Tesla Faces Significant Challenges Amid Increased Spending

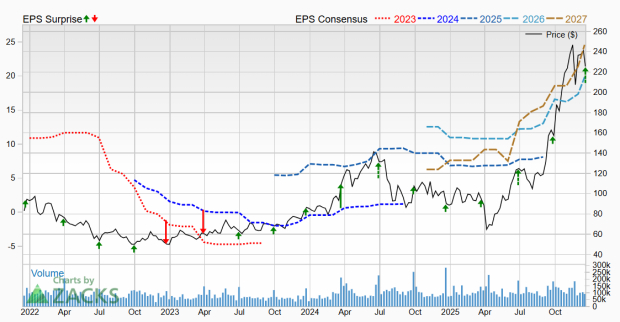

Tesla (NASDAQ: TSLA) reported a 50% increase in operating expenses to $3.4 billion for Q3 2023, driven by investments in robotics and autonomous vehicles. This comes as the company’s vehicle sales fell below 40,000 units in November, marking its lowest monthly sales in years. Tesla’s net income also dropped 37% to $1.4 billion, leaving less capital for reinvestment.

The company is focusing on expanding its robotaxi service and aims to produce up to 1 million Optimus robots by 2030. However, with rising costs and slowing demand for electric vehicles due to the expiration of federal EV tax credits, analysts warn that the company is in a precarious position. Tesla’s shares currently have a price-to-earnings ratio of 206, significantly higher than the tech sector average of 45, raising concerns about its valuation during this challenging transition period.