Netflix Shines as 2024’s Streaming Champion: A Look Ahead to January 6

In 2024, investors reaped substantial rewards. The S&P 500 and Nasdaq Composite posted impressive gains of 24% and 30%, respectively, driven mainly by advances in artificial intelligence (AI), popular weight loss drugs, and resilient consumer behavior amid an improving economy.

Netflix (NASDAQ: NFLX) stood out this year, surging 85% and trading close to its all-time highs.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Let’s explore why 2024 was such a pivotal year for Netflix and why investors should watch this stock as January 6 approaches.

Transformational Changes at Netflix in 2024

Netflix has long been known for its diverse content library, which ranges from comedies to thrillers, cartoons, and anime. In recent years, the company has heavily invested in original content by partnering with Hollywood’s top talent to create exclusive series and movies.

This original content strategy helped Netflix distinguish itself from competitors and attract viewers who were tired of old reruns.

However, other streaming services like Amazon, Apple, Paramount, and Disney quickly adopted similar tactics. As a result, Netflix found itself needing to carve out its niche while managing customer acquisition costs effectively.

Over the past year, Netflix ventured into the live sports arena—a move that sets it apart from rivals like Amazon and Apple, which have established their own sports offerings. Below, I will detail Netflix’s early successes in this category.

Live Sports Events on Netflix: An Overview

In 2024, Netflix hosted two major live sporting events: a boxing match between YouTube celebrity Jake Paul and boxing icon Mike Tyson, and NFL games streamed on Christmas Day.

Data from TVision shows that the Paul-Tyson match became the most streamed sporting event in history, attracting an estimated 108 million live viewers globally. Additionally, Nielsen reported that each of the Christmas Day NFL games reached an average of 24 million viewers, marking them as two of the most streamed games in NFL history.

Although Netflix is new to live sports, initial data suggests that its efforts in this area are paying off. On January 6, the company plans to launch its latest live event featuring WWE Raw wrestling content.

Image source: Getty Images.

Should You Buy Netflix Stock Before January 6?

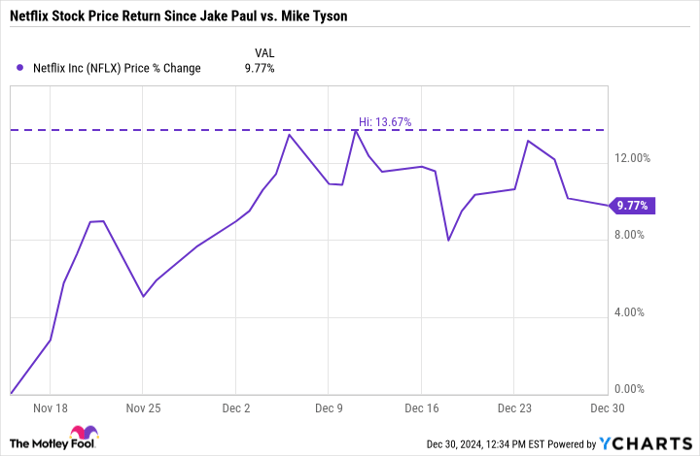

The highly publicized Paul-Tyson match took place on Friday, November 15, 2024. As shown in the chart below, Netflix shares jumped as much as 14% following the event, ultimately gaining 10% by December 30.

NFLX data by YCharts.

Interestingly, prior to Christmas Day, Netflix stock momentarily spiked in anticipation of the NFL games. However, it has since dipped about 3% post-event.

This indicates that Netflix stock has shown notable momentum surrounding its live events. Typically, I advise caution with momentum stocks due to their volatility.

Investing in Netflix before January 6 may not be crucial. The bigger takeaway is that Netflix’s live events have thus far yielded record viewership. While there’s no certainty that the WWE Raw event will replicate the success of the Paul-Tyson match or NFL games, I believe wrestling could serve as another positive driver for Netflix.

I view live events as a huge opportunity for Netflix and remain optimistic about the company’s potential to forge more partnerships across sports and entertainment in the future.

Your Chance for a Potentially Rewarding Investment

Do you ever feel like you missed out on investing in top-performing stocks? There’s still an opportunity for you.

The Motley Fool’s analysts occasionally issue a “Double Down” stock recommendation for companies poised for significant growth. If you’re concerned about missing your chance, now may be the time to invest. The successful returns speak for themselves:

- Nvidia: If you invested $1,000 when we doubled down in 2009, you’d have $348,216!*

- Apple: If you invested $1,000 when we doubled down in 2008, you’d have $47,425!*

- Netflix: If you invested $1,000 when we doubled down in 2004, you’d have $480,681!*

Currently, we are providing “Double Down” alerts for three exceptional companies, and another opportunity like this may not come again soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 30, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Amazon and Apple. The Motley Fool has positions in and recommends Amazon, Apple, Netflix, and Walt Disney. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.