Netflix’s Q4 Performance Sends Shares Skyrocketing

Shares of Netflix (NASDAQ: NFLX) jumped significantly following the streaming giant’s impressive fourth-quarter results and optimistic forecast. Over the past year, the stock has nearly doubled, contributing to a remarkable increase of over 1,500% in the past decade.

Let’s analyze its Q4 performance to see if the momentum is set to continue.

Where to invest $1,000 right now? Our analyst team has identified the 10 best stocks to consider. See the 10 stocks »

Impressive Membership Growth

Netflix continues to excel in growing its paid members. The company reported a 16% year-over-year increase, bringing the total to 301.63 million. In the last quarter alone, Netflix added an impressive 18.91 million new members. This marks six consecutive quarters of double-digit membership growth. However, Q4 2024 will be the last quarter that the company discloses membership figures on this basis.

| Metric | Q3 2023 | Q4 2023 | Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 |

|---|---|---|---|---|---|---|

| Membership growth (YOY) | 10.8% | 12.8% | 16% | 16.5% | 14.4% | 15.9% |

| Paid members (millions) |

247.15 | 260.28 | 269.6 | 277.65 | 282.72 | 301.63 |

Data source: Netflix earnings reports.

Revenue for the quarter rose 16% to $10.25 billion, exceeding the $10.11 billion forecast by analysts at LSEG.

In the U.S. and Canada, revenue grew by 15%, driven by a 12% increase in paid members and a 4% rise in average revenue per member (ARM). Asia led revenue growth with a remarkable 26%, followed by European and Latin American revenues at 18% and 6%, respectively. This demonstrates Netflix’s ability to engage audiences on a global scale.

Earnings per share (EPS) surged to $4.27, outpacing the $4.20 estimate from analysts.

Netflix’s ad-supported memberships have gained traction, with 55% of new sign-ups opting for these plans. Memberships on ad-supported tiers increased by 30% following a 35% jump in the previous quarter. Viewing hours for these plans closely mirror those of ad-free options, and ad revenue is projected to double in 2024. Management anticipates further doubling ad revenue in 2025.

Growth in membership also follows price increases implemented in various regions, including parts of Europe, Asia, and Latin America. Recently, Netflix announced price hikes for most of its U.S. plans and those in Canada, Portugal, and Argentina.

For guidance, Netflix expects first-quarter revenue to surpass $10.42 billion, reflecting over an 11% year-over-year increase, with EPS projected to rise about 6% to $5.58.

For 2025, Netflix has updated its forecasts, now estimating revenue between $43.5 billion and $44.5 billion, up from a previous forecast of $43 billion to $44 billion. The company also raised its operating margin outlook to 29%, compared to a prior estimate of 28%.

Image source: Getty Images.

Is It Too Late to Invest in Netflix?

The company’s ability to raise prices while maintaining strong membership growth puts it in a prime position. Moreover, Netflix has a strong slate of content for 2025 featuring popular series like Stranger Things, Wednesday, Squid Game, and Alice in Borderland. Additionally, its recent airing of the WWE’s Monday Night Raw attracted 5 million viewers for its debut show.

This lineup is expected to drive membership growth further. Furthermore, the introduction of options to add extra members to ad-supported plans in 10 of the 12 countries where they are available could significantly boost ad revenue this year. Although building a global ad network will take time, advertising is likely to evolve into a vital revenue stream for Netflix.

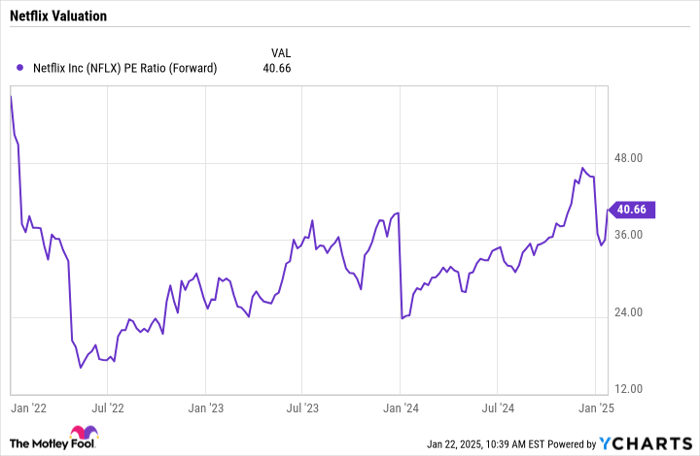

Valuation-wise, Netflix currently trades at a forward price-to-earnings (P/E) ratio of over 40 based on analyst estimates for 2025. While this valuation isn’t particularly low, it remains reasonable, considering the company’s growth and prospects.

Data by YCharts.

While investors should tread carefully, Netflix continues to be a strong long-term investment option.

Your Second Chance at a Lucrative Investment

Do you feel as if you let your opportunity to invest in top-performing stocks pass you by? If so, this could be a moment to consider.

Our analysts occasionally issue a “Double Down” stock recommendation for companies poised for rapid growth. If you believe you’ve missed your chance, now could be the time to invest, as illustrated by the following numbers:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $365,174!

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $42,164!

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $469,011!

We’re currently issuing “Double Down” alerts for three exciting companies, and such chances may not arrive again soon.

Learn more »

*Stock Advisor returns as of January 21, 2025

Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Netflix. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.