Baidu’s AI Focus Sparks Investor Interest in 2025 Growth Potential

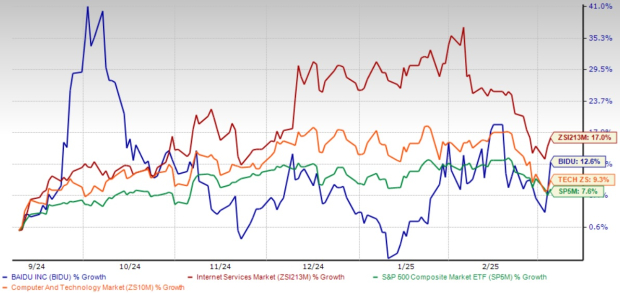

Baidu, Inc. BIDU, the premier search engine in China, has experienced a noteworthy 12.6% rise in its shares over the past six months, surpassing the Zacks Computer and Technology sector’s growth of 9.3%. This upward trend highlights the company’s ongoing shift from an internet-centric model to a leader in artificial intelligence (AI). Investors are now questioning if this momentum signals an ideal buying opportunity for 2025.

Fourth Quarter Performance

In the recent fourth quarter and fiscal 2024 earnings report, Baidu revealed that its AI initiatives are starting to produce results. While total revenues for the fourth quarter slightly decreased by 2% year-over-year to RMB34.1 billion ($4.68 billion), Baidu Core revenues showed a modest 1% increase, reaching RMB27.7 billion ($3.8 billion).

The company’s AI Cloud segment notably excelled, posting a robust 26% year-over-year growth in the fourth quarter. CEO Robin Li noted that this surge helped counterbalance the decline in the traditional online marketing sector, which fell by 7% compared to the preceding year.

6-Month Performance Overview

Image Source: Zacks Investment Research

AI Investments Yield Positive Results

Baidu’s long-term emphasis on AI appears to be gaining momentum. The company reported that its ERNIE foundation model managed approximately 1.65 billion API calls daily in December 2024, with external API calls increasing by a remarkable 178% quarter over quarter.

As part of its strategy, Baidu has decided to open-source its upcoming ERNIE 4.5 series and provide ERNIE Bot free of charge for end users. This initiative is viewed as a way to enhance market awareness of ERNIE’s capabilities and foster broader industry adoption.

Baidu has also been effective in deploying its AI technology to enhance consumer-facing products. For instance, the AI features in Baidu Wenku attracted 94 million monthly active users in December 2024—a staggering 216% increase year-over-year. Furthermore, 22% of search result pages now include AI-generated content, leading to greater user engagement and retention.

Growth in Autonomous Driving

Another promising avenue for Baidu is its autonomous ride-hailing service, Apollo Go. The service registered over 1.1 million rides in the fourth quarter of 2024, a 36% increase from the previous year. As of January 2025, Apollo Go surpassed a total of nine million rides, including achieving 100% fully driverless operations throughout China.

Baidu further expanded its operations by obtaining permits for autonomous driving testing in Hong Kong, marking its first foray into a right-hand drive market—a step that could pave the way for future market expansions.

Market Competition and Valuation Insights

Despite Baidu’s solid position in AI and autonomous driving, significant competition looms. In the AI cloud market, both Alibaba BABA and Tencent TCEHY command advantages through extensive enterprise relationships and substantial financial backing.

The autonomous driving space is also becoming increasingly crowded, with new entrants like Xpeng and WeRide rapidly gaining ground that could threaten Baidu’s industry leadership.

Currently, BIDU trades at a forward 12-month P/S ratio of 1.65x, considerably lower than the Zacks Internet – Services industry average of 5.57x. This discounted valuation indicates the market’s cautious outlook on Baidu’s AI-driven growth potential.

BIDU’s P/S F12M Ratio: A Discounted Valuation Perspective

Image Source: Zacks Investment Research

Robust Financial Position

Baidu retains a strong financial standing to facilitate its AI initiatives. As of December 31, 2024, the company reported holding RMB139.1 billion ($19.06 billion) in cash and short-term investments. Management has consistently shown its commitment to shareholder returns, having repurchased over $1 billion in shares since the start of 2024, with intentions to accelerate the buyback program.

The Zacks Consensus Estimate for 2025 revenues stands at $18.73 billion, reflecting a year-over-year decline of 1.31%. Meanwhile, the consensus estimate for 2025 earnings is $9.59 per share, with earnings projections having increased by 3.9% over the last month, which suggests growing optimism.

Image Source: Zacks Investment Research

Stay updated with all quarterly releases: view Zacks earnings Calendar.

Investment Perspective for 2025

Looking ahead to 2025, Baidu appears well-positioned to leverage increased adoption of AI and expansion of autonomous driving services. Management anticipates improvements in the advertising sector, especially as the company begins to monetize AI-generated search results effectively. The AI Cloud segment is expected to maintain strong growth alongside margin enhancements, while Apollo Go is projected to significantly boost ride volumes in the coming year.

With its technological leadership in AI, improving operational efficiencies, sturdy financial position, and strategic focus on high-growth ventures, Baidu currently presents an attractive entry point for long-term investors prepared to navigate some short-term fluctuations. The company’s ongoing transformation is set to potentially deliver considerable returns as its AI investments continue to evolve throughout 2025 and beyond. BIDU Stock holds a Zacks Rank #2 (Buy), suggesting a favorable outlook. You can explore the complete list of Zacks #1 Rank (Strong Buy) stocks here.

Only $1 to access All Zacks’ Buys and Sells

We’re serious.

Several years ago, we surprised our members by offering them 30-day access to all our recommendations for a total of just $1. No additional commitment required.

Thousands have taken advantage of this offer. However, some hesitated, thinking there was a catch. The truth is, we want you to explore our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators, and others, which boasted 256 positions with double- and triple-digit gains in 2024 alone.

view Stocks Now >>

Are you interested in recommendations from Zacks Investment Research? Today, you can download our report on the 7 Best Stocks for the Next 30 Days for free. Click for your copy.

Baidu, Inc. (BIDU): Free Stock Analysis report

Tencent Holding Ltd. (TCEHY): Free Stock Analysis report

Alibaba Group Holding Limited (BABA): Free Stock Analysis report

This article originally appeared on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.