Netflix Aims for $1 Trillion Market Value by 2030

Netflix (NFLX) aims to double its revenues by 2030 and achieve a market capitalization of $1 trillion. This goal comes after the streaming service reported strong first-quarter 2025 results, exceeding earnings expectations with $6.61 per share, representing a 54.8% increase year over year and beating the Zacks Consensus Estimate by 16.17%. (Read More: Netflix Q1 earnings Beat, Revenues Rise Y/Y on Subscriber Gain).

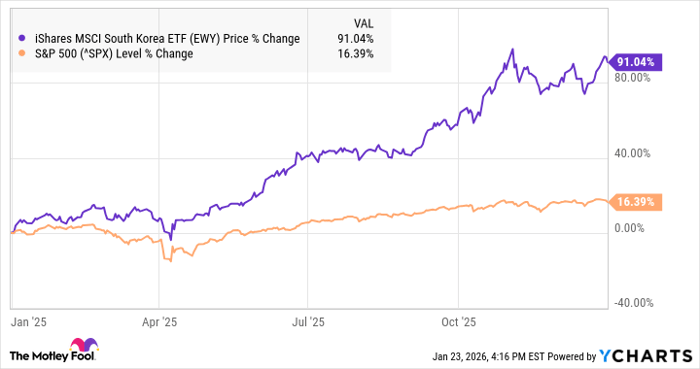

The company has outperformed market indices with a 39.1% six-month return, outpacing major competitors such as Apple (AAPL), Amazon (AMZN), and Disney (DIS), as well as the Zacks Consumer Discretionary sector and the S&P 500. During the same period, shares of Apple, Disney, and Amazon experienced declines of 11.6%, 8.1%, and 3.8%, respectively.

NFLX’s Strong Performance Against Competitors

Image Source: Zacks Investment Research

Strategic Growth Plan for a Trillion-Dollar Vision

Netflix’s ambition for a trillion-dollar valuation relies on a solid growth strategy focused on four key pillars: content expansion, live programming development, gaming enhancement, and advertising growth.

The company intends to diversify its content, adding genres, languages, and formats to attract a wider audience. Upcoming releases include films like Nonnas starring Vince Vaughn, Straw featuring Taraji P. Henson, and the action thriller Havoc starring Tom Hardy. New series will also debut, including Forever and The Royals, alongside returning favorites like Big Mouth and YOU.

Additionally, Netflix’s live programming has seen success, notably the Paul-Tyson fight, the most-streamed sporting event to date. Securing U.S. rights for FIFA’s Women’s World Cup in 2027 and 2031 highlights Netflix’s strategic approach to live content.

Ad-Supported Model: A Key Growth Driver

A notable component of Netflix’s growth strategy is its advertising business. In regions where it’s implemented, over 55% of new subscribers prefer the ad-supported option. Company projections estimate advertising revenues could reach $9 billion annually by 2030, marking significant potential for this revenue stream.

The Ad Suite was launched in the U.S. on April 1, with plans for international expansion. Management anticipates advertising revenues will double in 2025, underscoring the confidence in this new segment that diversifies Netflix’s revenue sources and lessens reliance on subscriptions alone.

Solid Financial Foundation for Long-Term Goals

Netflix’s financial health remains strong, with $10.54 billion in revenues reported for the first quarter of 2025, a 12.5% increase year over year. The operating margin improved to 31.7%, up 370 basis points from the previous year. Free cash flow for the quarter stood at $2.66 billion, compared to $1.37 billion in the prior quarter.

Looking ahead, Netflix expects second-quarter revenues to rise by 15.4% to around $11.035 billion, with an operating margin projected at 33%, indicating a ~6 percentage point year-over-year improvement. The full-year 2025 revenue guidance remains between $43.5 billion and $44.5 billion, with free cash flow anticipated at approximately $8 billion.

The Zacks Consensus Estimate for Netflix’s 2025 revenues is set at $44.47 billion, reflecting a year-over-year growth of 14.01%. The earnings consensus is pegged at $25.33 per share, which represents a 27.74% increase compared to the previous year.

Image Source: Zacks Investment Research

Justifying the Premium Valuation

Netflix trades at a forward 12-month price-to-sales (P/S) ratio of 9.77, a premium compared to the broader Zacks Broadcast Radio and Television industry’s forward earnings multiple of 3.91. This valuation is justified by Netflix’s unique standing at the intersection of technology and entertainment. Its competitive edge over traditional media and tech companies underscores its solid execution and business model.

NFLX’s P/S F12M Ratio Reflects Premium Valuation

Image Source: Zacks Investment Research

Investment Potential in 2025

For investors, Netflix represents a valuable opportunity moving into 2025. With a strong content lineup featuring new seasons of popular series like Squid Game, Wednesday, and Stranger Things, Netflix is well-positioned for subscriber growth. Its expanding advertising business, innovative gaming initiatives, and strategic live content acquisitions provide additional catalysts to pursue its ambitious trillion-dollar goal.

Additionally, Netflix continues to lead in engagement, averaging about two hours of viewing per paid membership daily, along with revenues around $39 billion and approximately $10 billion in operating profit.

Netflix Positioned for Growth in Expanding Streaming Market

Netflix, Inc. (NFLX) is gearing up for further growth as the streaming market evolves. Currently, streaming accounts for less than 10% of global TV viewing hours, indicating significant opportunities for expansion. For long-term investors interested in global entertainment trends, Netflix remains an attractive option in 2025, despite its high valuation. The company currently holds a Zacks Rank #2 (Buy), suggesting positive investor sentiment.

Market Trends Favoring Streaming Growth

As the entertainment landscape shifts, streaming services are becoming more integral to consumption habits. This evolving market positions Netflix advantageously for sustained growth, particularly as consumer preferences continue to lean towards digital content.

Zacks Identifies Top Semiconductor Stock

In a related strategic development, Zacks has highlighted a leading semiconductor stock that could have substantial upside potential. This company is markedly smaller than industry giant NVIDIA, which has experienced a more than 800% increase since its recommendation. While NVIDIA remains a strong player, the new semiconductor stock is poised for robust earnings growth driven by increasing demand in sectors like Artificial Intelligence, Machine Learning, and the Internet of Things.

Global semiconductor manufacturing revenue is projected to surge from $452 billion in 2021 to $803 billion by 2028, reflecting an expanding market that favors innovative firms.

For insights into these opportunities and more, investors can explore detailed stock analyses from Zacks Investment Research. This includes comprehensive evaluations for key players such as Amazon.com, Inc. (AMZN), Apple Inc. (AAPL), Netflix, Inc. (NFLX), and The Walt Disney Company (DIS).

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.