Nu Holdings: A Rare Opportunity in Growth Investing

Finding high-quality growth stocks on sale is uncommon, but Nu Holdings (NYSE: NU) represents such an opportunity. Operating exclusively in Latin America, this company might not be well-known to most investors. However, for those seeking substantial long-term growth potential at a discount, Nu Holdings could be a solid addition to your portfolio in 2025.

Nu Holdings: A Rapidly Growing Financial Services Company

Nu Holdings stands out as one of the fastest-growing financial services companies globally, with operations concentrated in just three countries: Brazil, Colombia, and Mexico.

The company’s strategy is straightforward: it offers financial services directly to customers through a smartphone app. While this concept may not be groundbreaking in the United States, it revolutionized the Latin American market when launched in 2013. At that time, traditional banks primarily operated through physical branches, incurring high costs that were passed on to customers in the form of elevated fees for basic services.

Doug Leone, a partner at Sequoia Capital who invested early in Nu, reflects, “At first, the competition failed to take Nubank seriously; they didn’t understand the deep technological work involved in the backend of the deceptively simple user experience and thought the company was nothing more than an app. But customers did notice how that work made their lives easier, and a waiting list began that continues to this day.”

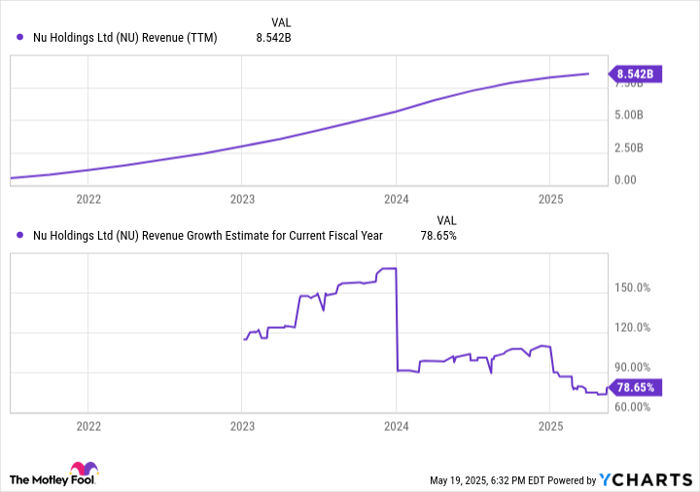

NU Revenue (TTM) data by YCharts

While Nu Holdings has experienced rapid growth, its biggest days may now be behind it. In Brazil, the largest country in Latin America, more than half of adults are already Nu customers, which limits future growth potential. In comparison, Mexico and Colombia are bigger and wealthier in terms of per capita income, meaning future growth may come from smaller, less affluent nations. Still, analysts project nearly 80% sales growth this year. Despite long-term growth challenges, the company’s valuation remains attractive.

Image source: Getty Images.

Nu Holdings’ Stock Valuation is Compelling

In contrast to most growth stocks, which often carry high premiums, Nu Holdings’ stock is currently priced at only 29.8 times earnings. This is notable for a company expected to grow its sales by nearly 80% annually. Looking forward, shares are trading at just 22.6 times forward earnings, closely aligned with the S&P 500.

Why is Nu Holdings trading at such a low valuation despite strong growth expectations?

NU PE Ratio data by YCharts

Nu faces long-term growth challenges, particularly from increased competition. Its success has drawn interest from other fintech companies eager to replicate its offerings at lower prices, which could impact Nu’s sales growth and profitability.

Nonetheless, shares of Nu Holdings are simply too attractive to overlook. Despite competitive pressures, the stock trades in line with the market on a forward basis while boasting significantly stronger fundamentals. While shares may not stay below $15 for long, investors today can benefit from this appealing valuation.

Should You Invest in Nu Holdings Now?

Before making a decision to invest in Nu Holdings, consider the following:

The analysis team has identified what they consider to be the 10 best stocks for investors currently, and Nu Holdings was not included in that selection. These recommended stocks are expected to generate substantial returns in the years ahead.

For example, if you had invested $1,000 in Netflix when it was recommended on December 17, 2004, you would now have $642,582! Similarly, investing $1,000 in Nvidia on April 15, 2005, would have resulted in $829,879!

The analysis team’s average return is 975%, significantly outperforming the S&P 500’s 172%. To discover the latest top 10 recommendations, consider subscribing.

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool recommends Nu Holdings. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.