Investors Eye Nvidia as Shares Experience Significant Dip

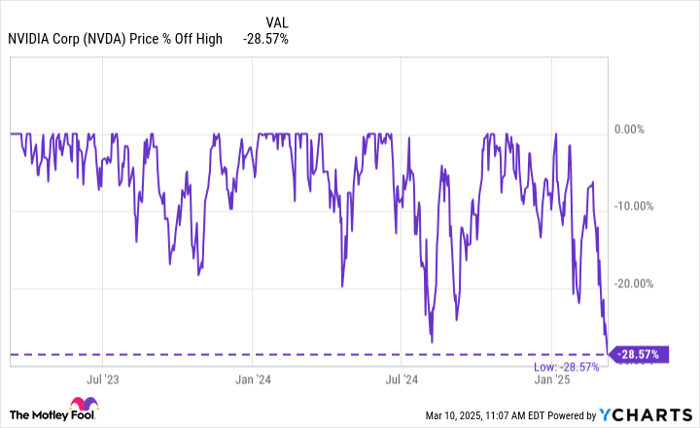

Investors have had few opportunities to buy shares of Nvidia (NASDAQ: NVDA) at a substantial discount in recent years. However, currently, the stock has experienced its largest pullback in two years. Year to date, shares are down by 20%, and they have fallen 28% from their January high.

Stock declines can occur for various reasons, such as company-specific news, sector rotation, or general market anxiety. In Nvidia’s case, it seems to be a mixture of these factors. Investors are left questioning whether this sell-off represents a rare buying opportunity or if it signals the end of Nvidia’s strong market performance.

Potential Sales Impact Due to External Factors

Despite the recent downturn, Nvidia shares have skyrocketed about 380% over the past three years. This increase was largely fueled by the demand for the company’s advanced semiconductor chips, which have become essential for businesses seeking to enhance compute power in AI model training and data center operations.

However, concerns over export restrictions are beginning to worry investors about Nvidia’s potential sales growth. The U.S. government has imposed restrictions on certain high-performance chips being sent to China due to national security considerations. These measures impact Nvidia’s ability to sell its most advanced graphics processing units (GPUs).

Additionally, apprehensions were heightened by reports that China’s DeepSeek has developed a large language model (LLM) at significantly reduced costs. This raises questions about future AI infrastructure spending and introduces more risk regarding Nvidia’s market position.

Nvidia’s Stock is Now Priced to Buy

Many leading technology firms have expressed intentions to continue investing heavily in data centers, suggesting that Nvidia’s current selling pressure could be a buying opportunity for long-term investors.

NVDA data by YCharts

The stock’s decline of nearly 30% from its January peak allows prudent investors to treat this situation as an opportunity to purchase quality assets on sale. Nvidia shares are not merely declining in value; they appear to be undervalued based on conventional metrics.

Market Responses and Future Growth

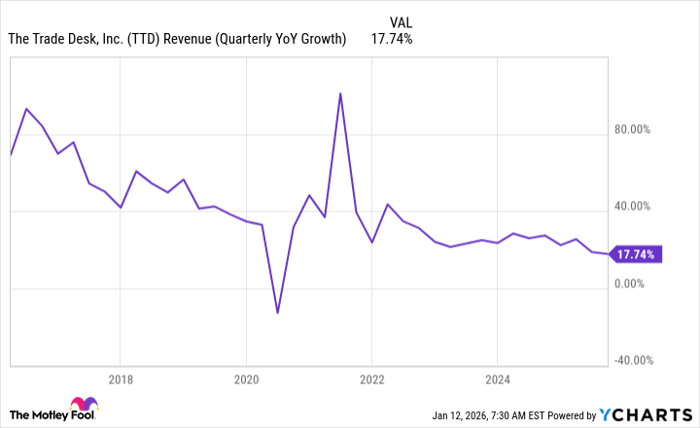

Although sales growth in Nvidia’s data center segment has moderated, the company projects an impressive 65% overall year-over-year sales growth in the current quarter. While this figure remains robust, it falls short of the 115% increase reported in fiscal year 2025, which concluded on January 26.

Nvidia continues to introduce powerful new platforms, with its Blackwell architecture now in full production. Upcoming innovations, including the Rubin GPU and CPU package aimed at AI training and inference, are expected to launch in 2026.

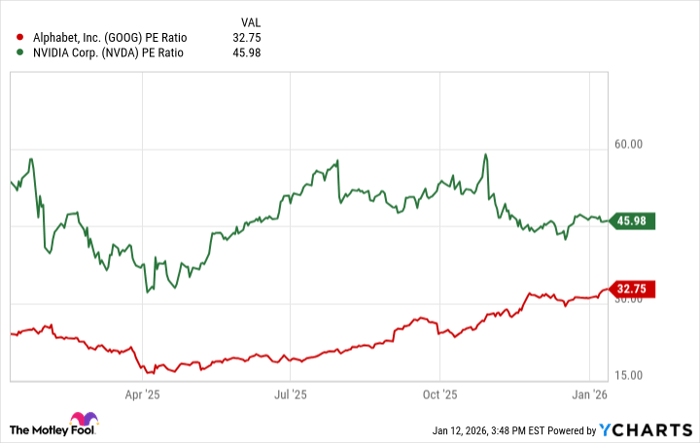

The recent stock pullback could be viewed as a healthy correction. As with many high-growth stocks, Nvidia’s share price has been bid up in anticipation of future growth. The current forward price-to-earnings (P/E) ratio sits at around 24, significantly lower than the 30 average for the Nasdaq Composite over the past decade.

Beyond the data center segment, Nvidia continues to have substantial growth potential. The gaming division generated over $11 billion in sales last fiscal year, while its robotics and automotive sectors are consistently expanding, with prospects for growth as humanoid robots and autonomous vehicles gain traction.

Is Now the Right Time to Invest in Nvidia?

Investors should reflect on whether to buy shares of Nvidia at this time. Notably, the Motley Fool Stock Advisor analyst team has identified other stocks they favor over Nvidia currently. The ten stocks on their list might yield significant returns in the coming years.

For context, consider when Nvidia was recommended on April 15, 2005; a $1,000 investment at that time would now be worth $690,624!

Stock Advisor equips investors with straightforward strategies for success, along with portfolio building guidance, regular updates, and two new stock recommendations each month. Since 2002, the Stock Advisor service has more than quadrupled the returns of the S&P 500.

*Stock Advisor returns as of March 10, 2025.

Howard Smith has positions in Nvidia. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

The views expressed here are those of the author and do not necessarily reflect those of Nasdaq, Inc.