Dollar Tree Stock Surges Despite Q4 Earnings Miss and Business Sale

Despite falling short of expectations for both revenue and earnings, Dollar Tree (DLTR) has seen its shares climb +13% following the announcement of its Q4 results on Wednesday.

Investors reacted positively to news of the company’s decision to sell its struggling Family Dollar division to Brigade Capital Management and Macellum Capital Management for $1.01 billion.

Q4 Financial Performance

In its fiscal Q4, Dollar Tree reported sales of $4.99 billion, a significant decline from $8.63 billion in the same quarter last year and below analysts’ expectations of $8.23 billion. CEO Mike Creedon emphasized that the divestiture of Family Dollar will enable the company to focus on long-term growth and profitability.

On earnings, Dollar Tree reported a Q4 earnings per share (EPS) of $2.11, missing the forecast of $2.18 and decreasing from $2.55 in the prior year.

Image Source: Zacks Investment Research

Annual Results and Future Projections

For the fiscal year 2025, Dollar Tree’s total sales fell by 10%, totaling $27.56 billion compared to $30.6 billion in FY24. The company’s annual earnings dropped 13%, with EPS of $5.10 compared to $5.89 in FY24.

Looking ahead to Q1, Dollar Tree anticipates sales between $4.5 billion and $4.6 billion, down from $7.63 billion in the same period last year. The projected EPS for Q1 is between $1.10 and $1.25, lower than the current Zacks Consensus estimate of $1.46, which reflects a 2% decline.

For fiscal year 2026, Dollar Tree expects total sales to fall between $18.5 billion and $19.1 billion, with an EPS forecast of $5.00 to $5.50, both figures below the Zacks Consensus estimate of $5.94 per share, representing a 16% decline. However, Zacks projects annual earnings to rebound in FY27 with an estimated 11% rise to $6.62 per share.

Image Source: Zacks Investment Research

Analyst Reactions and Price Targets

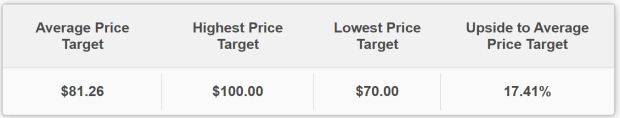

Following the sale of Family Dollar, many analysts have upgraded their price targets for Dollar Tree, including firms like Bernstein, Evercore ISI, and Deutsche Bank.

Currently, the Average Zacks Price Target stands at $81.26, suggesting a potential 17% upside for DLTR, based on short-term price estimates from 23 analysts.

Image Source: Zacks Investment Research

Conclusion

In summary, despite a notable drop in revenue post-earnings, Dollar Tree holds a Zacks Rank #3 (Hold). While the divestiture of Family Dollar will reduce overall revenue, projected lower operating costs may enhance profitability. The stock currently trades at a relatively low forward earnings multiple of 11.6X.

Only $1 to See All Zacks’ Buys and Sells

We’re not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent.

Thousands have taken advantage of this opportunity. Thousands did not – they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators, and more, that closed 256 positions with double- and triple-digit gains in 2024 alone.

Dollar Tree, Inc. (DLTR) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.