Wall Street Weighs In: Is United Airlines Stock a Good Buy?

Investors frequently rely on advice from Wall Street analysts when deciding whether to Buy, Sell, or Hold a stock. Although media coverage of these analysts’ rating changes can influence stock prices, their true value is up for debate.

Before examining the trustworthiness of brokerage recommendations, let’s look at what analysts say about United Airlines (UAL).

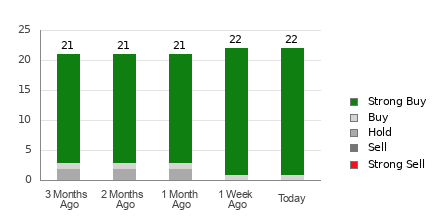

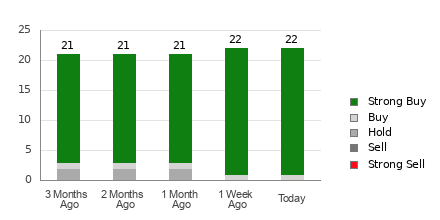

United Airlines boasts an average brokerage recommendation (ABR) of 1.05, based on a scale from 1 to 5, where 1 is Strong Buy and 5 is Strong Sell. This ABR is derived from the recommendations of 22 brokerage firms, indicating a consensus leaning towards Strong Buy.

Of these 22 ratings, 21 classify the stock as Strong Buy, while one suggests a Buy. This translates into 95.5% of recommendations being Strong Buy and 4.6% as Buy.

Current Trends in Brokerage Recommendations for UAL

Explore price target and stock forecast for United here>>>

While the ABR indicates a buying opportunity for United, relying solely on this data might not be prudent. Research suggests that brokerage recommendations often fail to guide investors towards stocks that will experience significant price increases.

Why is this the case? Brokerage firms often have vested interests in the stocks they cover, leading to an inherent bias in their ratings. Findings indicate that for every “Strong Sell” recommendation, there are five “Strong Buy” ratings.

This bias means that brokerage recommendations may not always align with retail investors’ interests, often failing to accurately predict stock prices. Thus, the best approach is to use these recommendations to complement your own research rather than as a standalone guide.

A trusted alternative is the Zacks Rank, an internally audited stock rating tool. This model classifies stocks into five groups, from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), and provides a more reliable forecast of short-term price performance. Using the Zacks Rank alongside ABR can enhance investment decisions.

Understanding the Distinction: Zacks Rank and ABR

Although both Zacks Rank and ABR use a scale from 1 to 5, they measure different things.

The ABR is calculated solely from brokerage recommendations, typically presented as decimals (e.g., 1.28). In contrast, the Zacks Rank employs a quantitative model that focuses on earnings estimate revisions, represented in whole numbers.

Historically, analysts at brokerage firms have displayed a tendency to be overly optimistic in their ratings. Their ratings frequently do not reflect true stock potential, often misleading investors.

Conversely, the Zacks Rank centers on earnings estimate revisions, which empirical research links closely to short-term stock price movements.

Furthermore, Zacks Rank applies its ratings uniformly across all stocks with current-year earnings estimates. This balanced approach ensures that all five ranks are represented fairly.

Another important distinction lies in timeliness. The ABR may not reflect the latest data, while the Zacks Rank is updated quickly based on the latest earnings estimates, keeping it relevant for predicting stock prices.

Should You Invest in UAL?

For United Airlines, the Zacks Consensus Estimate for this year has risen by 0.4% to $10.27 over the past month.

This increased optimism among analysts, coupled with a high level of agreement on revised earnings estimates, serves as a solid basis for expecting potential stock growth in the near future.

The change in the consensus estimate, along with several other key factors, has culminated in a Zacks Rank #1 (Strong Buy) for United. To see the complete list of Zacks Rank #1 (Strong Buy) stocks, click here>>>>

Therefore, while the ABR for United suggests a good buy opportunity, validating this against your findings could make your investment decision stronger.

Explore High-Potential Clean Energy Stocks

The energy sector is a vital part of our economy, a massive industry that has given rise to some of the world’s largest companies.

With advances in technology, clean energy sources are becoming more prevalent than traditional fossil fuels. Massive investments are being channeled into clean energy, spanning solar to hydrogen fuel cells.

New leaders in this arena could greatly enhance your investment portfolio.

Download “Nuclear to Solar: 5 Stocks Powering the Future” to access Zacks’ top picks for free today.

Download United Airlines Holdings Inc (UAL) : Free Stock Analysis Report

To read more about this on Zacks.com, click here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.