“`html

Digital Realty Trust Expands in Data Center Sector

Digital Realty Trust (NYSE: DLR) operates over 300 data centers globally and serves more than 5,000 tenants, which include major companies like Meta Platforms and Oracle. The company’s management estimates that global data center spending could approach $7 trillion by 2030. Currently, Digital Realty has about 2.8 gigawatts (GW) of capacity and plans to expand by an additional 4 GW.

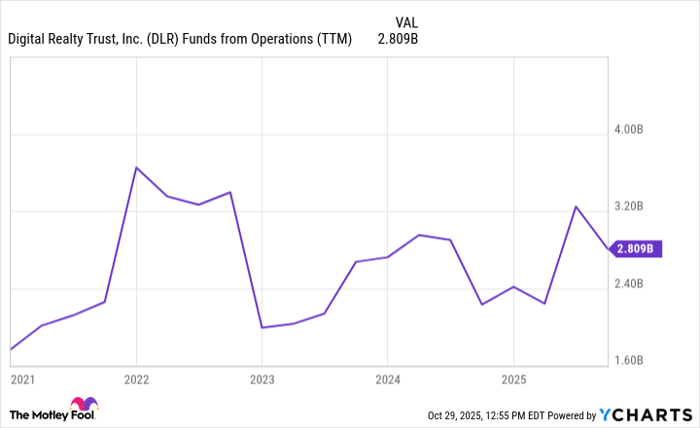

Despite a 6% decline in share prices over the past year, Digital Realty has seen over a 60% increase in stock value over the last three years and anticipates demand for data center capacity to increase by 3.5 times in the next five years. The company has maintained its annualized dividend at $4.88 per share, which is well-supported by projected funds from operations.

“`