AMD’s Ambitious Data Center Expansion

Advanced Micro Devices (NASDAQ: AMD) is poised to significantly enhance its presence in the data center market with the launch of its MI450 Series GPUs in late 2026. This new lineup is designed to deliver up to 36 times more performance than the current MI355X, which garnered over 131,000 orders from Oracle in 2025. The company’s data center segment generated $11.2 billion in revenue during the first three quarters of 2025 and is targeting a $100 billion opportunity over the coming years, bolstered by a partnership with AI startup OpenAI, committed to supply up to 6 gigawatts of GPU capacity by 2030.

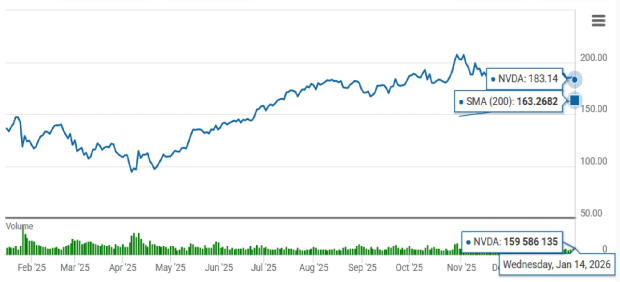

AMD’s total revenue for the first three quarters of 2025 reached $24.3 billion. While the company faces stiff competition from Nvidia, which leads the graphics processing unit market, AMD’s advancements in AI-focused hardware position it as a formidable competitor. AMD’s current stock price sits at approximately $207.69, with a P/E ratio of 55.6, higher than Nvidia’s 45.6. Despite recent stock fluctuations, Wall Street estimates foresee AMD’s earnings growing to $6.49 per share in 2026, suggesting that investors may see potential in the current price as it approaches what could be a lucrative market.