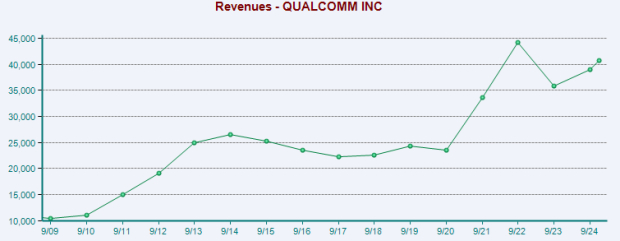

Qualcomm Reports Strong Q1 2025 Results: Automotive and Handset Revenues Soar

Qualcomm Incorporated QCOM has announced impressive first-quarter fiscal 2025 results, surpassing both adjusted earnings and revenue expectations set by the Zacks Consensus Estimate. This surge was primarily fueled by strong demand in the Android handset and automotive sectors, demonstrating the company’s ability to adapt to changing market conditions.

Discover the latest EPS estimates and surprises on Zacks Earnings Calendar.

Record Revenue Growth in Automotive and Handsets

Qualcomm is on a mission to evolve from a mobile communication firm into a comprehensive connected processor company for the intelligent edge. With the acceleration of 5G technology and an expanding revenue base, Qualcomm is positioned to achieve its long-term revenue goals.

The company is seeing significant growth in EDGE networking, which is modernizing connectivity across various sectors including automotive, businesses, homes, and more. Qualcomm plans to leverage artificial intelligence (AI) to meet the rising demand for digital transformation in the cloud economy.

Key innovations, such as automotive telematics and connectivity platforms, along with solutions for digital cockpits and C-V2X (cellular vehicle-to-everything), are driving trends in the automotive industry. The company expects to become the leading supplier of smartphone radio-frequency front-end components by revenue soon. Automotive revenues surged 61% to a record $961 million, spurred by increased integration of its Snapdragon Digital Chassis in new vehicle launches. Handset revenues also climbed 13% to reach $7.57 billion, propelled by strong sales in premium Android devices.

Image Source: Zacks Investment Research

Expanding into AI Chip Development

Qualcomm is venturing further into AI capabilities with the launch of its Snapdragon X chip, targeting mid-range laptops and desktops. This move aims to diversify its business as the smartphone sector shows signs of slowing growth. Strengthening its position in AI is expected to extend Qualcomm’s influence in the tech landscape.

The Snapdragon X SoC is the latest addition to the Snapdragon X processor series, following several successful launches. Built on a 4-nanometer process, it features an 8-core Oryon central processor alongside a neural processing unit (NPU) designed to enhance AI processing, achieving an impressive 45 TOPS (trillions of operations per second). This innovation supports Microsoft Corporation’s MSFT Copilot+PCs initiative, introducing AI-first Windows hardware aimed at budget-friendly pricing.

By utilizing multi-core chips with advanced functionalities, Qualcomm’s Snapdragon mobile platforms facilitate exceptional performance. Devices powered by these platforms provide top-tier augmented reality, virtual reality experiences, and superior connectivity.

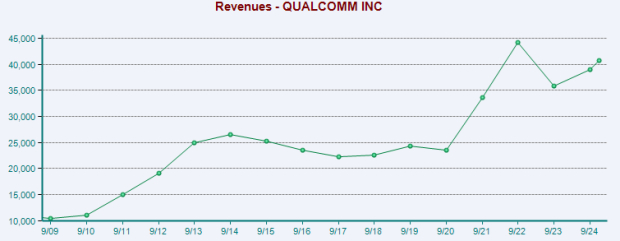

Stock Performance Analysis

In the past year, Qualcomm shares have gained 9.7%, falling short of the industry average growth of 28.3%. The company has trailed behind peers like Hewlett Packard Enterprise Company HPE and Broadcom Inc. AVGO during this period.

QCOM Stock One-Year Price Performance

Image Source: Zacks Investment Research

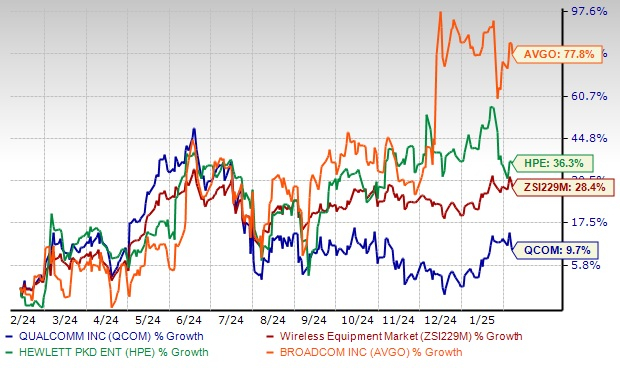

Positive Trends in Earnings Estimates

Over the last week, earnings estimates for Qualcomm in fiscal 2025 have risen by 1.3% to $11.36, while estimates for fiscal 2026 climbed 2.4% to $12.61. These upward revisions reflect positive sentiment surrounding the stock.

Image Source: Zacks Investment Research

Conclusion

With strong fundamentals and robust demand for AI chips, Qualcomm presents a compelling investment opportunity. The firm’s focus on quality, effective execution of strategies, and ongoing enhancements position it well for future growth. Rising earnings estimates contribute to a growing positive perception among investors.

The stock has shown a trailing four-quarter average earnings surprise of 7.8% and holds a VGM Score of A. Qualcomm is currently rated a Zacks Rank #2 (Buy), suggesting strong potential for price appreciation.

Recently Released: Zacks Top 10 Stocks for 2025

Now is the time to explore our top 10 stock picks for 2025. Curated by Zacks Director of Research Sheraz Mian, this portfolio has achieved impressive success. Since its inception in 2012 through November 2024, the Zacks Top 10 Stocks has gained +2,112.6%, vastly outperforming the S&P 500’s +475.6%. You can still see these newly released stocks with significant potential.

See New Top 10 Stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

QUALCOMM Incorporated (QCOM) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Broadcom Inc. (AVGO) : Free Stock Analysis Report

Hewlett Packard Enterprise Company (HPE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.