Nvidia for five years, the situation becomes even more favorable. The stock has appreciated in value in 19 of the 21 five-year periods since its IPO, boasting an average return of a remarkable 551%.

This historical data indicates that buying Nvidia stock by the end of the year often results in substantial returns.

A New Era for Nvidia

However, the question arises: Does past performance guarantee future returns? Current market conditions are different now compared to earlier years. Nvidia’s earlier successes were achieved before the rise of generative AI and during a time of lower interest rates. Now, competitors are actively entering the market, and Nvidia’s future returns could be affected as AI chip supply meets growing demand.

On the flip side, Nvidia’s prospects could improve even further. CEO Jensen Huang suggests that the new Blackwell GPU architecture might be among the most successful products in Nvidia’s history—and potentially in the wider tech industry. With a planned yearly launch of new chips, even more powerful GPUs are expected soon.

Furthermore, AI technology is still in its early stages, and better innovations, including artificial general intelligence (AGI), may drive Nvidia’s growth like never before. Even without considering AI, the company could tap into a $1 trillion market as businesses transition to accelerated computing.

If you believe Nvidia’s growth potential could surpass its history, investing in the stock before the year ends makes a solid case.

Diving Into a New Investment Opportunity

Feel like you missed your chance to buy successful stocks? Don’t worry; there are still opportunities available.

Our team of analysts occasionally identifies “Double Down” stock recommendations for companies poised for growth. If you fear you’ve already missed out, now is an ideal time to invest.

- Nvidia: if you invested $1,000 when we recommended it in 2009, you’d have $359,445!*

- Apple: if you invested $1,000 when we recommended it in 2008, you’d have $45,374!*

- Netflix: if you invested $1,000 when we recommended it in 2004, you’d have $484,143!*

Currently, we’re issuing “Double Down” alerts for three incredible companies—don’t miss another chance to invest!

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 2, 2024

Keith Speights has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.