Netflix Poised for Strong Q4 Earnings: What Investors Need to Know

Netflix NFLX is gearing up to announce its fourth-quarter 2024 results on January 21, following the market’s close. This report prompts an evaluation of the fundamentals behind the world’s leading video-streaming platform as the earnings date approaches.

Check the Zacks Earnings Calendar for crucial market news updates.

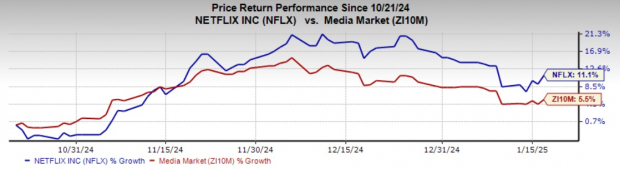

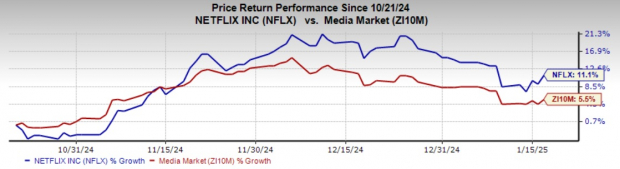

In the past three months, Netflix shares have surged by 11%, outperforming the industry average increase of 5.5%. Analysts believe this positive momentum is likely to persist, enhancing the company’s chances of outperforming expectations this upcoming earnings season.

Image Source: Zacks Investment Research

With this success, several ETFs that heavily invest in Netflix are attracting attention, including MicroSectors FANG+ ETN FNGS, Invesco Next Gen Media and Gaming ETF GGME, First Trust Dow Jones Internet Index Fund FDN, FT Vest Dow Jones Internet & Target Income ETF FDND, and Communication Services Select Sector SPDR Fund XLC.

Earnings Expectations

Netflix showcases an Earnings ESP of +0.19% alongside a Zacks Rank #3 (Hold). Our analysis indicates that having a positive Earnings ESP and a Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 enhances the likelihood of an earnings beat. Utilize our Earnings ESP Filter to discover optimal stock picks ahead of their reports.

In the week leading to the report, Netflix’s earnings estimate fell slightly, with a downward revision of one cent. Nevertheless, the company is anticipated to achieve impressive earnings growth of 98.6%, alongside a substantial revenue increase of 14.5% for the upcoming quarter. Notably, Netflix has a strong earnings surprise history, delivering an average surprise of 5.73% over the last four quarters and ranks within the top 16% of Zacks industries (over 250+ groups).

Netflix, Inc. Price, Consensus and EPS Surprise

Netflix, Inc. price-consensus-eps-surprise-chart | Netflix, Inc. Quote

Analyst Insights

Analysts hold a favorable view of Netflix, with an Average Brokerage Recommendation (ABR) of 1.91 from 41 brokerage firms. Out of this group, 23 firms rate the stock as a Strong Buy and two as a Buy. These ratings translate to 56.1% for Strong Buy and 4.88% for Buy. The average price target for Netflix stands at $889.81, ranging between a low of $650.00 and a high of $1,100.00. Recently, BMO Capital increased its price target for Netflix to $1,000 from $825 while keeping an Outperform rating, reflecting confidence in its future performance.

For the fourth quarter, Netflix anticipates revenue growth of 15% compared to the previous year. The company expects to gain more subscribers this quarter, bolstered by a robust content lineup featuring live NFL games and the release of “Squid Game” Season 2. Bloomberg Intelligence projects that new subscriber additions will double this quarter relative to the third quarter.

For the full year, revenues are predicted to grow near the upper end of the previously stated guidance of 14-15% year-over-year.

