NVIDIA Delivers Impressive Fourth Quarter Earnings with AI Growth Potential

NVIDIA Corporation (NVDA) has once again showcased its impressive performance with a recent earnings report. On February 26, the company announced fourth-quarter fiscal 2025 revenues of $39.33 billion, reflecting a remarkable 78% increase year-over-year and surpassing the analyst consensus estimate of $37.72 billion.

The data center segment continues to hit record highs, coupled with robust demand for NVIDIA’s AI-driven computing solutions. This strong performance solidifies NVDA Stock as an appealing investment option at this time.

NVIDIA’s Data Center Segment: Driving Growth

The Data Center business is a crucial aspect of NVIDIA’s financial success, generating $35.58 billion in the fourth quarter—90.5% of total sales. This constitutes an impressive 93% year-over-year increase and a 16% sequential growth, primarily fueled by the accelerated adoption of AI workloads.

Key contributors to this surge include the demand for NVIDIA’s Hopper 200 and Blackwell GPU computing platforms, which cloud providers and enterprises are increasingly adopting to enhance their AI infrastructure. Notably, large cloud service providers accounted for nearly 50% of Data Center revenue, indicating a significant investment in AI-driven computing.

As industries ramp up AI adoption, NVIDIA’s strong position within the data center market ensures it remains a significant beneficiary of ongoing trends, setting the stage for sustained revenue growth.

Exceptional Financial Discipline and Profitability

In addition to impressive revenue growth, NVIDIA demonstrated strong financial management. The company reported non-GAAP gross margins of 73.5%, maintaining profitability even amid rising operational costs. Non-GAAP operating income soared by 73% year-over-year to $25.52 billion, showing NVIDIA’s capability to convert revenue gains into substantial profit.

NVIDIA exhibited robustness with cash flow generation, closing the fourth quarter with $43.2 billion in cash, cash equivalents, and marketable securities—up from $38.4 billion in the prior quarter. This liquidity affords NVIDIA flexibility to reinvest in research & development, expand manufacturing capabilities, and distribute capital to shareholders.

AI Momentum as a Long-Term Growth Catalyst

During the earnings call, NVIDIA’s CEO Jensen Huang discussed the significant potential of AI across various sectors. He noted the increased adoption of reasoning AI models that demand greater computational capabilities. The Blackwell architecture—boasting up to 25 times higher token throughput for AI inference than its predecessor, Hopper 100—is anticipated to play a pivotal role in the next evolution of AI-driven computing.

Looking ahead, the imminent launch of NVIDIA’s Blackwell Ultra and Vera Rubin platforms is expected to enhance its technological advantages. With global investments in AI infrastructure on the rise, NVIDIA is well-positioned to leverage these expanding opportunities.

Positive Q1 Guidance for Continued Success

NVIDIA’s outlook for the first quarter of fiscal 2026 is optimistic, with projected revenues of $43 billion. This forecast underscores the persistent momentum in AI demand. The company anticipates maintaining strong gross margins at 71%, despite rising costs linked to increased Blackwell production.

Moreover, NVIDIA is experiencing significant growth in emerging AI applications such as enterprise AI, autonomous vehicles, and robotics. This diverse array of AI-driven revenue streams supports the company’s long-term growth potential.

The Zacks Consensus Estimate for first-quarter revenues is $43.28 billion, indicating a substantial 66.2% growth year-over-year. The consensus for non-GAAP earnings predicts an increase to 92 cents per share, a 50.8% rise from the previous year.

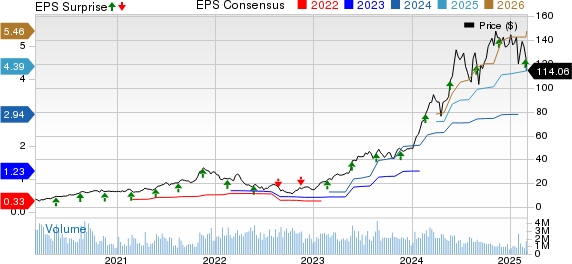

NVIDIA has consistently outperformed earnings expectations, beating the Zacks Consensus Estimate in each of the last four quarters, with an average surprise of 7.9%.

