Gilead Sciences Stock Reaches New Heights Amid Market Uncertainty

Gilead Sciences GILD has achieved new 52-week highs even as the broader market has faced a sharp pullback recently. Along with Johnson & Johnson JNJ, the pharmaceutical company is among a select group of healthcare stocks that have reached impressive peaks.

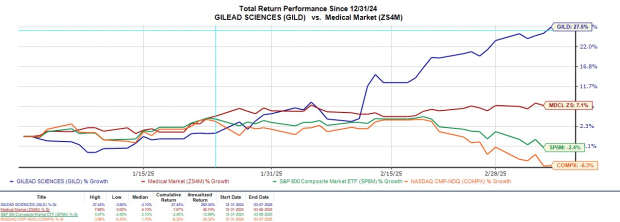

With shares trading at $117, Gilead has surged nearly +30% year-to-date, while major market indexes remain in the negative. Investors are keen to explore exposure in the medical sector during this period of economic uncertainty.

Image Source: Zacks Investment Research

Leadership in the Medical Sector

Gilead is known for its advancements in medicines aimed at preventing and treating life-threatening diseases, especially as a leader in the treatment of HIV. The company offers a diverse portfolio of drugs that also serves needs in liver diseases, inflammation/respiratory diseases, and hematology/oncology.

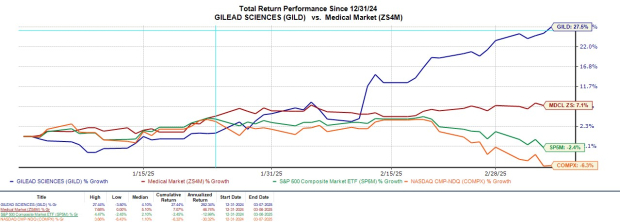

Projected revenues for 2024 are $28.75 billion, marking a 1% dip this year. However, Gilead expects a rebound, anticipating a 4% increase to $29.7 billion by fiscal 2026.

Image Source: Zacks Investment Research

EPS Growth Analysis

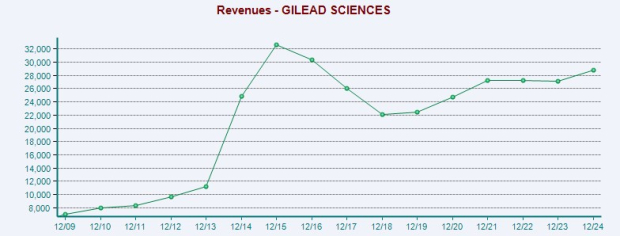

Gilead’s operational efficiency has proven beneficial, with annual earnings expected to increase by 70% in FY25, reaching $7.87 per share compared to $4.62 last year. Furthermore, FY26 earnings per share (EPS) are projected to grow another 5%.

Image Source: Zacks Investment Research

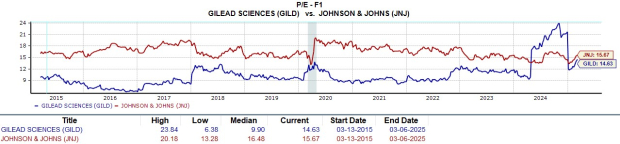

Evaluating Gilead’s Valuation

Currently, GILD trades at a forward earnings multiple of 14.6X, slightly below Johnson & Johnson’s 15.6X. In comparison, Gilead’s valuation remains a bargain against its Zacks Medical-Biomedical and Genetics Industry average of 19.1X and the broader S&P 500 average of 21.6X.

Image Source: Zacks Investment Research

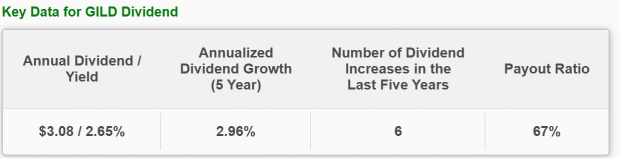

Attractive Dividend Yield

Gilead also attracts investors with a 2.65% annual dividend yield, exceeding the benchmark average of 1.27% and the industry average of 1.49%. This yield can serve as a defensive hedge in uncertain market conditions.

Image Source: Zacks Investment Research

Concluding Thoughts

Despite the sharp gains this year, Gilead Sciences holds a Zacks Rank #2 (Buy), suggesting there could be more potential for price appreciation. The upward trend in FY25 and FY26 EPS estimates supports this outlook.

Investors may find GILD stock attractive as a hedge against market volatility, particularly in light of its EPS growth, robust industry position, and favorable valuation metrics.

Just Released: Zacks Top 10 Stocks for 2025

Don’t miss the opportunity to be early on our 10 top stocks for 2025. Curated by Zacks Director of Research Sheraz Mian, this portfolio has demonstrated impressive returns. Since its inception in 2012 through November 2024, Zacks Top 10 Stocks gained +2,112.6%, significantly outperforming the S&P 500’s +475.6%. Sheraz has identified the best 10 stocks to buy and hold in 2025. You can be among the first to access these exciting investment opportunities.

Gilead Sciences, Inc. (GILD): Free Stock Analysis Report

Johnson & Johnson (JNJ): Free Stock Analysis Report

Originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.