Tesla Prepares for Robotaxi Launch Amid Mixed Financial Outlook

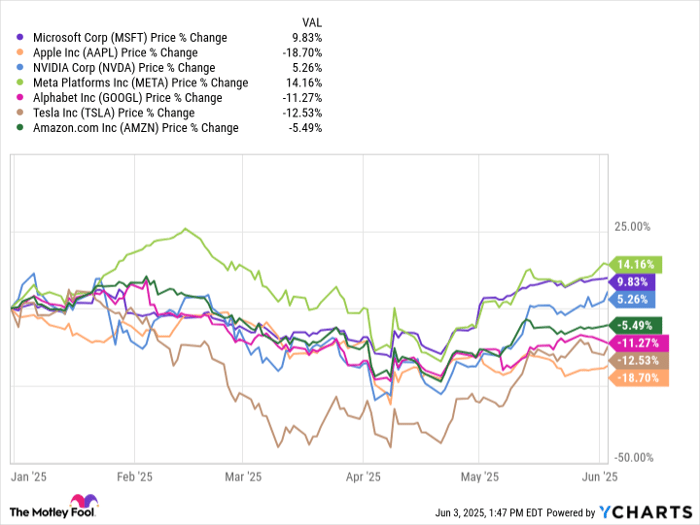

Electric carmaker Tesla (NASDAQ: TSLA) has had a turbulent year, with its stock fluctuating as investors assess its EV business challenges, CEO Elon Musk’s controversial actions, and new initiatives like robotaxis.

Bloomberg reports that Tesla will launch a limited fleet of robotaxis in Austin, Texas, on June 12. This event could reveal critical information about Tesla’s self-driving technology effectiveness.

Issues in Tesla’s Core Business

Tesla faced difficulties in its core EV operations, recording 337,000 deliveries in Q1 2023, marking the lowest delivery count in over two years. Reasons for these struggles include Musk’s political engagement and heightened competition. Sales do not appear to have improved in Q2. Despite these challenges, Tesla’s stock maintains a high valuation.

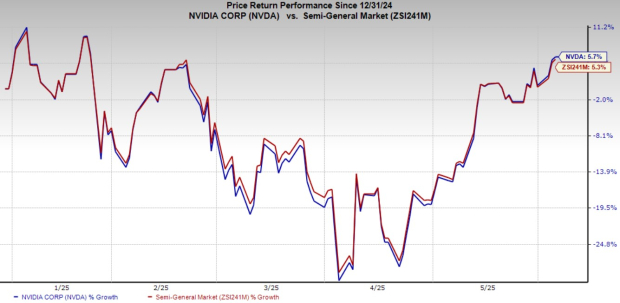

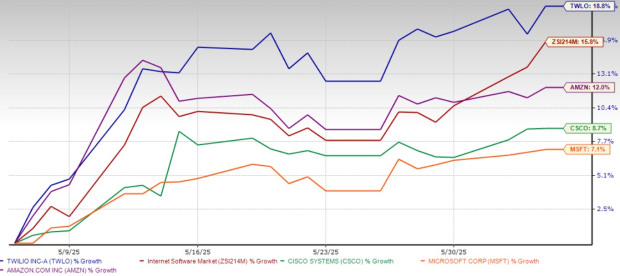

Data by YCharts.

Future initiatives such as affordable EVs, robotaxis, and the Optimus humanoid robots drive ongoing interest in Tesla’s stock. The Austin robotaxi launch is expected to involve 10 to 20 Tesla Model Ys with human supervisors, restricted to designated areas.

Musk suggests that within months, 1,000 robotaxi units could be operational. However, opinions vary on the performance of Tesla’s full self-driving (FSD) technology. Users have logged billions of miles with FSD, but doubts have emerged regarding its safety compared to human drivers. Morgan Stanley analyst Adam Jonas advised caution ahead of the June 12 launch, stating that expectations should be tempered.

If FSD proves successful, Musk plans to establish a self-driving ride-hailing fleet. “We have millions of cars that will operate autonomously,” he stated. This would include allowing Tesla owners to rent their cars to the fleet for profit.

Investor Sentiment Ahead of Launch

As the Austin introduction approaches, analysts are keenly watching for any technical issues with FSD. The potential for new revenue exists, but skepticism remains regarding the technology’s strength and the speed of scaling operations. Given Tesla’s lofty valuation, the market seems to have priced in anticipated success from robotaxis and other ventures like the Optimus robots.

Long-term prospects for Tesla within the autonomous driving sector look promising, but the industry is still developing. Thus, caution is warranted for investors considering Tesla stocks before the June 12 event.

A single event should not dictate stock transactions. It’s essential to evaluate long-term company fundamentals rather than react to short-term changes.

Final Thoughts

The upcoming Austin robotaxi launch holds significant importance, but investors should focus on the long-term vision rather than short-term fluctuations. Sustainability in Tesla’s stock performance will depend on successfully navigating current challenges and executing future plans effectively.

Bram Berkowitz holds no positions in mentioned stocks. The Motley Fool has positions in and recommends Tesla. The Motley Fool’s disclosure policy applies.

The views expressed here are the author’s and do not necessarily reflect those of Nasdaq, Inc.