Intuit’s Stock Shows Resilience Despite Recent Challenges

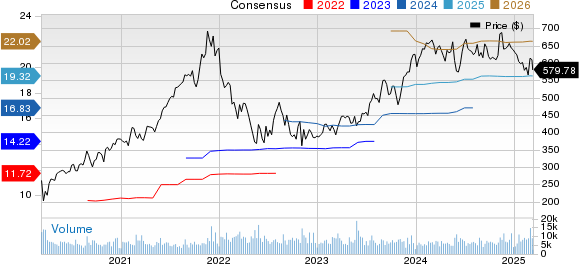

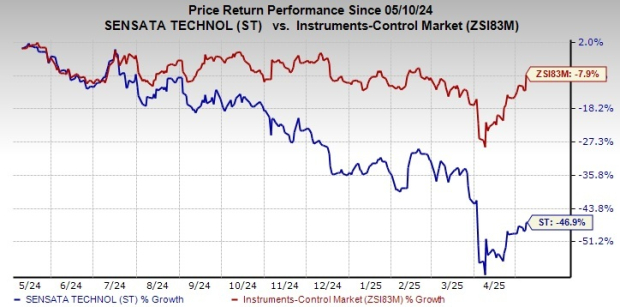

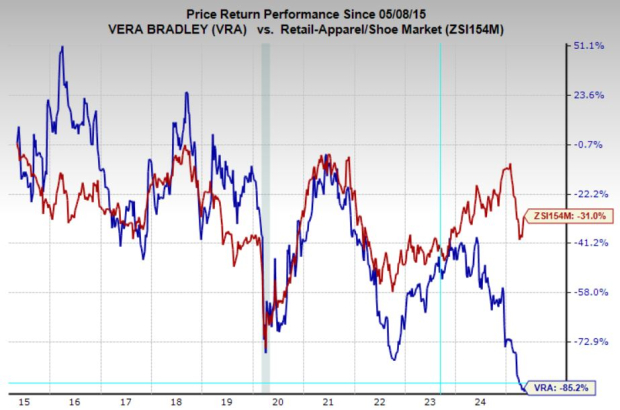

Intuit (INTU) has experienced a 12.6% decline in share value over the past year, trailing behind the Zacks Computer and Technology sector’s growth of 10.3% and the Computer – Software industry’s slight downturn of 2.5%.

Despite these challenges, Intuit’s strong prospects stem from its robust AI integration and strategic financial partnerships, signaling that now may be an opportune time for investors to consider the stock.

The company, known for its TurboTax and QuickBooks software, has outperformed competitors such as Adobe (ADBE), Verint Systems (VRNT), and Open Text (OTEX), which have seen their stock prices drop by 24.9%, 29.4%, and 32.1% respectively during the same period.

Intuit Inc. Price and Consensus

Intuit Inc. price-consensus-chart | Intuit Inc. Quote

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

Strengthened Market Share Through Key Partnerships

Recent partnerships have enhanced Intuit’s market share and directly contributed to revenue growth. QuickBooks was named Amazon’s preferred partner for financial management solutions within Amazon Seller Central, aiding sellers in managing their businesses.

Additionally, Intuit established a multi-year agreement with the Professional Women’s Hockey League in Canada, designating QuickBooks as the league’s Official Accounting Software Partner, and similarly partnered with the National Hockey League (NHL) in Canada.

Innovative Product Launches and AI Integration

Recently, Intuit introduced QuickBooks Sole Trader in the U.K., a cloud-based tax and accounting solution featuring AI automation tailored for sole traders with annual incomes under £90,000. This initiative aims to enhance revenues and profitability for users, while also expanding Intuit’s customer base.

Investment in AI capabilities has already yielded significant efficiencies, with nearly $90 million generated in the first half of 2025. The introduction of Intuit Assist—a Generative AI-powered financial assistant—has resulted in a 20% reduction in the need for TurboTax customer support.

Positive Outlook for Q3 Fiscal 2025

Intuit projects a favorable outlook for its third-quarter fiscal 2025 results. The company expects non-GAAP earnings per share between $10.89 to $10.95 and anticipates revenue growth of 12-13% year-over-year for the upcoming quarter.

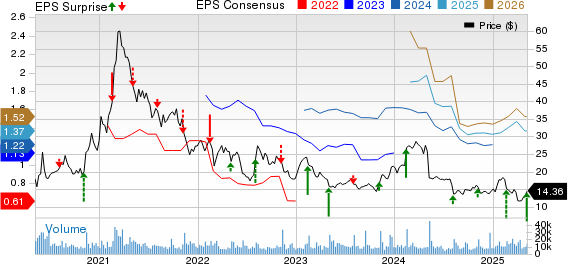

The Zacks Consensus Estimate for this quarter’s earnings stands at $11.01 per share, a decrease of 4.76% compared to last month, yet suggesting an 11.44% increase from the same period last year. Expected revenues are pegged at $7.56 billion, representing a year-over-year growth of 12.19%. Intuit has consistently surpassed earnings estimates over the previous four quarters, averaging an 11.85% surprise rate.

Investor Considerations for INTU Stock

Intuit has established a strong position in the market with a sought-after product lineup, including QuickBooks, TurboTax, Credit Karma, and Mailchimp, targeting individuals and various business sizes. With over 29 million small and medium-sized businesses in the U.S., Intuit is strategically positioned to benefit from this expanding market, presenting substantial growth opportunities.

The company’s advancements in AI have effectively reduced operational expenses and streamlined workflows. Transitioning from on-premise software to cloud-based solutions has lowered IT costs by diminishing the need for extensive server infrastructure and personnel. Ongoing collaborations with major players like Amazon continue to enhance revenue and bolster market share.

Currently, INTU holds a Zacks Rank #2 (Buy), making it a promising option for investors. To explore more top-ranked stocks, you can find today’s Zacks #1 Rank (Strong Buy) list here.

Zacks’ Research Chief Recommends High-Growth Stock

Our experts have identified five stocks with the potential for significant gains of 100% or more soon. Sheraz Mian, Director of Research, highlights one stock as the top contender for remarkable growth. This innovative financial firm, which has already attracted over 50 million customers, is expected to deliver substantial returns. While not all selections will succeed, the potential of this stock could exceed previous Zacks picks, like Nano-X Imaging, which soared +129.6% in just nine months.

Free: See Our Top Stock And 4 Runners Up

Adobe Inc. (ADBE) : Free Stock Analysis Report

Intuit Inc. (INTU) : Free Stock Analysis Report

Open Text Corporation (OTEX) : Free Stock Analysis Report

Verint Systems Inc. (VRNT) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.