Super Micro Computer Prepares for Q3 Fiscal 2025 Earnings Report

Super Micro Computer, Inc. (SMCI) is set to release its third-quarter fiscal 2025 results on April 29.

Revenue and Earnings Expectations

For the upcoming fiscal third quarter, the company anticipates revenues between $5 billion and $6 billion. The Zacks Consensus Estimate stands at $5.34 billion, reflecting a growth of 38.6% compared to the same quarter last year.

Super Micro Computer projects non-GAAP earnings per share between 46 cents and 62 cents. The Zacks Consensus Estimate for earnings is set at 52 cents per share, indicating a decline of 22.4% from the prior year. This estimate has not changed in the last 60 days.

Image Source: Zacks Investment Research

Historical Performance in Earnings

Over the last four quarters, Super Micro Computer has beaten the Zacks Consensus Estimate twice while missing once and matching in the other quarter, resulting in an average negative surprise of 1.82%.

Price and EPS Surprise

Super Micro Computer, Inc. price-eps-surprise | Super Micro Computer, Inc. Quote

Earnings Whispers

Currently, our model does not predict a clear earnings beat for Super Micro Computer. While a positive earnings ESP combined with a Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 (Hold) generally enhances the probability of a beat, this situation does not apply here.

Although SMCI holds a Zacks Rank of #1, its earnings ESP is at 0.00%.

Key Factors Ahead of Q3 Results

Super Micro Computer is likely to benefit from the growing demand for artificial intelligence (AI) workloads. The expansion of data centers and the rising need for high-performance and energy-efficient servers are expected to enhance their financial results for the fiscal third quarter.

The popularity of SMCI’s liquid-cooled and modular servers among cloud service providers, government agencies, and enterprises indicates positive trends for the upcoming results. Collaborations with NVIDIA (NVDA) to incorporate NVIDIA’s Blackwell GPUs are anticipated to boost financial performance as well.

Holding a commanding 70% market share in the Direct Liquid Cooling market should also provide stability to revenue. Additionally, the company’s rapid production ramp-up across locations in Malaysia, Taiwan, Europe, and the United States may further support third-quarter results.

SMCI’s strong market position in high-end data centers and diverse customer bases, driven by next-generation AI and CPU platforms, is expected to yield positive gains in the upcoming quarter.

Stock Performance & Valuation

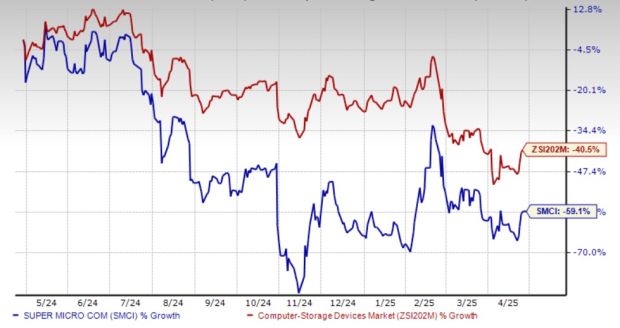

Over the past year, Super Micro Computer shares have declined by 59.1%, trailing the Zacks Computer – Storage Devices industry, which saw a 40.5% downturn.

One Year Performance Chart

Image Source: Zacks Investment Research

Currently, SMCI is trading at a forward price-to-earnings (P/E) ratio of 11.60X, lower than the industry average of 16.46X, suggesting it is trading at a discount for potential investors.

P/E Valuation Chart

Image Source: Zacks Investment Research

Investment Outlook for SMCI

Super Micro Computer is positioned to grow substantially in AI infrastructure, leveraging its expertise in liquid cooling and scalable manufacturing. The recent launch of its new AI data server using NVIDIA’s Blackwell platform is likely to enhance revenues in coming quarters.

Strong cash flow, increasing margins, and rising AI-driven demand add to SMCI’s investment attractiveness. The company’s leadership in scalable AI training and inference infrastructure, supported by Intel (INTC) Gaudi 3 accelerators, is expected to amplify demand for its offerings.

Moreover, SMCI utilizes Advanced Micro Devices (AMD) accelerators for performance in AI and data-intensive applications, ensuring reliability through integration with AMD and Intel processors.

Conclusion on SMCI Investment

Considering the strong fundamentals, favorable valuation, and promising growth in AI infrastructure, investing in Super Micro Computer shares could be beneficial for investors. The company is well-equipped to achieve robust growth as demand for AI solutions continues to rise.