Zoom Transitions to AI-Focused Work Platform: Strong Q3 Results Fuel Investor Interest

Zoom Communications ZM is making significant changes, moving from being a video conferencing company to an AI-driven work platform. In the third quarter of fiscal 2025, Zoom reported revenues of $1.178 billion, exceeding expectations with a year-over-year growth of 3.6%. The recent launch of its AI Companion 2.0 illustrates the company’s innovative direction, with a remarkable 59% increase in Active Users for the feature in just one quarter, totaling over 4 million enabled accounts.

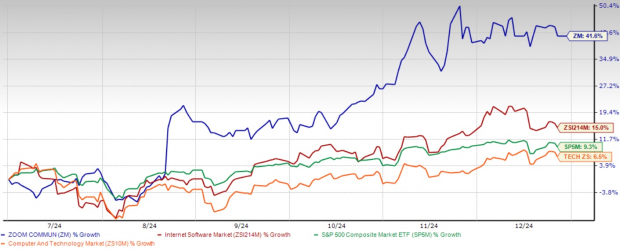

Over the past six months, Zoom’s shares have increased by 41.6%, significantly outperforming the broader Zacks Computer and Technology sector, which grew only 6.5%. This surge prompts investors to consider whether it’s the right time to invest in Zoom stock.

Recent Stock Performance

Image Source: Zacks Investment Research

Growth in Enterprises and Market Reach

Momentum in the enterprise segment is growing, with revenues increasing by 6% year over year and now accounting for 59% of total revenues. Zoom has seen success in the upmarket sector, with approximately 4,000 customers generating over $100,000 in trailing twelve-month revenues, a 7% increase from the previous year. Additionally, the company reported its lowest monthly churn rate ever at 2.7%, indicating strong customer satisfaction and loyalty.

Expanding Product Range and AI Development

Zoom is not just focusing on meetings; its expansion into different product areas is proving fruitful. The Contact Center segment recently achieved a record deployment with over 20,000 seats, while its total customer base for the Contact Center has grown by 82% year over year to more than 1,250 customers. The Workvivo platform has seen a notable 72% growth in customers year over year, with several wins including contracts with Fortune 10 companies. Moreover, Workvivo was designated as Meta Platform’s META preferred migration partner as it winds down Workplace.

Strong Financial Position and Shareholder Returns

Zoom boasts a solid financial foundation with about $7.7 billion in cash and marketable securities, ensuring strong profitability. Its non-GAAP operating margin stands at 38.9%, showcasing efficient operations amid ongoing investments in AI and product development. Recently, the board authorized an additional $1.2 billion for share repurchases, raising the total buyback capacity to $2 billion, demonstrating confidence in Zoom’s future and commitment to returning value to shareholders.

Competitive Landscape and Opportunities

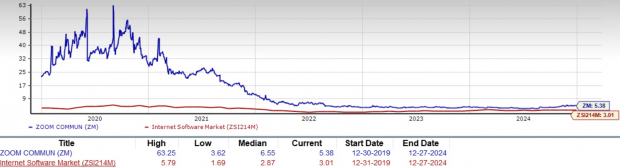

Although competitors like Microsoft MSFT and Cisco CSCO present challenges, Zoom’s innovative approach sets it apart. The company’s strategy includes offering basic AI features at no extra cost while capitalizing on advanced enterprise capabilities for monetization. Currently, Zoom’s 12-month price-to-sales ratio stands at 5.38, which, albeit higher than the Zacks Internet – Software industry average of 3.01, indicates market confidence in Zoom’s growth potential.

Valuation Insights for Zoom

Image Source: Zacks Investment Research

Future Growth Drivers for 2025

Looking forward, Zoom has several growth catalysts. The rollout of Custom AI Companion add-ons tailored for Healthcare and Education in early 2025, alongside Zoom Workplace for Frontline, opens up new avenues. Collaborations with key partners like ServiceNow and investments in AI capabilities further provide opportunities for expansion.

Revised Financial Guidance

Zoom has updated its fiscal 2025 revenue guidance, projecting figures between $4.656 billion and $4.661 billion, which translates to an approximate 2.9% growth compared to the previous year. The operating margin is expected to remain strong at 39%, reflecting a balanced approach to growth and profitability.

The Zacks Consensus Estimate for fiscal 2025 anticipates a 2.87% increase in revenue to $4.66 billion, with earnings expected at $5.43 per share, reflecting a year-over-year increase of 4.22%.

Image Source: Zacks Investment Research

Keep an eye on the latest earnings trends and surprises on Zacks Earnings Calendar.

Investment Outlook

For those looking to invest in the evolving technology workplace, Zoom could be an attractive choice at this time. With its strong financial health, a broadening product range, and leadership in AI, Zoom seems poised for growth in 2025 and beyond. While its valuation metrics may suggest it is on the higher side, the company’s strategic moves, noticeable growth, and healthy profitability lend legitimacy to its valuation. The blend of an AI-first strategy, enterprise development, and new products suggests multiple growth routes. Investors might find it a timely opportunity to purchase Zoom stock, anticipating appreciation in 2025. Currently, Zoom Video has a Zacks Rank of #1 (Strong Buy).

Zacks Highlights for the Top 10 Stocks in 2025

Curious about our top picks for 2025? Historical performance indicates their potential for exceptional returns.

From 2012, when our Director of Research Sheraz Mian began overseeing the portfolio, through November 2024, the Zacks Top 10 Stocks saw gains of +2,112.6%, significantly surpassing the S&P 500’s +475.6%. Currently, Sheraz is reviewing 4,400 firms to identify the best 10 stocks for 2025. Don’t miss the chance to invest when they become available on January 2.

Want the most recent stock recommendations from Zacks Investment Research? You can download 5 Stocks Set to Double for free.

Microsoft Corporation (MSFT): Free Stock Analysis Report

Cisco Systems, Inc. (CSCO): Free Stock Analysis Report

Zoom Communications, Inc. (ZM): Free Stock Analysis Report

Meta Platforms, Inc. (META): Free Stock Analysis Report

For the original article, visit Zacks.com.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.