NVIDIA Corporation Stock Price and Performance

NVIDIA Corporation price and performance metrics | NVIDIA Corporation Quote

Valuation Insights: NVIDIA Stocks Present a Buying Opportunity

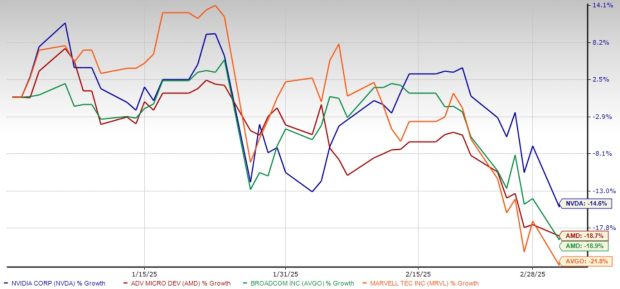

Despite the excellent performance, NVIDIA’s shares have dropped 14.6% year to date due to broader market fluctuations. This decline coincides with market fears regarding DeepSeek’s innovation possibly impacting demand for NVIDIA’s high-end AI chips. Additionally, overall market pressures resulting from new import tariffs on Canada, Mexico, and China have influenced NVIDIA’s stock performance.

Other major semiconductor companies, such as Advanced Micro Devices (AMD), Broadcom (AVGO), and Marvell Technology (MRVL), have also faced similar downward trends amid recent market volatility.

Year-to-Date Stock Price Performance

Image Source: Zacks Investment Research

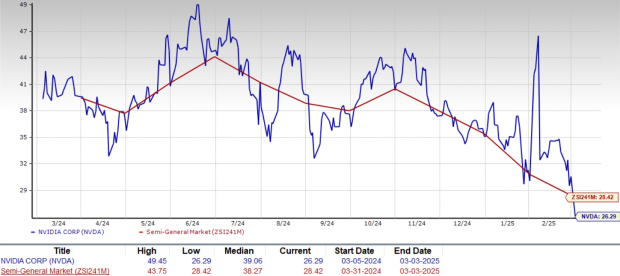

Nonetheless, this recent market pullback has created a buying opportunity, as NVDA is now trading at a favorable valuation multiple. The stock currently holds a trailing 12-month price-to-earnings (P/E) ratio of 26.29, lower than the Zacks Semiconductor – General industry average of 28.42. This suggests NVIDIA is operating at a relative discount, positioning it for potential gains.

NVDA Forward 12-Month P/E Ratio

Image Source: Zacks Investment Research

Conclusion: Consider Investing in NVIDIA Stock

NVIDIA’s strong performance and promising future indicate a solid investment opportunity in the semiconductor and AI sectors.

NVIDIA’s Strong Q4 Earnings Highlight AI Computing Leadership

NVIDIA Corporation’s fourth-quarter earnings results reaffirm its role as a dominant player in AI-driven computing. The company reported record Data Center revenues, impressive profit margins, and offered optimistic guidance for the first quarter of fiscal 2026, underscoring its robust growth trajectory. NVIDIA’s long-term outlook in AI computing and its strengths in data center operations, combined with an attractive valuation, position it as a stock worth considering for investment. Currently, NVDA has a Zacks Rank #2 (Buy).

Access Zacks’ Stock Recommendations for Just $1

No, we’re not exaggerating.

A few years ago, we surprised our members by offering a 30-day trial to our stock picks for just $1, with no further obligation. Thousands have seized this opportunity, while others remained cautious, thinking there had to be a catch.

The reason behind this offer is simple: we want you to experience our range of portfolio services, including Surprise Trader, Stocks Under $10, Technology Innovators, and more, which closed 256 positions with double- and triple-digit gains just in 2024 alone.

Explore Stocks Now >>

Interested in the latest stock recommendations from Zacks Investment Research? You can download our report on the 7 Best Stocks for the Next 30 Days for free. Click here to access the report.

Here are some free stock analysis reports you might find interesting:

- Advanced Micro Devices, Inc. (AMD): Free Stock Analysis report

- NVIDIA Corporation (NVDA): Free Stock Analysis report

- Marvell Technology, Inc. (MRVL): Free Stock Analysis report

- Broadcom Inc. (AVGO): Free Stock Analysis report

This article was originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.