Barrick Gold Expects Strong Q1 2025 Earnings Amid Cost Challenges

Barrick Gold Corporation (GOLD) is set to release its first-quarter 2025 results on May 7, before market opening. The company is anticipated to demonstrate improved performance driven by rising gold prices, despite facing cost pressures.

The Zacks Consensus Estimate for the first-quarter earnings has shifted 26.1% upward over the last 60 days. The consensus predicts earnings of 29 cents per share, indicating a significant 52.6% increase year-over-year.

Image Source: Zacks Investment Research

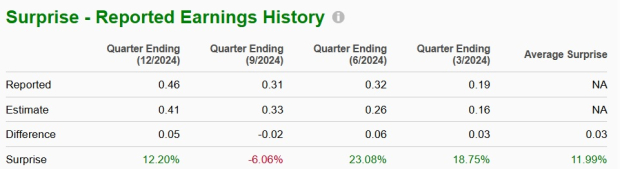

In recent quarters, GOLD has exceeded the Zacks Consensus Estimate for earnings in three out of four reports, averaging an earnings surprise of approximately 12% during this timeframe.

Image Source: Zacks Investment Research

First Quarter Earnings Outlook for Barrick Gold

Current analysis does not definitively predict an earnings beat for Barrick this season. A positive earnings surprise potential depends on a favorable earnings ESP (Earnings Surprise Prediction) and a Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 (Hold). Unfortunately, GOLD’s outlook indicates otherwise. The company holds an earnings ESP of 0.00% and is ranked #3 by Zacks.

(For the latest EPS estimates and surprises, refer to Zacks earnings Calendar.)

Key Factors Influencing Barrick’s Q1 Results

The rise in gold prices is expected to bolster Barrick’s performance for the March quarter. Concerns over the global trade landscape have increased the demand for safe-haven commodities, causing gold prices to rally. This surge in prices is primarily fueled by ongoing trade disputes, global economic uncertainties, and a weaker U.S. dollar. In Q1, gold prices rose nearly 19% and are up around 23% for the year.

However, Barrick faces challenges due to anticipated lower production levels. The consensus estimate for quarterly production stands at 710,000 ounces, representing a decline of about 34% sequentially and 24% year-over-year.

During the fourth-quarter call, the company provided a cautious forecast for 2025, projecting attributable gold production between 3.15 to 3.5 million ounces, excluding the temporarily suspended Loulo-Gounkoto mine. While a potential mine restart could benefit production levels, the projection indicates an expected decline compared to the previous year. Increased output from sites such as Pueblo Viejo and Turquoise Ridge is likely to be offset by reduced production at Veladero and Phoenix.

Production costs are influencing the company’s first-quarter results negatively. Cash costs per ounce of gold increased about 7% year-over-year in Q4 2024, with all-in sustaining costs (AISC) rising approximately 6%. For 2025, Barrick forecasts total cash costs per ounce between $1,050 and $1,130, and AISC ranging from $1,460 to $1,560, indicating a year-over-year increase at the midpoint of these ranges.

Barrick Gold’s Stock Performance and Valuation

Over the past year, GOLD’s shares increased by 11.6%, lagging behind the Zacks Mining – Gold industry’s gain of 47.2% and the S&P 500’s rise of 8.7%. Rivals such as Newmont Corporation (NEM), Kinross Gold Corporation (KGC), and Agnico Eagle Mines Limited (AEM) have achieved gains of 26.6%, 115.6%, and 73.1%, respectively, during the same timeframe.

GOLD’s One-year Stock Price Performance

Image Source: Zacks Investment Research

In terms of valuation, GOLD is currently trading at a forward 12-month earnings multiple of 10.76, which is below its five-year median. This translates to roughly a 28.1% discount compared to the industry average of 14.96X.

Image Source: Zacks Investment Research

Investment Analysis for Barrick Gold

Barrick Gold is positioned to gain from advancements in its key growth projects, which are projected to contribute significantly to overall production. The company’s main gold and copper projects are progressing on schedule and within budget, supporting future profitable production.

The company maintains strong liquidity and generates robust cash flows, allowing it to explore development, acquisition, and exploration opportunities while also enhancing shareholder value and reducing debt. Rising gold prices should facilitate increased profit margins and free cash flow generation.

However, concerns remain regarding elevated costs that may impact profit margins. Increased spending on mine-site sustainability, labor costs, and potential energy price hikes could lead to higher overall costs.

Conclusion: Hold on to Barrick Gold Shares

Barrick Gold benefits from a rich pipeline of growth projects, solid financial health, and favorable market conditions for gold. The strength of gold prices is expected to enhance profitability and facilitate cash flow generation. Nonetheless, caution is warranted due to high production costs. Investors already holding shares may find it prudent to maintain their positions until more clarity emerges from the upcoming earnings report.

The views and opinions expressed herein belong to the author and do not necessarily represent those of Nasdaq, Inc.