Hertz Stock Surges Amid Tariff Turmoil in the Auto Industry

Despite facing challenges due to tariff pressure in the stock market, vehicle rental company Hertz Global Holdings, Inc. (HTZ) made notable gains on Thursday. The question now is: what fueled this increase in share value, and is it time to consider an investment in Hertz’s stock? Let’s explore the details.

Reasons for Hertz’s Stock Price Increase

Hertz has recently encountered difficulties, announcing a staggering loss of nearly $2.9 billion for 2024. This downturn was driven by a decline in electric vehicle prices acquired in 2021 and ongoing vehicle depreciation.

However, Bill Ackman, CEO of Pershing Square Capital Management, believes in Hertz’s future. Ackman has amassed a significant 19.8% stake in the company, acquiring approximately 12.7 million shares since late 2024.

What insights could be prompting Ackman’s confidence in this distressed company? He anticipates that Hertz will pivot away from its underwhelming investment in Tesla Inc. (TSLA) electric vehicles and capitalize on rising used-car prices attributed to tariffs imposed by the Trump administration on U.S. auto imports.

As automakers like Volkswagen and Audi may limit imports to avoid incurring 25% tariffs, Hertz may benefit from the potential increase in used-car prices due to greater demand. Ackman estimates that with over 500,000 vehicles worth nearly $12 billion, a mere 10% rise in used-car prices could translate to a $1.2 billion increase in Hertz’s auto asset value.

Moreover, Ackman is optimistic about Hertz’s management under CEO Gil West. He believes they have the expertise to manage debt effectively, reduce operational costs, increase revenue per unit, and enhance profit margins in the years ahead.

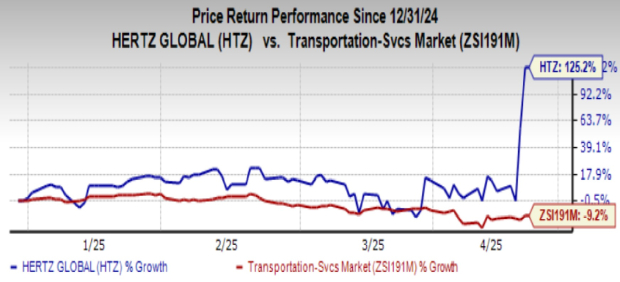

Ackman’s confidence led to a substantial rise in Hertz’s shares, which jumped nearly 44% in New York trading on Thursday. The stock has more than doubled its value over the past two trading sessions, reaching an all-time high of $8.74 before closing at $8.22. Year-to-date, HTZ shares have soared 125.2%, while the Transportation – Services industry has experienced a loss of 9.2%.

Image Source: Zacks Investment Research

Is Now the Right Time to Buy HTZ Stock?

While Ackman’s significant investment has certainly elevated Hertz’s stock price, the company’s fundamentals might still raise concerns. The rental business continues to deal with substantial fixed costs related to its fleet and ongoing vehicle depreciation without any significant changes in operations.

Additionally, despite Ackman’s optimism, the long-term outlook for Hertz appears uncertain amid prevailing economic conditions. Tariffs have dampened consumer sentiment, resulting in decreased travel spending which adversely affects rental companies such as Hertz.

Hertz also struggles with profitability, maintaining a negative net profit margin of 31.6%, significantly below the industry average of 1.2%.

Image Source: Zacks Investment Research

Consequently, Hertz holds a Zacks Rank #4 (Sell), with a Zacks Consensus Estimate of -$1.30 for HTZ’s earnings per share (EPS), reflecting a decrease of -864.7% from the previous year. You can see the full list of today’s Zacks Rank #1 (Strong Buy) stocks here.

Image Source: Zacks Investment Research

Zacks’ Research Chief Names Stock Most Likely to Double

Our team of experts has released a list of five stocks with the highest potential for gaining +100% or more in the coming months. Among these, Director of Research Sheraz Mian highlights the stock expected to see the largest gains.

This top choice belongs to one of the most innovative financial firms, currently boasting a fast-growing customer base of over 50 million. With a diverse range of cutting-edge solutions, this stock is well-positioned for substantial growth. While not every elite pick succeeds, this one could significantly outperform previous Zacks stocks set to double, such as Nano-X Imaging, which surged +129.6% in just over nine months.

Free: see our top stock and four runners-up.

Want the latest recommendations from Zacks Investment Research? Today, you can download the 7 Best Stocks for the Next 30 Days. Click to access this free report.

Hertz Global Holdings, Inc. (HTZ): Free stock analysis.

Tesla, Inc. (TSLA): Free stock analysis.

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.