PagerDuty Faces Challenges Amid Strong Industry Growth

PagerDuty (PD) shares have dropped 15.7% so far this year, while the Zacks Internet – Software industry has risen by 38.3%, and the broader Zacks Computer & Technology sector has gained 35.5%.

PD’s performance lags behind competitors like Atlassian (TEAM), which has seen its shares rise by 13.5% in the same period.

This underperformance is mainly due to ongoing weakness in the Small and Medium-sized Business segment and a tough macroeconomic environment affecting the Enterprise segment, which has led to extended sales cycles.

Despite these headwinds, PD is experiencing growth from an expanding customer base and increased adoption of its Operations Cloud, which includes AIOps and automation tools.

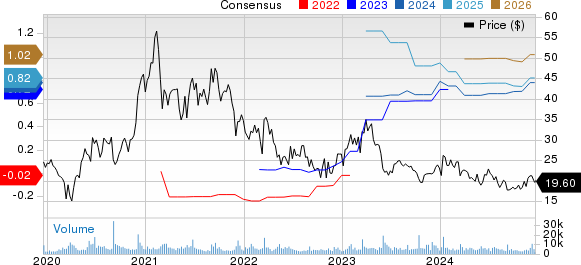

PagerDuty Price and Consensus

PagerDuty price-consensus-chart | PagerDuty Quote

In the third quarter of 2024, PD reported an increase in high-value customers, now totaling 825 companies spending over $100,000 in Annual Recurring Revenue (ARR). This marks a 6% increase from last year and underscores the growing appeal of PagerDuty’s offerings to larger clients.

AI-Driven Solutions Fuel Growth

The surge in demand for automation and generative AI has become a significant driver for PagerDuty.

In the third quarter of 2024, PD unveiled AI-driven products, including PagerDuty Advance, which employs generative AI to enhance incident management and shorten response times. This move has attracted new customers aiming to streamline their IT operations.

Moreover, PagerDuty announced updates to its Operations Cloud in October, focusing on AI-driven automation and machine learning designed to bolster operational resilience while minimizing downtime and outage risks.

Notably, AIOps and Automation tools contributed over 40% of PagerDuty’s net new ARR in the third quarter of 2024, reflecting a growing need for advanced IT operation solutions.

Expanding Client Base Drives Success

PagerDuty’s diverse service offerings are helping it to widen its clientele, supported by collaborations with major industry entities like Amazon (AMZN) and Snowflake (SNOW).

Recently, PD announced additional generative AI features for PagerDuty Advance, using Amazon Web Services (AWS) tools to enhance incident management and operational efficiency.

Additionally, PagerDuty has integrated its Operations Cloud with Snowflake Trail to assist joint clients in proactively managing incidents and improving operational effectiveness while lowering downtime.

Encouraging Guidance for FY24

For the fourth quarter of 2024, PagerDuty projects revenues between $118.5 million and $120.5 million. Non-GAAP earnings are anticipated to be between 15-16 cents per share.

The Zacks Consensus Estimate for fourth-quarter revenue stands at $119.46 million, indicating an increase of 7.50% compared to the previous year.

For fiscal 2024, PagerDuty forecasts revenues ranging from $464.5 million to $466.5 million, slightly adjusted from the previous guidance of $463.0 million to $467.0 million, which reflects an 8% year-over-year growth.

Expected non-GAAP earnings are set at 78-79 cents per share, revised from the earlier estimate of 67-72 cents per share.

The Zacks Consensus Estimate for 2024 revenues is projected at $465.54 million, representing an 8.09% annual increase, while earnings are estimated at 78 cents per share, reflecting an 11% upward revision in the past month.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

Investor Considerations for PD Stock

Currently, PagerDuty stock is seen as somewhat pricey, earning a Value Score of D, which suggests a high valuation at present.

When looking at the Price/Book ratio, PD trades at 15.83X, significantly above the Zacks Internet – Software industry’s average of 3.78X.

Nevertheless, PagerDuty’s strong AI capabilities and a growing network of partnerships present compelling reasons for investors to consider the stock.

With a Zacks Rank #2 (Buy) and a Growth Score of A, PD presents a robust investment opportunity according to Zacks Proprietary analysis. For those interested, you can explore the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Explore Opportunities in the Nuclear Energy Sector

The demand for energy is surging. Simultaneously, there is a push to lessen reliance on fossil fuels. Nuclear energy stands out as a viable alternative.

Recently, leaders from the US and 21 other nations committed to tripling the world’s nuclear energy capacities. This ambitious goal could yield significant returns for investors in nuclear-related stocks who act swiftly.

Our report, Atomic Opportunity: Nuclear Energy’s Comeback, analyzes key players and technologies driving this trend, highlighting three prominent stocks positioned to benefit.

Download the report on Atomic Opportunity: Nuclear Energy’s Comeback for free today.

Want the latest recommendations from Zacks Investment Research? Today, you can access 5 Stocks Set to Double. Click to get this complimentary report.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Snowflake Inc. (SNOW): Free Stock Analysis Report

Atlassian Corporation PLC (TEAM): Free Stock Analysis Report

PagerDuty (PD): Free Stock Analysis Report

For the full article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily represent those of Nasdaq, Inc.