Valuation Overview

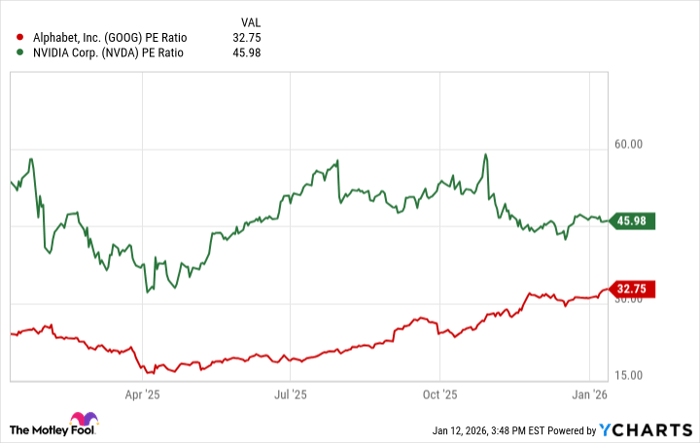

Currently, Netflix shares hold a P/E ratio of 36.70, which is significantly higher than the industry average of 10.86. However, the company boasts a strong Growth Score of A, indicating potential for continued growth, thereby justifying its elevated valuation.

Highlighted ETFs

MicroSectors FANG+ ETN (FNGS)

This ETN tracks the NYSE FANG+ Index, featuring an equal-weight design for ten high-traded growth stocks associated with technology and tech-enabled firms. Netflix constitutes 10% of the fund. As of now, MicroSectors FANG+ ETN has $427.9 million in assets and charges 58 bps in annual fees, with an average trading volume of 121,000 shares daily and a Zacks ETF Rank #3.

Invesco Next Gen Media and Gaming ETF (GGME)

GGME focuses on companies that significantly contribute to the evolution of media. The fund tracks the STOXX World AC NexGen Media Index, holding 87 stocks, with Netflix representing 7.7% of its assets. GGME has $34.3 million in assets, 61 bps in annual fees, and sees an average of 6,000 shares traded daily, earning a Zacks ETF Rank #3.

First Trust Dow Jones Internet Index Fund (FDN)

This ETF follows the Dow Jones Internet Composite Index, which encompasses a broad spectrum of the internet industry. Netflix ranks third, holding 7.6% of the 41 stocks in the portfolio. FDN remains one of the most popular ETFs in the tech space, with $6.7 billion in assets and an average trading volume of around 366,000 shares. The fund charges 51 bps in fees annually and has a Zacks ETF Rank #1, indicating a high risk outlook.

FT Vest Dow Jones Internet & Target Income ETF (FDND)

This is an actively managed fund that aims to track the Dow Jones Internet Composite Index, engaging in an “option strategy” that involves writing U.S. exchange-traded call options on the Nasdaq-100 Index. It features Netflix as the third-largest holding at a 7.65% share out of 42 stocks. FDND has $2.3 million in assets, trades about 2,000 shares daily, and charges 75 bps in annual fees.

Communication Services Select Sector SPDR Fund (XLC)

XLC offers exposure to firms within telecommunications, media, and interactive services. The fund holds $20.5 billion in assets and follows the Communication Services Select Sector Index, including 22 stocks with Netflix capturing the fourth position at 6.4%. Approximately 41% of the portfolio is weighted towards interactive media & services, followed closely by entertainment and media. XLC charges only 9 bps in annual fees and typically sees about 4 million shares traded each day, currently holding a Zacks ETF Rank #1.

Subscribe for More Insights

Stay informed with Zacks’ free Fund Newsletter, providing weekly updates on critical news, analysis, and top-performing ETFs.

Explore the latest recommendations from Zacks Investment Research. Download our report on the “7 Best Stocks for the Next 30 Days” today for free.

Netflix, Inc. (NFLX): Free Stock Analysis Report

First Trust Dow Jones Internet ETF (FDN): ETF Research Reports

Communication Services Select Sector SPDR ETF (XLC): ETF Research Reports

MicroSectors FANG+ ETN (FNGS): ETF Research Reports

Invesco Next Gen Media and Gaming ETF (GGME): ETF Research Reports

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.