New York Community Bancorp Seizes Opportunity as Interest Rates Decrease

Last month, the Federal Reserve cut its benchmark interest rate by 50 basis points. This marked the Fed’s first rate reduction since the pandemic began in 2020, providing much-needed relief to interest rate-sensitive companies.

A Bank in Transition

New York Community Bancorp (NYSE: NYCB) is one institution that welcomes these cuts. The bank has encountered considerable challenges this year, primarily due to significant write-offs in the last quarter of the previous year and subsequent upheaval within its management team.

Trading at $10.95 per share, New York Community Bancorp is viewed as a potential investment opportunity, especially with projections suggesting a further 2% decrease in interest rates over the next couple of years. Prospective investors should weigh several factors before deciding to purchase shares.

The Challenges Facing New York Community Bancorp

New York Community Bancorp holds a substantial commercial real estate portfolio, which has suffered under recent economic conditions. This sector has faced significant pressures as the Federal Reserve implemented aggressive rate hikes to combat inflation, raising rates at the fastest pace in four decades.

Banks with significant exposure to commercial real estate, like New York Community Bancorp, have particularly struggled. Nearly half of its $85 billion loan portfolio is tied to multi-family properties, and the bank also holds roughly $3.4 billion in office properties, which are considered among the riskiest types of commercial loans.

Last year’s fourth quarter saw the bank report an unexpected loss of $260 million due to a $185 million net charge-off linked to two loans. One loan entered non-accrual status, while the other was a cooperative loan with unusual pre-funded capital expenditures.

The situation worsened when the bank discovered a significant weakness in its internal controls impacting financial statement integrity and accuracy. Specifically, the company struggled with its loan review process and lacked effective oversight on its loan portfolio.

This led to a delay in filing its annual 10-K report and necessitated a $2.4 billion goodwill impairment charge, further diminishing its fourth-quarter results.

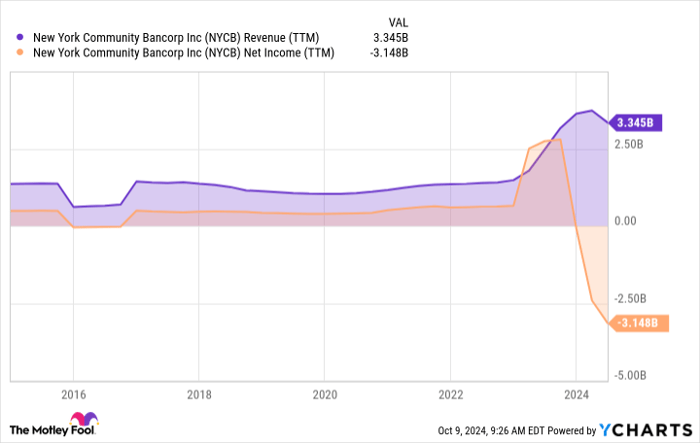

NYCB Revenue (TTM) data by YCharts.

Transforming for the Future

In response, the bank has enacted significant changes, including hiring a new CEO, Chief Risk Officer, and Chief Audit Executive. Notably, the bank also secured a $1 billion capital investment led by former Treasury Secretary Steve Mnuchin’s Liberty Strategic Capital, along with backing from Hudson Bay Capital, Citadel Global Equities, and other institutional investors.

Moving forward, the bank has taken additional steps to strengthen its balance sheet. In March, it sold the cooperative loan, realizing a gain, and also sold consumer loans valued at $899 million. In May, NYCB agreed to sell about $5 billion in mortgage warehouse loans to JPMorgan Chase. Following this sale, analysts at KBW commented that this is likely one of the bank’s more profitable ventures, although achieving a respectable return on tangible equity remains challenging.

In July, its subsidiary, Flagstar Bank, announced plans to sell its residential mortgage servicing operations, including servicing rights and its third-party origination platform, to Mr. Cooper for approximately $1.4 billion. This transaction is expected to enhance the bank’s CET1 ratio by around 60 basis points and is slated for completion in the fourth quarter of this year.

Is Investing in NYCB Worth It?

With the Federal Reserve easing interest rates, banks like New York Community Bancorp stand to gain. Analysts at JPMorgan Chase suggest that these rate cuts will shift from being detrimental to advantageous for banks over the coming quarters. Mid-cap banks like NYCB, which exhibit high sensitivity to interest rates, may benefit significantly.

While NYCB’s recovery is ongoing and will take time, the bank’s measures to fortify its balance sheet and improve its business foundations have been promising. According to Barclays, there is potential for the bank’s CET1 ratio to exceed 11% by year-end.

Currently, the stock trades at a 36% discount to its tangible book value. Although the turnaround process takes time, the possibility of further interest rate cuts and a strengthening bottom line suggests that New York Community Bancorp represents a solid investment opportunity for patient investors willing to accept some risk.

Don’t Miss the Chance for Potential Gains

Ever feel like you let a great investment slip away? This might be your moment.

Occasionally, our team of analysts identifies a “Double Down” stock, predicting a significant rise in value. If you think you missed earlier investment opportunities, now could be the ideal time to get involved. The statistics back this up:

- Amazon: If you had invested $1,000 when we endorsed it in 2010, you’d have $21,266!*

- Apple: Investing $1,000 when we recommended it in 2008 would have grown to $43,047!*

- Netflix: Had you invested $1,000 upon our recommendation in 2004, you’d now possess $389,794!*

Currently, we have “Double Down” alerts for three exceptional companies, and this opportunity may not come around again quickly.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 7, 2024

JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Courtney Carlsen has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends JPMorgan Chase. The Motley Fool recommends Barclays Plc. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.