Analyzing Nvidia’s Stock Amid Market Volatility and Tariff Concerns

This year has been particularly dynamic in the Stock market. In 2025, the S&P 500 fell by as much as 15%, while the Nasdaq Composite experienced a peak decline of 21%. These fluctuations seem largely influenced by the newly implemented tariff policies from the Trump administration, overshadowing news from Chinese AI start-up DeepSeek and other mixed economic indicators. Although both the S&P 500 and Nasdaq have rebounded, they still exhibit negative returns, with major losses recorded in megacap technology stocks.

Currently, Nvidia (NASDAQ: NVDA) has seen its market value plummet by nearly $1 trillion in 2025. This significant drop suggests that investor sentiment towards the once-celebrated semiconductor company has soured. With Nvidia’s fiscal first-quarter earnings report set for May 28, it’s essential to consider whether now might be the right opportunity to invest in Nvidia Stock.

What Historical Trends Indicate for Nvidia After May 28

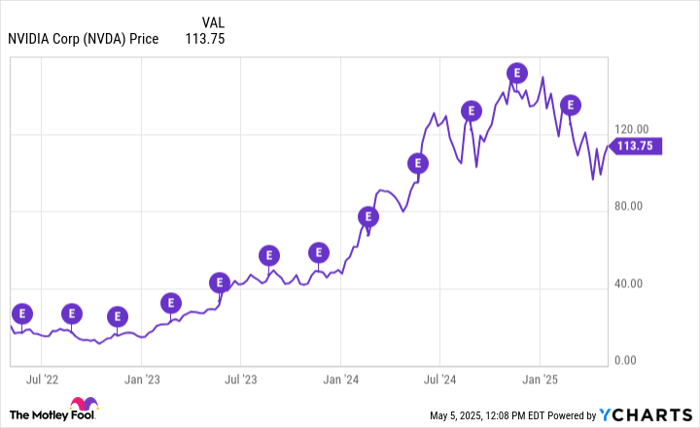

The chart below shows Nvidia’s share price trends over the past three years. The purple circles marked with “E” indicate earnings reports, and historically, Nvidia’s Stock has typically risen following these announcements. This pattern suggests that Nvidia Stock might continue its post-report success.

NVDA data by YCharts

However, there is a crucial factor to consider before assuming a similar upward trajectory after the upcoming earnings report. The most significant deviation from Nvidia’s usual post-report rises occurred in February, when the company disclosed its fourth-quarter and full-year 2024 results. Following the February 26 report, shares have fallen by 13% as of now.

Factors Impacting Nvidia Stock Currently

While the recent decline in Nvidia Stock may be alarming, it’s important to discuss the underlying context. The earnings report was not problematic; the key highlight was Nvidia’s Blackwell GPU architecture, which brought in $11 billion in revenue for the fourth quarter, surpassing management’s expectations.

Management also indicated that they expect an improvement in gross margin as they ramp up production of Blackwell. Additionally, plans for future GPU architectures, including Blackwell Ultra and Rubin, suggest continued growth over the coming years.

So why the prolonged sell-off if the company’s fundamentals appear strong? The decline can be attributed to rising investor concerns related to tariffs and new export controls affecting China, a key revenue source for Nvidia. While these concerns are valid, they may be overstated.

Image source: Getty Images.

Key Insights for the Q1 Call

As the earnings call approaches, I will pay close attention to how ongoing trends in AI infrastructure are shaping Nvidia’s long-term outlook, especially in the face of near-term challenges posed by tariffs and geopolitical dynamics in China.

Recent earnings reports from tech leaders like Meta Platforms, Alphabet, Amazon, and Microsoft have illustrated how these firms are managing the current tariff-related turbulence. These companies together are investing hundreds of billions this year on data center developments, all while emphasizing AI infrastructure. If tariffs were truly detrimental to long-term prospects, it stands to reason that big tech wouldn’t be aggressively pursuing their AI initiatives.

Considering that these firms are customers of Nvidia, I believe the chipmaker is well-positioned to alleviate investor fears regarding growth. This leads me to conclude that Nvidia Stock may surpass expectations and re-attract growth investors.

I view Nvidia as an appealing investment opportunity now for growth-oriented investors holding the Stock for the long haul.

Potential Opportunity Awaits Investors

For those feeling they may have missed out on investing in leading stocks, this might be your chance. Our analysts occasionally provide a “Double Down” Stock recommendation for companies they believe are on the cusp of significant gains. Current insights suggest it’s not too late to invest. Consider the following potential returns:

- Nvidia: Investing $1,000 when we doubled down in 2009 would yield $303,566!*

- Apple: A $1,000 investment in 2008 would now be worth $37,207!*

- Netflix: A $1,000 investment in 2004 would have grown to $623,103!*

Currently, we are issuing “Double Down” alerts for three exceptional companies, available when you become a member of Stock Advisor. Don’t miss out on this opportunity.

*Stock Advisor returns as of May 5, 2025

The views expressed are those of the author and do not necessarily reflect the opinions of Nasdaq, Inc.