Key Points

-

E-commerce and cloud growth is in the double digits, but the performance of smaller enterprises mostly negated those gains.

-

A rising valuation may call Alibaba’s value proposition into question.

Alibaba Group (NYSE: BABA) will announce its earnings for the December quarter of 2025 on or around February 19. Despite a 3% annual revenue rise to nearly $70 billion in the first half of fiscal 2025, the company faced challenges: revenue from smaller businesses fell by 27%, and earnings missed estimates in three of the last four quarters. While cloud revenue grew by 30% and e-commerce segments increased by 12% and 14%, the company’s mixed earnings history has investors questioning whether to buy shares before the earnings report. Alibaba currently has a P/E ratio of 22, lower than Amazon’s 28 and Sea Limited’s 47.

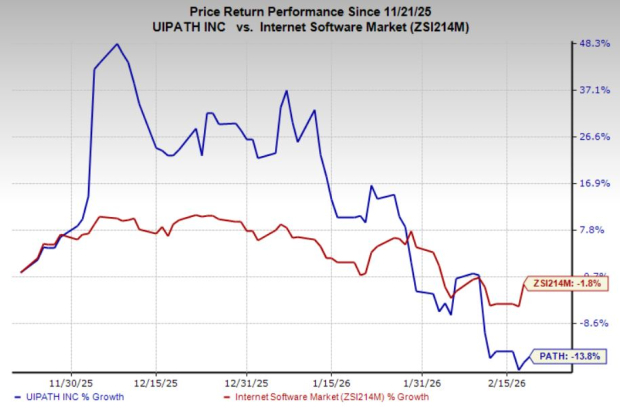

Investor sentiment has grown cautious due to Alibaba’s past earnings results and continuing geopolitical concerns. Analysts suggest that the recent improvement in the stock’s outlook, along with strong growth figures, may not suffice to assure investors, especially given that the stock’s significant gains occurred mostly last fall. As such, most experts recommend exercising caution before any new purchases ahead of the upcoming earnings report.