PayPal Faces Challenges Amidst Efforts for Growth Revival

PayPal Holdings (NASDAQ: PYPL) has experienced a substantial decline in investor confidence over the past few years. The company’s stock has fallen 77% since its peak in 2021. Yet, it still retains popularity with its 434 million active users. In response, PayPal has revamped its leadership team to stimulate growth and restore trust among its shareholders.

In the realm of investing, when a well-established company like PayPal sees a significant drop in its stock price, it’s crucial to analyze whether investors should buy, sell, or hold their positions.

Reasons Behind PayPal’s Stock Struggles

During the pandemic, digital payments grew rapidly, and PayPal benefitted greatly from the surge in e-commerce. However, as in-person shopping resumed, that momentum declined. Additionally, heightened competition from Apple Pay, Block‘s Cash App, and various other fintech companies has made it challenging for PayPal to preserve its market leadership in business and consumer payments.

Revenue growth weakened significantly in 2022 and 2023, with an annual increase of just 8%, compared to the double-digit growth experienced during the pandemic. Furthermore, rising transaction costs and increased investments in new ventures have pressured profit margins, leaving profitability stagnant.

In an effort to turn things around, PayPal appointed former senior Intuit executive Alex Chriss to replace longtime CEO Dan Schulman in September 2023. Chriss indicated that a high cost basis is slowing PayPal’s progress, stating, “The company’s focus has not been clear.”

Looking at 2024, PayPal reported $31.8 billion in net revenue, marking a 7% increase year over year. However, net income fell by 2% year over year to $4.2 billion due to a 7% rise in operating expenses, which included a $438 million charge for “restructuring and other” costs. Consequently, PayPal’s operating margin dipped from 16.9% in 2023 to 16.7% in 2024.

Moreover, user growth seems to be stagnating. The company reported 434 million active users by the end of Q4 2024, reflecting only a 2.1% rise from Q4 2023.

Positive Aspects for PayPal’s Shareholders

Despite the slowdown in growth, there are reasons for PayPal shareholders to be optimistic. The company is currently debt-free, boasting $943 million in net cash. This financial position allows it to avoid interest expenses in a high-rate climate and pursue potential acquisitions or share repurchases.

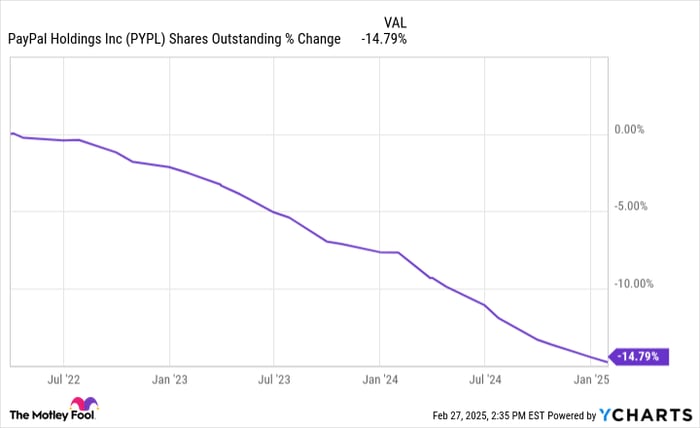

Management has prioritized share buybacks, repurchasing 92 million outstanding shares for $6 billion in 2024, reducing the total share count by 7.4%. Over the past three years, this strategy has decreased the number of outstanding shares by almost 15%.

Even though PayPal’s stock price has struggled, investors who hold their positions have seen their ownership increase. A recently announced $15 billion share repurchase program indicates that this buyback strategy will continue, potentially enhancing value for long-term investors.

PYPL Shares Outstanding data by YCharts

From a valuation perspective, PayPal’s stock still appears undervalued. Based on management’s projected earnings per share (EPS) of $4.95 to $5.10 for 2025, it currently trades at a forward price-to-earnings ratio of 14 to 15, its lowest multiple over the past six months.

PYPL PE Ratio (Forward) data by YCharts

New Management Seeks to Ignite Growth

Stock buybacks and appealing valuations are positive moves, but many investors may desire more: a revival in significant business growth. To achieve this, PayPal aims to expand beyond its traditional payments service into a more comprehensive commerce platform. According to Chriss, the goal is to “help merchants win every sale and assist consumers in shopping smarter.”

During its recent Investor Day, PayPal unveiled PayPal Open, a consolidated merchant offering designed for businesses of all sizes. Management anticipates “low teens” non-GAAP (adjusted) EPS growth by 2027, with an ambitious long-term goal of 20% annual growth. Chriss envisions PayPal as the commerce platform fueling the global economy, leveraging scale, ubiquity, and data advantages.

The ability of PayPal to effectively execute this transformation remains uncertain, but investors now have clear metrics to monitor its progress.

Should You Buy, Sell, or Hold PayPal?

PayPal stands at a crucial juncture, and the current stock price suggests that the market is skeptical about the future of a company that has been a leader in the payments sector. However, with an attractive valuation and consistent profitability, even modest growth could trigger a notable rebound in the stock price. The key issue over the next few years will be whether this growth occurs. Nonetheless, the downside risk appears limited at this stage. Given these considerations, PayPal is an intriguing option worth contemplating for your portfolio.

Is Now the Right Time to Invest $1,000 in PayPal?

Before purchasing stock in PayPal, it is important to evaluate this:

The Motley Fool Stock Advisor analyst team recently identified what they consider the 10 best stocks to buy now, and PayPal wasn’t included. The stocks that made the list have the potential for substantial returns in the coming years.

For instance, had you invested $1,000 in Nvidia when it made this list on April 15, 2005, you’d have $699,020 today!

Stock Advisor offers investors a straightforward plan for success, with guidance on portfolio building, regular analyst updates, and two new stock picks each month. The Stock Advisor service has more than quadrupled the S&P 500’s returns since 2002.* Don’t miss the latest top 10 list, available upon joining Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of March 3, 2025

Collin Brantmeyer has positions in Apple and PayPal. The Motley Fool has positions in and recommends Apple, Block, Intuit, and PayPal. The Motley Fool recommends the following options: long January 2027 $42.50 calls on PayPal and short March 2025 $85 calls on PayPal. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.